Here’s Who is Driving the Bitcoin Rally Past $71,000 Today

Today, Bitcoin reached a fresh record, successfully recapturing the much-anticipated $70,000 level—a threshold it had struggled to regain over the last four months.

Bitcoin has not only re-entered the $70,000 range but is also progressing swiftly toward its all-time high. Specifically, it has hit an intraday high of $71,475 and continues to maintain its gains. Now, Bitcoin is just 3.5% shy of its peak of $73,750.

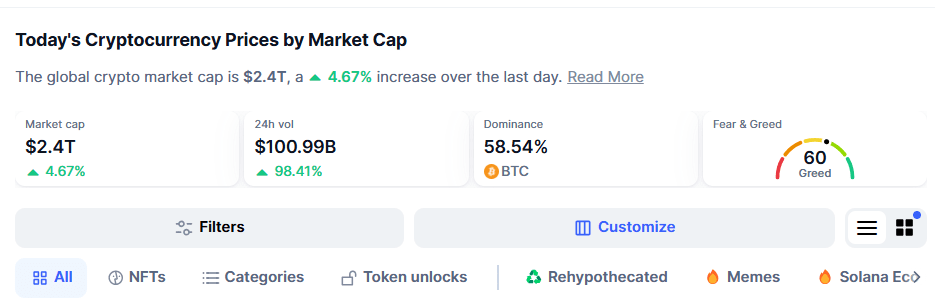

Bitcoin’s rally has been felt throughout the crypto market. The global market experienced a 4.56% increase over the past day, bringing it to $2.4 trillion. This reflects a fresh influx of approximately $112.08 billion entering the market in the last 24 hours. Moreover, market volume has surged by 89.41%, now standing at $100.99 billion.

Robust crypto market amid Bitcoin rally

This unexpected development has prompted market participants to consider the factors behind the turnaround. Analytics platform CryptoQuant attributes the Bitcoin uptrend to massive trading activity, particularly from Binance whales—large traders on the Binance exchange.

How Binance Whales Are Driving Bitcoin Price

In an analysis today, CryptoQuant market watcher Mignolet highlighted that Binance whales have been engaging in the market during Asian trading hours, beginning around October 14.

This activity has impacted the Coinbase Premium Gap (CPG) data, which tracks price differences between Coinbase and Binance—prominent exchanges for U.S. and international traders. As of today, the CPG is declining even as Bitcoin’s price rises, showing a “negative premium.”

Mignolet cautions against interpreting this as a drop in U.S. demand. In fact, since October 14, U.S. Bitcoin spot ETFs have seen heightened inflow, with net influxes of about 47,000 Bitcoin—roughly $3.34 billion, given Bitcoin’s current market value above $71,000.

Additionally, recent inflows into U.S. Bitcoin ETFs reached a six-month high, as reported by The Crypto Basic last week.

Mignolet further noted that CPG data closely tracks ETF demand, as most ETF products use Coinbase. Normally, high U.S. demand would drive the CPG positive, but the negative premium instead suggests that Binance whales are playing a central role in driving Bitcoin’s price. In contrast, U.S. demand remains robust but isn’t fully reflected in Coinbase prices.

Essentially, the current Bitcoin price is being influenced primarily by Binance whales, with strong support from steady U.S. capital inflows.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Waves

Waves  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD