FTX Token crashes after repayment plan approval: is this the end for FTT?

FTX Token (FTT) has been on the investors’ radar due to bankruptcy proceedings between the debacle trading company and the United States regulators.

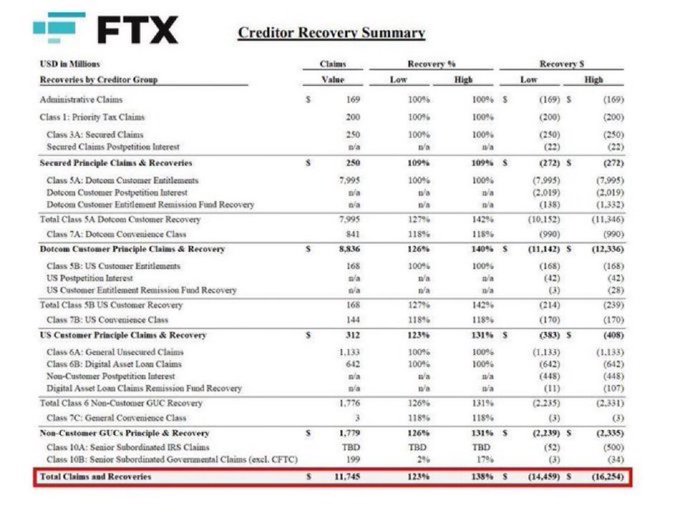

On Monday, 7 October 2024, the US court approved FTX’s repayment plan, with former customers expecting a refund of 119% of their investments before the insolvency filing.

BREAKING: 🇺🇸 FTX bankruptcy plan approved by judge, clearing the path to $16 BILLION in repayments. SEND IT! 🚀

0:58 am · 8 Oct 2024 Read 226 replies

Meanwhile, the ruling sent the native token FTT on a downside spiral, plummeting from $3.060 to press time levels of $2.26.

While the altcoin exhibits an upside stance after gaining approximately 5% in the past week, things don’t appear welcoming for FTT investors.

FTT on a relentless fall

The token saw a massive upswing on 7 October as enthusiasts awaited FTX’s bankruptcy case final hearing.

FTT jumped over 56% to $3.422. The bullish wave emerged as the community watched to see whether the court would reject or authorize the exchange’s repayment plan.

While the US court approved the plan, FTT bears took over from $3.060. The token traded at $2.26 during this publication, down around 35% over the past two days.

Technical outlook

The 1-hour chart shows FTT’s price moving in an ascending parallel channel.

The alt sways at the channel’s lower range at press time, and the surging bearish strength indicates an impending breakdown.

Moreover, the price hovers beneath the vital 50- and 200-day Exponential Moving Averages on the hourly timeframe, suggesting bear dominance.

FTT is losing ground on the support barrier at the 200 Moving Average ($2.293), with the remaining averages exerting bearish pressure.

The Moving Average Convergence Divergence supports the downward stance as the MACD line crosses the signal line to the downside.

Also, the Relative Strength Index at 41 suggests soaring bear favoritism.

Possible liquidations darken FTT’s future

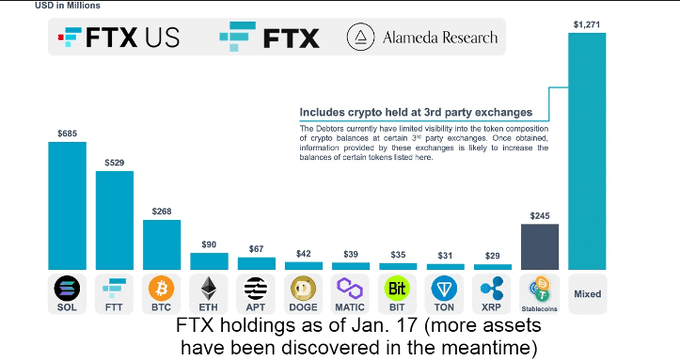

Speculations of the FTX estate liquidating the native coin to refund creditors emerged after the court authorized the exchange’s repayment scheme.

That has prompted Coinmarketcap to warn traders about interacting with FTT as it no longer has utility.

The data aggregator platform stated:

The FTX bankruptcy proceedings are underway. The FTT token no longer has any use and may be liquidated by the estate to pay creditors. Please proceed with caution.

The fallen empire could kick-start a $200 million per week FTT liquidation next week, which would welcome a massive selling momentum, plunging prices.

Big selling pressure is potentially coming next week🚨 FTX will likely get approval to liquidate its assets on Sept. 13. FTX had $3.4B in crypto in April. The proposed plan is to sell assets worth up to $200M per week.

4:19 pm · 9 Sept 2023 Read 399 replies

FTX CEO John J. Ray III confirmed such a narrative in a 7 October press release. He said:

We are poised to return 100% of bankruptcy claim amounts plus interest for non-governmental creditors through what will be the largest and most complex bankruptcy estate asset distribution in history.

What next for FTT’s price?

The altcoin changes hands at $2.26 after losing nearly 8% of its value in the past 24 hours.

The 65% dip in daily trading volume suggests weakness, opening the path for more declines.

Source – Coinmarketcap

Meanwhile, FTT could stay afloat in the near term amid increased activity as the fallen exchange arranges to settle with its creditors in over 200 jurisdictions globally.

Nevertheless, a liquidation announcement from the FTX estate could trigger massive panic as investors lose their holdings.

FTT has no utility, and the estate will likely liquidate the token to collect repayment funds.

That would see prices crashing to never-seen-before lows.

The post FTX Token crashes after repayment plan approval: is this the end for FTT? appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Monero

Monero  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD