Grayscale dumps more Bitcoin on Coinbase Worth $175 Million

Despite the Bitcoin price staying above the $50,000 mark, the past three days are marked red and have led to a 2.65% drop. Recovering from the cold days after the ETFs listing, the pre-halving rally boosts the crypto and accounts for an almost 20% jump this February. However, despite the recent pump, Grayscale, the digital asset management company, is starting to go against the tide.

Infamous for causing a bear market after the Bitcoin Spot ETF approval, the Grayscale Bitcoin Trust (GBTC) continues to dump Bitcoin.

Grayscale Sells Off $175 Million Worth Bitcoin

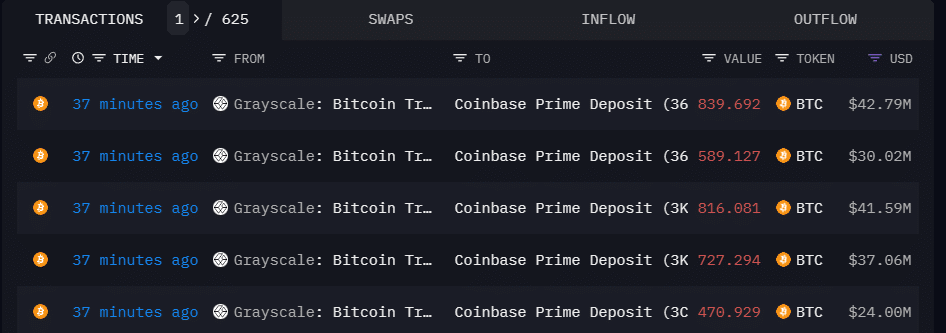

In a notable transaction observed by Arkham, Grayscale conducted a significant transfer of Bitcoin on February 23 at 22:12 UTC+8. The transaction involved moving 3,443.1 BTC into the Coinbase Prime Deposit address.

Arkham Intelligence

This transfer is particularly noteworthy due to its substantial value, estimated at approximately US$175 million, with the current Bitcoin price around $50,920.

Why the sudden sell-off?

The exact causes for the swift capital outflows observed recently remain uncertain at this moment. However, one plausible explanation could be that traders decided to liquidate their holdings to capitalize on the profits from the recent surge in market values, especially after having their investments tied up in the fund for an extended period.

In the U.S. based spot Bitcoin ETFs, GBTC stands out for its relatively high management fee, set at 1.5%. This fee is significantly higher compared to its competitors, such as BlackRock’s IBIT, which has a much lower fee of 0.12%. However, it’s important to note that BlackRock has announced plans to adjust IBIT’s fee structure, raising it to 0.25% in the coming 12 months.

The difference in management fees could be a critical factor for investors when choosing between various investment options, as lower fees generally translate to higher net returns over time, making products like IBIT more attractive to cost-conscious investors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  KuCoin

KuCoin  Maker

Maker  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Dash

Dash  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Waves

Waves  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD