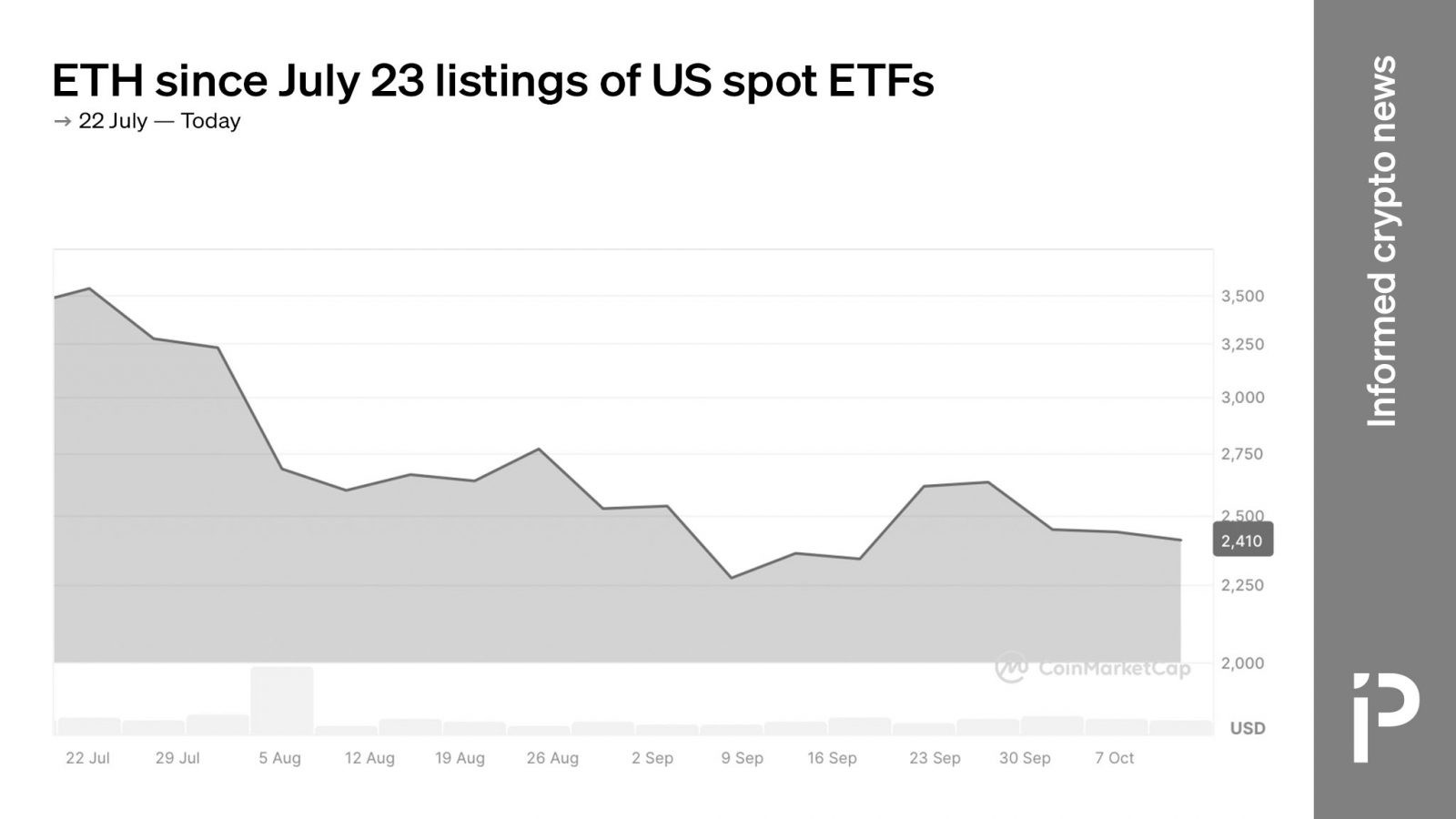

Five days of $0 inflows to spot ether ETFs since July launch

Since spot ether Exchange Traded Funds (ETFs) began trading on US securities exchanges, five days have seen precisely $0 of Ethereum capital inflows. Even worse, since July 23, 2024, owners of the nine spot ether ETFs have actually withdrawn money from those products.

Incredibly, because trusts and other investors seeded over $10 billion worth of spot ether into the ETFs prior to their debut on US exchanges, the tally of post-launch trading activity is negative $556 million.

‘Inflows’ is a term used to describe the net US dollar flow into spot ether ETFs. It excludes all other Ethereum-related purchases and sales such as futures, options, derivatives, or spot ether itself.

Investors track ETF inflows as a way to measure how much effect ETFs are having on Ethereum’s market capitalization independent of other variables. In this case, the answer is simple: Ether ETFs have not helped.

The tally of post-launch trading activity is negative $556 million.

Ether inflows crash, billions behind bitcoin ETFs

Although US spot ether ETFs have been net negative since inception, spot bitcoin ETFs as an investment vehicle have been indisputably beneficial for bitcoin inflows. Although bitcoin holders might choose to sell other products and buy spot ETFs — a roundtrip of non-economic purpose — there is significant evidence that ETFs are truly contributing to bitcoin’s market capitalization.

Specifically, since spot bitcoin ETFs began trading on US exchanges on January 11, 2024, inflows have exceeded $18.7 billion. That compares starkly with spot ether ETF outflows of -$556 million.

The disappointment is even more bitter after a promising start. On their opening day, spot ether ETFs bested the debut of spot bitcoin ETFs. Soon, however, Ethereum gave up its initial lead.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Zcash

Zcash  Tezos

Tezos  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD