FCA Intervenes on Over 3,000 Financial Promotions: 528 Alerts Issued

Between April 1, 2024, and June 30, 2024, the Financial Conduct Authority (FCA) took actions against firms breaching financial promotion rules, as well as investigations into unregulated activity.

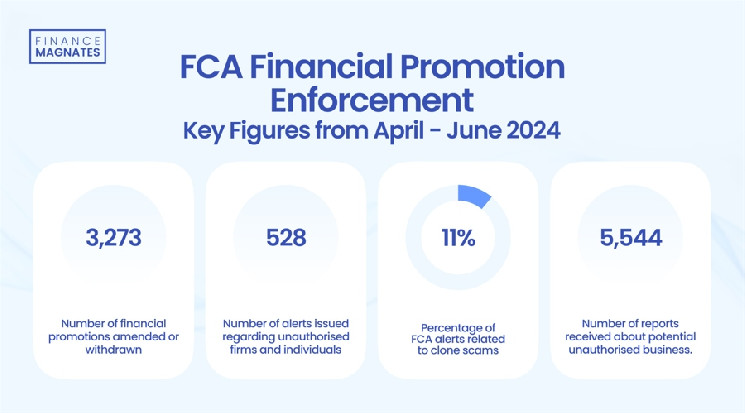

During this period, 3,273 promotions from authorised firms were either amended or withdrawn. Additionally, 528 alerts were issued regarding unauthorised firms and individuals, with 11% of these alerts related to clone scams, where fraudsters use details of legitimate firms to appear genuine.

FCA Enforcement: Key Figures

Following the end of the modification by consent for the Direct Offer Financial Promotion (DOFP) rules introduced by Policy Statement 23/6, compliance reviews were conducted. Feedback was provided to firms, and supervisory actions were taken when breaches were identified.

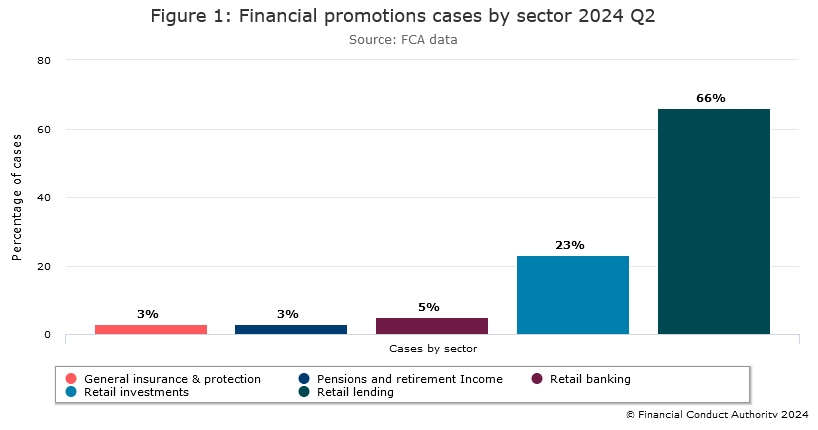

A total of 943 financial promotions were reviewed during this period. Of these, 69% were identified through proactive monitoring, 11% through consumer complaints, 10% through firm submissions, 6% from UK regulators, and 4% from other FCA areas. The retail investments and retail lending sectors saw the highest levels of amendments and withdrawals, accounting for 89% of the total interventions with authorised firms.

In terms of unauthorised firms, 5,544 reports were received about potential breaches. Among these, 528 alerts were issued, with 11% related to clone scams. These scams often involved breaches of online financial promotion restrictions, and actions were taken to remove the offending websites.

Source: FCA

FCA Monitors Crypto Promotions

For cryptoasset firms, the Direct Offer Financial Promotion (DOFP) rules that came into effect on January 8, 2024, require personalized risk warnings, a 24-hour cooling-off period, and client categorisation and appropriateness assessments. Reviews of compliance with these rules led to feedback for firms and actions where breaches were found. Findings on good and poor practices were also published to improve sector standards.

Registered cryptoasset firms using ‘widget’ models to provide services through APIs were reviewed for compliance. Concerns were raised about illegal promotions by partner firms.

Firms were advised to ensure they understand and comply with UK financial promotion regulations, conduct thorough reviews and ongoing monitoring of partner firms, and avoid implying that partners do not need to comply with these regulations. Action was expected to address risks if partners were found in breach of the regulations.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Hive

Hive  Status

Status  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom