Here’s why Bitcoin price is crashing

With only four days left until the end of August, the cryptocurrency industry has witnessed a rapid decline in the price of Bitcoin (BTC), which has crashed below the psychological level of $60,000, and crypto traders and investors are curious about the factors behind the sudden drop.

Indeed, Bitcoin has accumulated a dip of over 10% in the last 30 days, its current price crowning last week’s volatility in the crypto market, during which the prices of many other crypto assets were rising and nosediving indiscriminately, raising concerns among crypto investors.

Bitcoin price analysis

Specifically, Bitcoin is currently changing hands at the price of $59,530, which suggests a 3.99% decline in the last 24 hours, a modest recovery of 0.50% across the previous seven days, while losing 14.04% in the past month, according to the most recent chart data retrieved on August 28.

Why is Bitcoin crashing?

Notably, one reason for the massive dump could be significant whale sell-offs, as demonstrated by one whale who had moved 2,300 BTC worth $142.24 million to Kraken, a renowned crypto exchange, as recorded by the crypto transaction tracking platform Arkham Intelligence.

In fact, sending a large amount of a crypto asset to centralized exchanges often happens with the goal of selling it, triggering a bearish sentiment as other holders follow suit, and, considering the above whale still has 18,141 BTC worth $1.08 billion in their possession, getting rid of it could add to the downtrend.

At the same time, Bitcoin has faced a wave of large liquidations stemming from the embattled crypto trading platform Celsius’s repayment of close to $2.5 billion to its 251,000 creditors since the plan kicked off in January 2024, a recent court filing reveals.

Specifically, the filing to the Delaware bankruptcy court points out that:

“Since the Effective Date, the Post-Effective Date Debtors have successfully made initial distributions to approximately 251,000 creditors – roughly two-thirds of all eligible creditors by number and approximately 93% of the eligible value.”

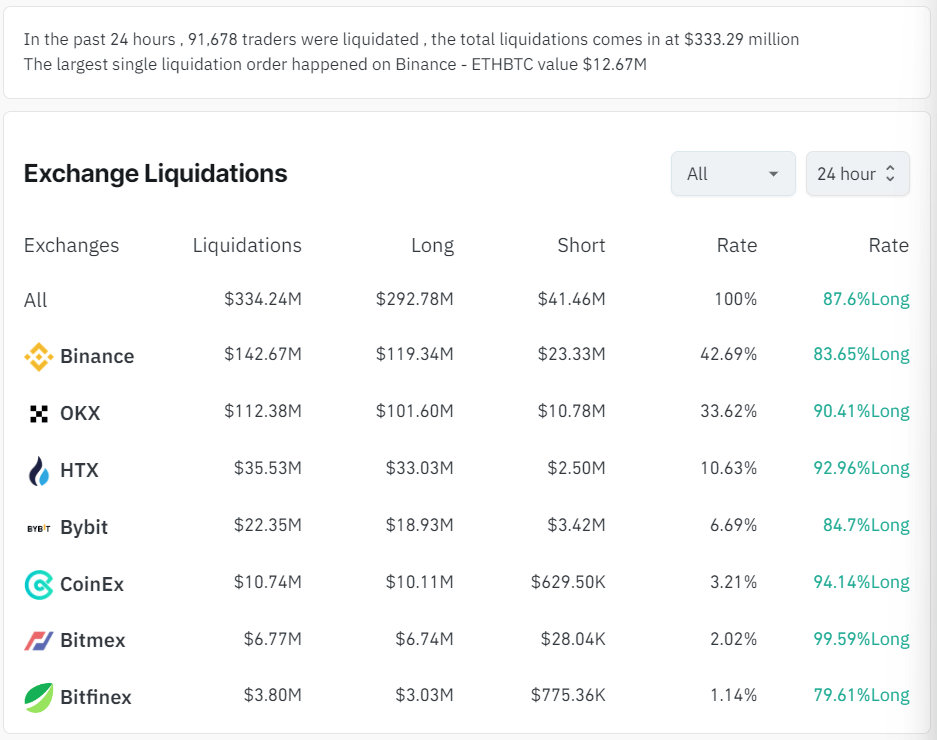

In response, the crypto market reacted with nearly $335 million in liquidations of leveraged crypto derivatives positions in the timeframe of just 24 hours, the largest since the August 5 crash, as per the latest data by aggregated derivative exchange data platform CoinGlass.

On the other hand, Steven Lubka, head of private clients and family offices at Swan Bitcoin, the financial services provider focusing solely on the largest asset in the crypto sector by market capitalization, believes this could be a great ‘buy the dip’ opportunity for Bitcoin, telling CNBC that:

“Leverage-driven flushes typically are great buying opportunities. (…) And while I expect markets to buy the dip on Bitcoin, Ethereum (ETH) may continue to struggle until investors have a reason to be positive on the asset again.”

BTC consolidation = imminent recovery?

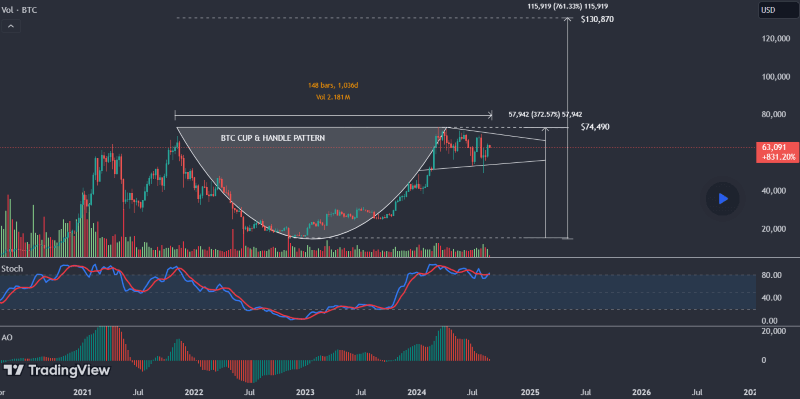

Meanwhile, as Bitcoin continues consolidating in a nearly six-month price range that is getting tighter, a breakout might be imminent as the range acts like the ‘handle’ to a three-year ‘cup’ chart pattern, as recently stressed by pseudonymous crypto market analyst MetaShackle.

Furthermore, a bullish analysis also comes from another pseudonymous crypto expert, TradingShot, who has recently highlighted that the end of August could be pivotal in pushing Bitcoin to reach the high price mark of $100,000, considering its remarkable resilience.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom