Here’s How 2024 U.S Crypto Policy Can Impact Global Adoption

Since World War 1, the United States has made its presence felt as a leader among all other countries. As the leading global superpower, the United States has impacted politics, policies, trade, health, and money markets.

Looking at the past, if we mention the Reagan government & its controversial “War on Drugs,” the United States banned all drug-related and psychotropic substances. The drug ban policy was mirrored by most countries around the world. But now that the United States has regulated the control of a few drugs, various countries have followed suit.

We observed something similar with cryptocurrencies: heavy taxes, scrutiny, and abolishment of the blockchain-based currencies worldwide following suit of the Biden Government and Gary Gensler-led SEC’s war on crypto around most countries in the world.

Surprisingly, 2024 has turned into the year of crypto as it is the prime focus of the U.S. presidential elections. The entire crypto community is watching how the United States reacts to cryptocurrencies, as the President-elect can set the tone for global crypto regulations.

Trump as the 47th president of the United States

The current presidential run comes amid geopolitical wars between Russia and Ukraine, Israel and Palestine, and global unrest in LATAM, Asia, and Africa. On the other hand, more nations have joined BRICS to cut ties with the worldwide supremacy that comes with the dollar—the de-dollarization agenda.

Global markets will embrace crypto, especially Bitcoin, under Donald Trump, the 47th POTUS. Once a crypto critic, Trump has become a crypto supporter with a promise to make the U.S. the leading global crypto hub. At a Bitcoin Conference over the weekend, he told BTC holders not to sell their Bitcoin.

Trump has stated that once elected President, he will end the Russia-Ukraine war. With an end to the war, which has entered its third year, markets could see stability. The former President’s statements follow the market crash at the start of the Russian-Ukraine war, which has been struggling with recovery ever since.

After COVID-19 and the war onset, the U.S. Federal Reserves took a stand to hike rates, a move other nations borrowed. As reported by CNBC, Goldman Sachs economists predict that another term of Trump could have “profound implications” for the euro area’s economy.

Our baseline estimates point to a sizeable GDP [gross domestic product] hit of around 1% with a modest 0.1pp [percentage point] lift to inflation […] Trump’s re-election would thus pose a significant downside risk to our otherwise constructive growth forecast for the Euro area.

Goldman Sachs’ Jari Stehn and James Moberly

The “Trump Trade” concept in financial markets increased before the November elections. After Trump’s win in 2016, major stock exchanges in the U.S. and the dollar’s value surged, fueled by Trump’s promises to cut corporate taxes, ease financial regulations, and adopt more strict and protectionist trade policies.

This time, investors are betting on the same market plan, with the addition of crypto in the mix and some more with Trump’s MAGA (Make America Great Again).

The biggest sigh of relief came when Trump promised to fire Gary Gensler upon taking over the Oval Office and laying down a committee to ensure the U.S. is progressive in its financial policies with the aim of becoming the biggest Bitcoin reserve in the world.

Advertisement

Also Read: Gary Gensler & the US SEC’s Fate Depends on Election Result

Will Kamala Harris Adopt Crypto?

With the decline in the health of the current President, Joseph Biden, the Democratic Party seemed to have lost the 2024 Presidential elections after he could not keep up with the Republican opposition.

The Democrats sighed a breath of relief after the President announced his wish to drop out of the Presidential Race and nominated the current Vice President, Kamala Harris, as the Presidential candidate in his stead.

The tech-savvy supporters of the Democratic party expected Harris to be a bit more evolved than her counterpart in adopting new technology. However, her absence from the 2024 Bitcoin Conference was seen as an act of ignorance toward blockchain technology.

Various industry leaders were vocal about their disappointment and anger at the Democrat’s not attending any blockchain or crypto-related event.

It seems Kamala Harris has recently acknowledged the importance of digital assets in the 2024 elections. Several Democratic benefactors called for the political party to actively take measures to support the digital currency industry.

As previously reported by CryptoNewsZ, Kamala Harris’s team contacted crypto industry leaders to understand blockchain technology better.

Industry leaders like the Winklevoss Twins quickly grilled Harris on her stance on crypto, claiming they wouldn’t believe her allying with crypto after the U.S. Government moved $2 billion worth of Bitcoin the previous week.

Kamala Harris has also accepted campaign donations in digital assets, according to the CEO of Coinbase, who mentioned Harris’s campaign’s interest in the decentralized economy. Even Ripple’s co-founder donated over $5 Million to Harris’s presidential campaign. Bill Gates is also in support of the Democratic President elect.

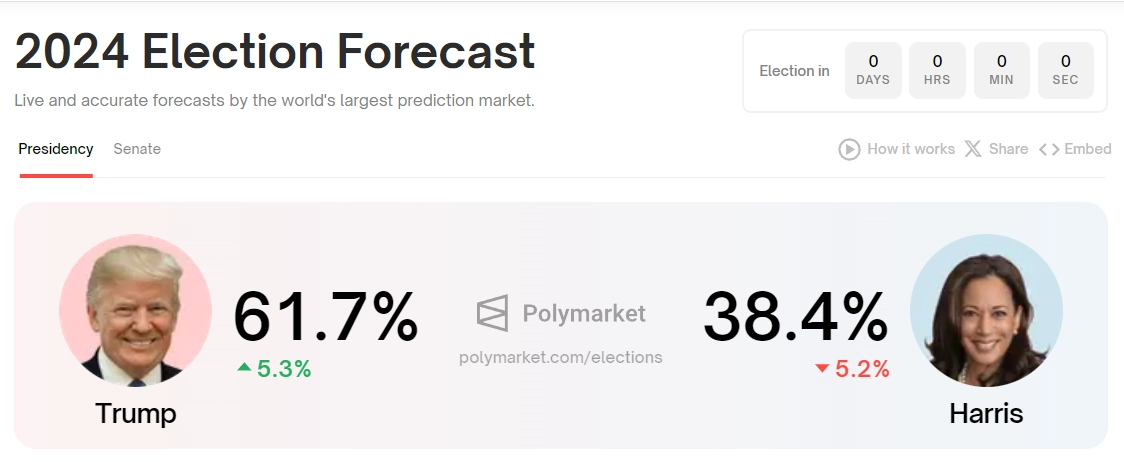

Despite showing a pro-crypto stance, Kamala Harris’s odds of winning the presidential elections have dropped to about 33% on Polymarekt bets, showing the domination by Donald Trump.

The Global Impact

If the 47th President of the United States ceases the ongoing scrutiny of cryptocurrencies, the markets are sure to see a bullish momentum take charge. We expect the allies of the United States to follow suit; the NATO alliance, along with other smaller countries that mirror the movements of the U.S., are sure to follow suit.

Canada has restricted Crypto activities with a ban on perpetual, futures, and options trading. The taxes in the Great North also dissuade new investors from entering the crypto markets. However, if its neighbor accepts Bitcoin and crypto, the great North will also follow suit, as it has with all other policies of the United States.

While taking the NATO alliance into consideration, each country allied has followed the United States in all other aspects, including war. The recent Russia-Ukraine conflict, along with the Israel and Hamas conflict, all NATO countries have sided with the United States ally.

There are various smaller countries that rely on the United States’ aid, donations, and trade support to sustain their economy, and they have majorly followed the States in their political and financial decisions.

U.S Elections Odds on Polymarket

Current Polymarket bets show 61.7% odds favoring ex-President Donald Trump, with only 38.4% Supporting Kamala Harris. Despite support from famous artists and the hip-hop culture, the money flow by the crypto industry is definitely the game changer in the 2024 elections.

All things considered Donald Trump taking the Oval Office will definitely help impact the crypto agency with a projection of Bitcoin price shooting above the elusive $100,000 mark.

Also Read: Crypto in the Voting Booth? Analyst Predicts Bitcoin’s Role in Elections

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Gate

Gate  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD