How many crypto millionaires are there? Meet the industry’s biggest players

Many people have stumbled upon unexpected wealth thanks to cryptocurrencies. You don’t have to be an expert to see that Bitcoin’s price is sky-high compared to when it first started. Back around 12-15 years ago, you could buy thousands of Bitcoins for almost nothing.

It’s believed that the biggest gains were made by those who believed in digital currencies at the very beginning. But fast forward to today, and new coins are still popping up, offering fresh opportunities to make a fortune. Recent reports show that the number of crypto millionaires is on the rise, proving that people are still cashing in on this digital gold rush. How many cryptocurrency millionaires are there?

Table of Contents

- Understanding crypto millionaires

- Estimating the number of crypto millionaires

- Factors influencing the number of crypto millionaires

- Who are some of the top crypto whales?

- Counting Millionaires

Understanding crypto millionaires

Crypto millionaires come from diverse backgrounds and employ various strategies to maintain their wealth. Beyond early investors, many have made their fortunes through savvy trading, capitalizing on market volatility to buy low and sell high.

Others have really flourished in the world of decentralized finance, finding ways to earn passive income by lending out their assets or providing liquidity to exchanges. Some crypto millionaires really make the most of their expertise by launching exciting projects that solve real problems or offer new experiences, drawing in significant investment.

The crypto world changes fast, and these millionaires realize that staying attuned to market trends is key to their continued success.

Estimating the number of crypto millionaires

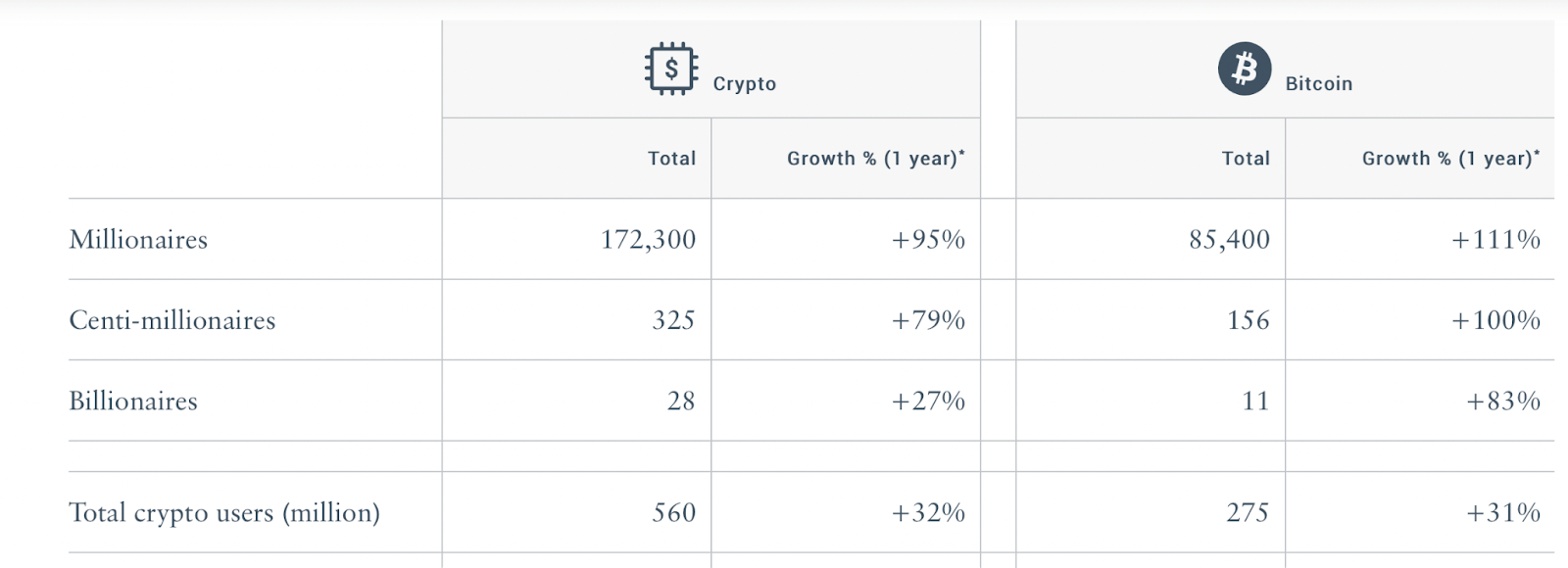

How many crypto millionaires are there in the world? According to the 2024 report by New World Wealth and Henley&Partners, there are currently 172,300 individuals worldwide who hold crypto assets worth over $1 million.

The number of millionaires exclusively owning Bitcoin has more than doubled compared to last year, reaching 85,400. Wealth growth in the crypto industry is being observed at all levels. There are now 325 crypto centimillionaires — individuals with crypto assets exceeding $100 million — and 28 crypto billionaires.

Among the six new crypto billionaires who emerged in the past year, five attribute their wealth to Bitcoin, highlighting its dominant role among long-term investors.

Worldwide crypto wealth statistics | Source: Henley&Partners

Factors influencing the number of crypto millionaires

The surge in wealthy individuals within the crypto space can be traced back to the growth of Bitcoin ETFs, which have gathered over $50 billion in assets since their introduction in January 2024, enticing institutional investors.

Additionally, just this March, Bitcoin (BTC) soared to a new all-time high of about $73,750, contributing to the total market value of crypto assets climbing to $2.43 trillion at the time of writing. This growth has undoubtedly made many crypto holders richer. Although some coins still haven’t bounced back to their 2021 peak values, the acceptance of cryptocurrencies by big names like BlackRock and Fidelity could fuel even more wealth for those heavily invested.

Who are some of the top crypto whales?

According to Forbes, the list of crypto whales features the founders of prominent exchanges, developers behind blockchain platforms, and other influential figures closely tied to the crypto scene. Here are the five richest among them.

Paolo Ardoino

Paolo Ardoino | Source: CoinDesk

Paolo Ardoino is a notable player in the crypto world, stepping into the CEO role at Tether in 2023. His journey began in 2014 as a senior software developer at Bitfinex, and since then, he has been instrumental in Tether’s growth, expanding its stablecoin offerings and enhancing blockchain infrastructure. Ardoino’s net worth is estimated at $3.9 billion.

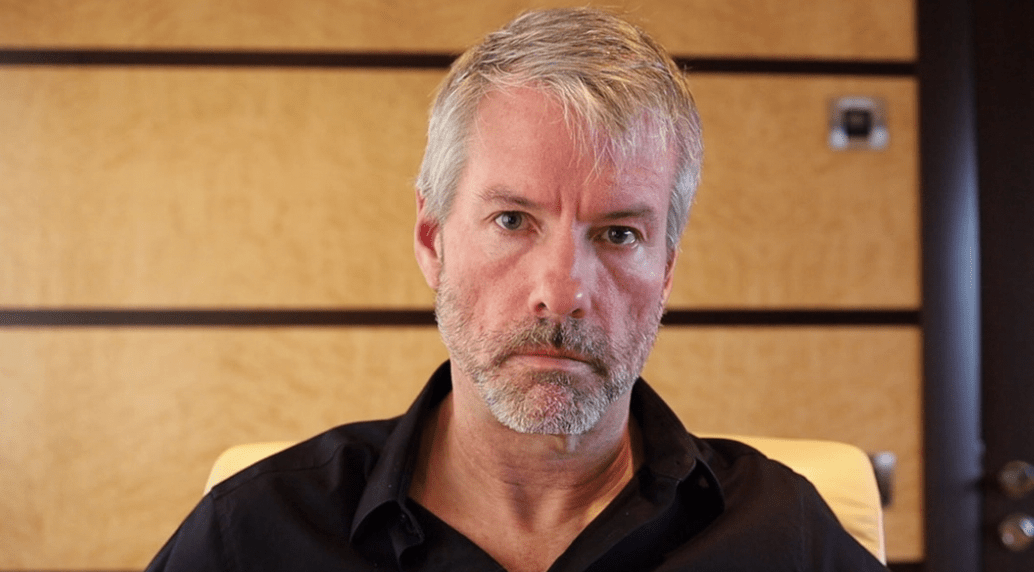

Michael Saylor

Michael Saylor | Source: michael.com

Michael Saylor is the founder and CEO of MicroStrategy, a company that specializes in business analytics software. Since 2020, he has passionately championed Bitcoin, leading his firm to make bold acquisitions in the cryptocurrency. This innovative approach has allowed MicroStrategy to stand out as a pioneer among public companies in the ever-evolving crypto arena. Saylor’s net worth is estimated at $4.4 billion.

Giancarlo Devasini

Giancarlo Devasini | Source: Bloomberg

Giancarlo Devasini co-founded Bitfinex and served as its CEO for a period. Currently, he’s the Chief Financial Officer and holds a 47% stake in Tether, a position that has greatly contributed to his wealth. His net worth is estimated at $9.2 billion.

Brian Armstrong

Brian Armstrong | Source: CNN

Brian Armstrong is the founder and CEO of Coinbase, one of the largest cryptocurrency exchanges in the world. With its easy navigation and solid security, Coinbase has gained a loyal following.

Beyond his work with the exchange, Armstrong actively supports the blockchain community, co-founding the Stand With Crypto movement to encourage education and advocate for favorable regulatory changes. His net worth is estimated at $11.2 billion.

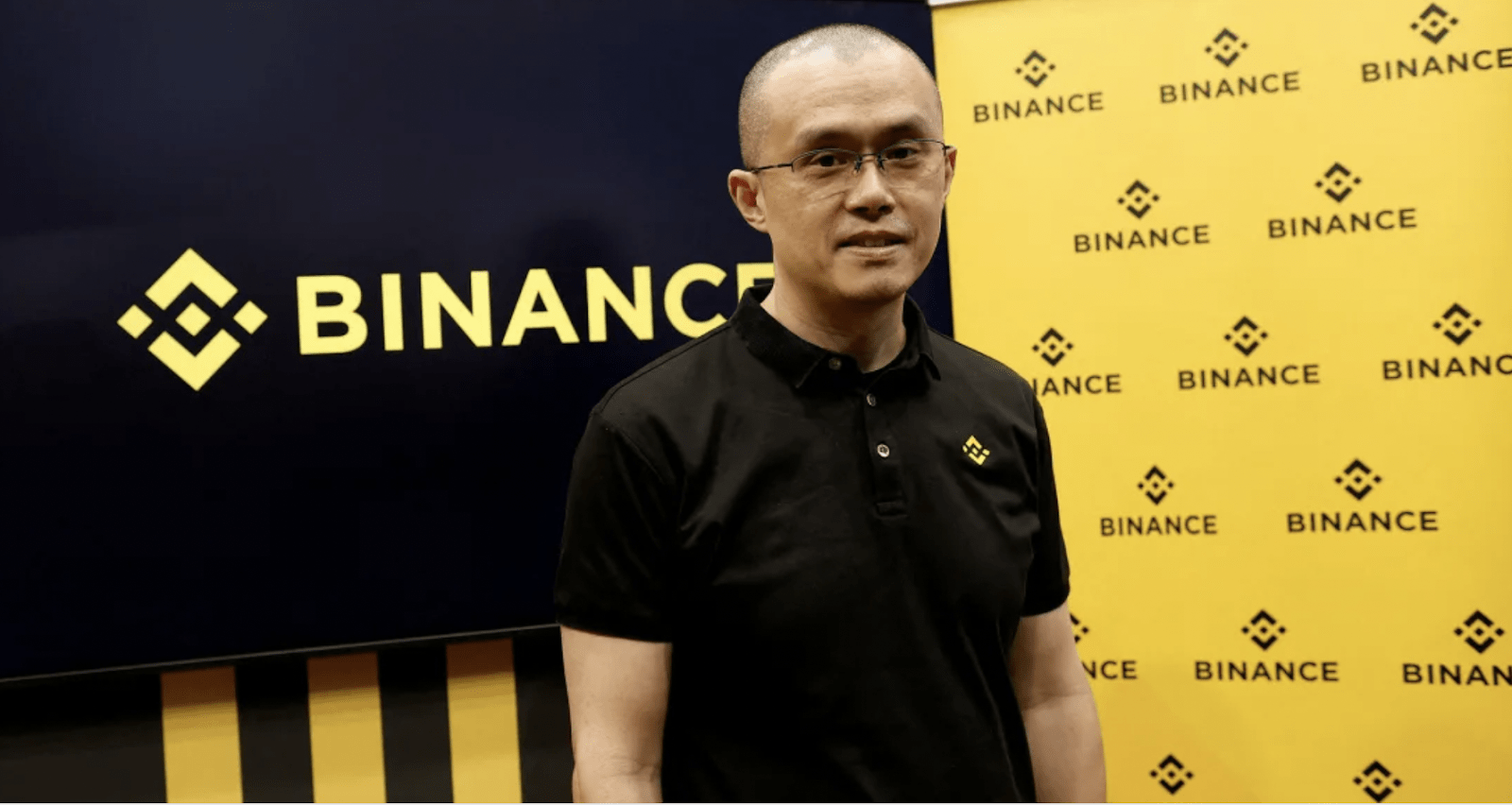

Changpeng Zhao

Changpeng Zhao | Source: CNN

Often called ‘CZ’, Changpeng Zhao is the founder and former CEO of Binance, the biggest cryptocurrency exchange out there. His wealth stems from his ability to elevate Binance into a premier trading platform and his strategic investments in innovative blockchain projects that are making waves in the industry. Although he stepped down as CEO following an agreement with the U.S. Department of Justice, his influence as a leading crypto whale remains strong. Zhao’s net worth is estimated at $33 billion.

Counting Millionaires

In summary, there are around 85,000 known millionaires in the world, although the true number is difficult to ascertain due to the pseudonymous or even anonymous features baked into cryptocurrency technology.

The wealth of crypto whales reflects not only their personal success but also the growing significance of digital assets in the global economy.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom