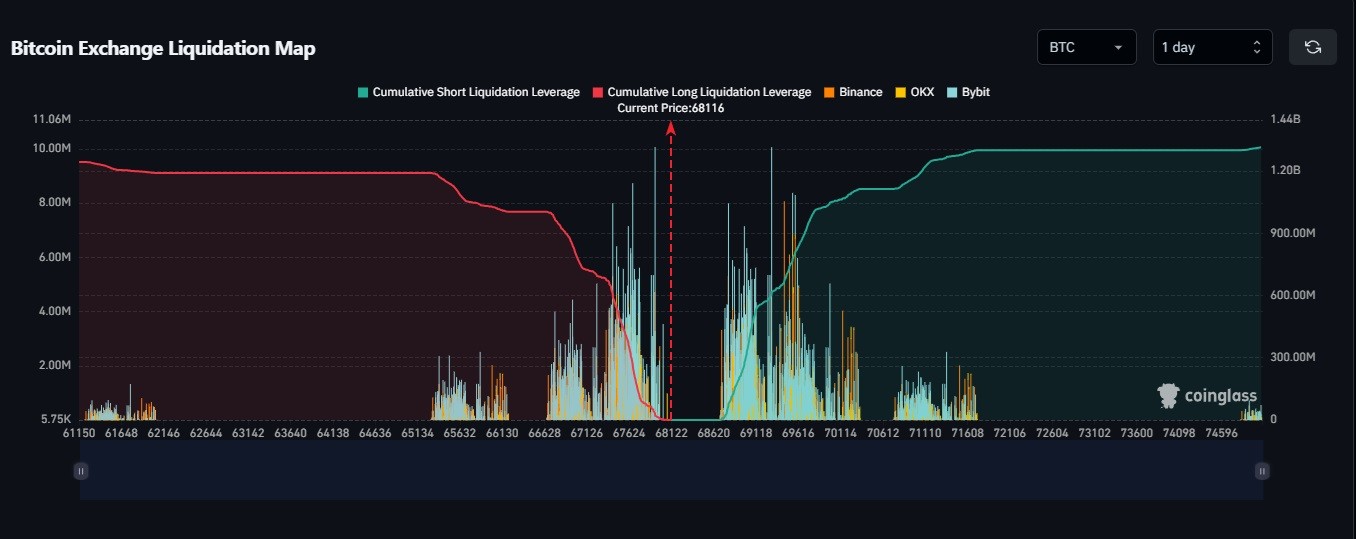

Here are the Long and Short Price Levels to Trigger Massive Liquidation in Bitcoin

If Bitcoin surpasses $69,000, the cumulative short order liquidation intensity on mainstream centralized exchanges (CEX) could reach $101 million, according to Coinglass data.

However, if Bitcoin falls below $68,000, the cumulative long order liquidation density on these exchanges could rise to $293 million.

It is important to note that the liquidation table does not give the exact number or value of contracts to be liquidated. Instead, it shows the relative importance of each liquidation cluster compared to neighboring clusters and highlights the intensity of each potential price move. A higher liquidation bar indicates that the market is likely to react more strongly to a liquidation wave at that price level.

Coinglass liquidation data over the past hours reveals the following for the entire cryptocurrency market:

- 1-Hour Data: $4.62 million was liquidated, including $3.94 million worth of long orders and $680,000 worth of short orders.

- 4-Hour Data: $9.21 million was liquidated, including $6.32 million worth of long orders and $2.89 million worth of short orders.

- 12-Hour Data: $26.29 million was liquidated, including $18.62 million worth of long orders and $7.67 million worth of short orders.

- 24-Hour Data: $60.59 million was liquidated, including $31.31 million long and $29.28 million short.

*This is not investment advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Nano

Nano  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD