How To Use Polymarket In The United States: Step-by-Step Guide

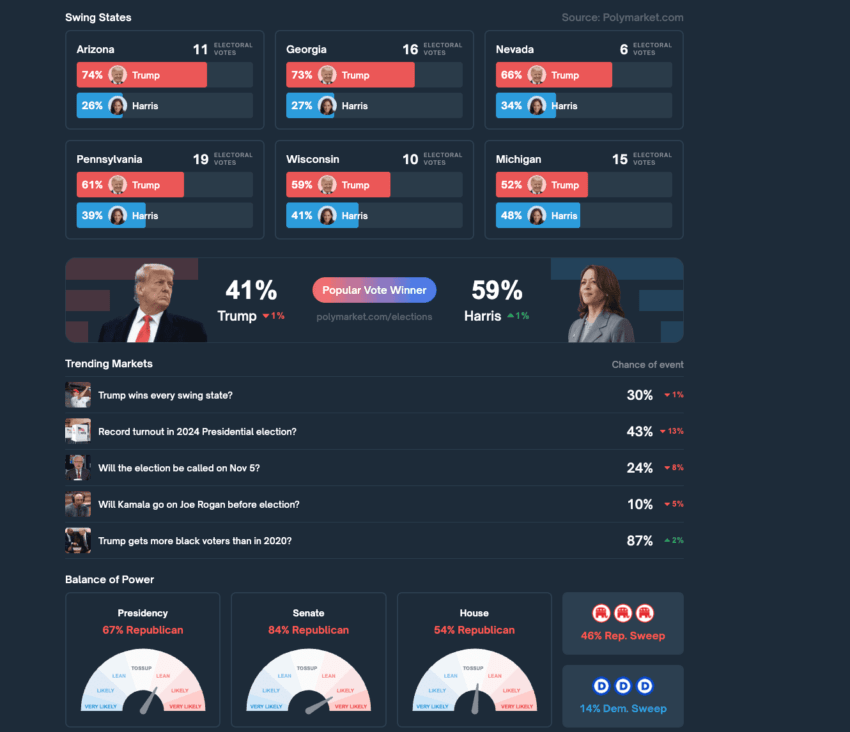

The U.S. presidential election — a seemingly needle-close and often polarizing contest pitting Donald Trump against Kamala Harris — has been a key source of speculation and driver of discourse in 2024. With Polymarket, you can make calculated predictions on key events, from political predictions to real-world outcomes, adding value to your insights. This guide will show you how to use Polymarket effectively, understand election odds, and get started with your own prediction markets.

In this guide:

- How to bet on Trump vs. Harris on Polymarket

- Getting started with Polymarket in the U.S.

- Tips for making money on Polymarket

- What can go wrong with Polymarket?

- Why Polymarket stands out among prediction platforms

- How to trade safely on Polymarket

- Frequently asked questions

How to bet on Trump vs. Harris on Polymarket

Can you actually predict the next president of the United States of America via Polymarket? The answer is yes, and it’s potentially easier than you might think. By following a few steps, you can make informed predictions, see real-time election odds, and potentially make a profit.

In short, to use Polymarket to predict the result of the U.S. election, you must:

- Set up your crypto wallet and fund it with USDC.

- Navigate to the Trump vs. Harris prediction market

- Select your chosen outcome (Trump win or Harris Win)

- Buy shares (before selling, if necessary, as election odds change).

Let’s break the process down in more detail, step by step.

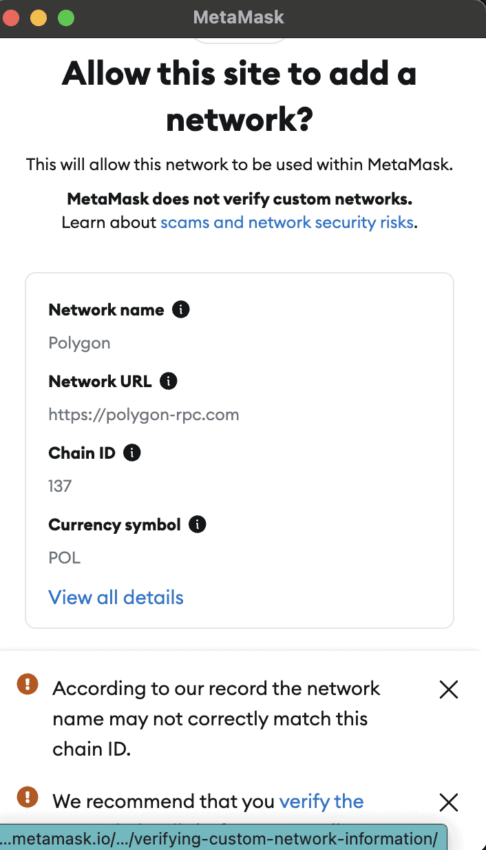

1. Set up your wallet for Polymarket

Before placing your prediction, you’ll need a crypto wallet and some USDC in it. Here’s how to get started:

- Choose your wallet: Many users prefer MetaMask, a reliable Ethereum-compatible wallet that works well with Polymarket’s Polygon integration for low transaction fees.

Polymarket wallet sync: MetaMask

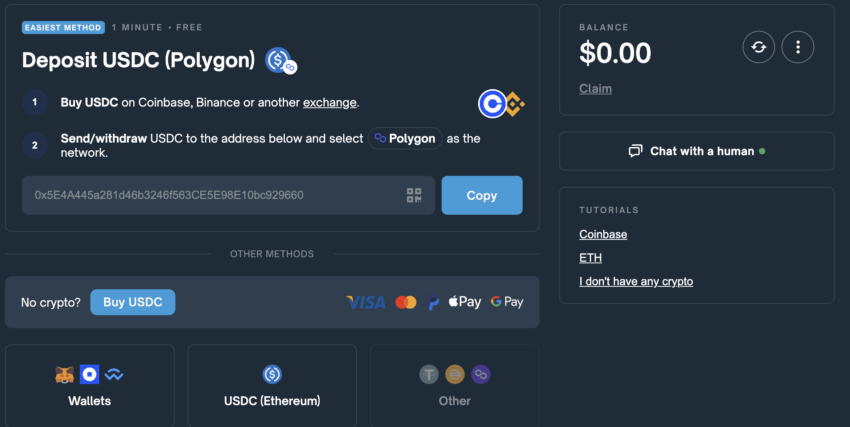

- Fund with USDC and MATIC: USDC is used to buy shares, while MATIC (Polygon’s currency) covers transaction fees. Even a small amount of MATIC, around 0.1, usually covers initial trades.

How to use Polymarket and deposit USDC: Polymarket

- Buy USDC if not already holding: Besides wallet transfers, you can purchase USDC using traditional tools like debit and credit cards.

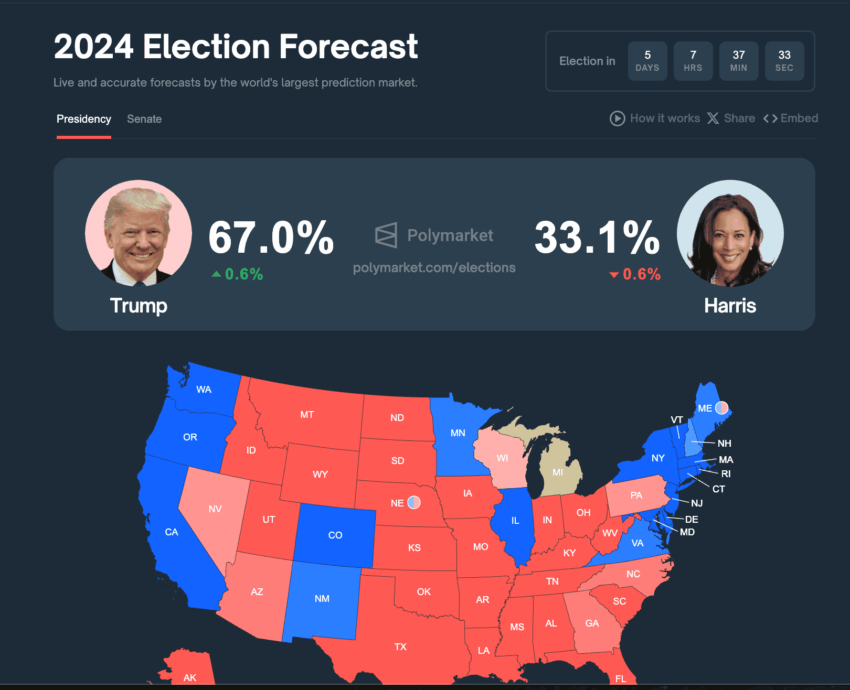

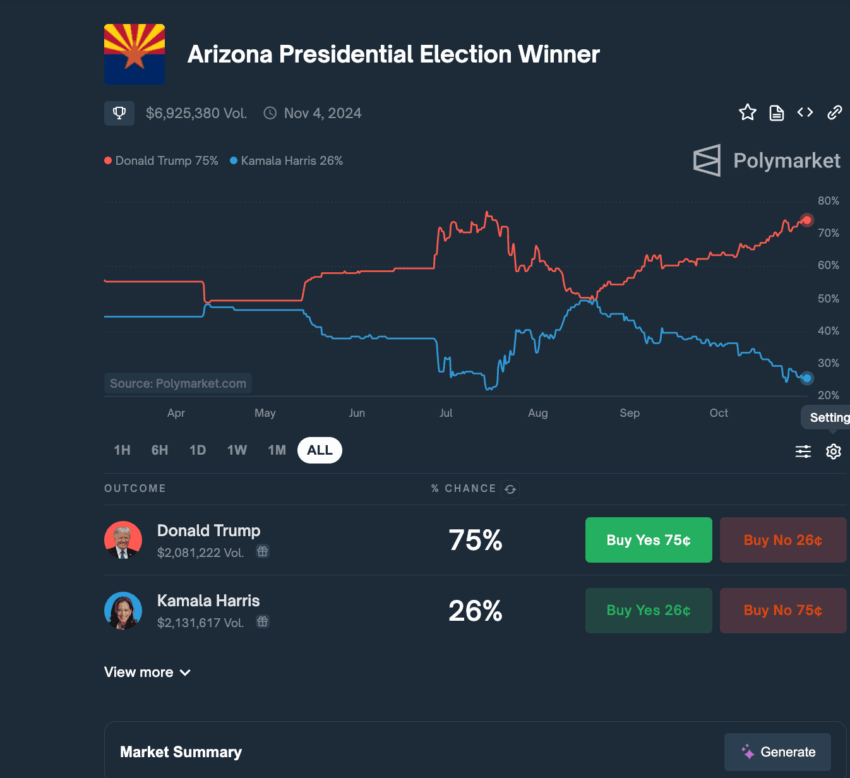

2. Find the Trump vs. Kamala prediction market

To view current odds for Trump vs. Harris, head to Polymarket’s U.S. elections section or type “Trump vs. Harris” in the search bar. Each market’s interface displays share prices for “Yes” or “No,” letting you see where other users stand on the outcome.

How to predict Trump vs. Kamala: Polymarket

At present, simply heading to the Elections tab will reveal all Trump vs. Harris prediction markets.

Election markets on Polymarket

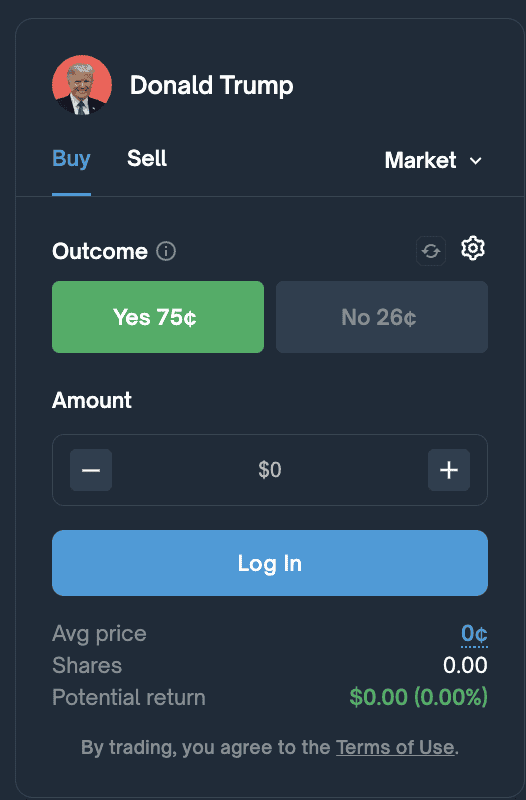

3. Buy shares in the Trump vs. Kamala market

When you find the right market, here’s how you can place your prediction:

- Select your outcome: Choose between Yes or No shares based on who you think will win.

- Purchase shares: Share prices fluctuate based on supply and demand. If the prediction turns out correct, buying at a lower price could increase your returns.

How to use Polymarket for buying shares: Polymarket

Here is a quick mathematical scenario to help you out:

Here’s what happens next:

- If Trump wins: Each “Yes” share is worth $1 when the market resolves, so you make $0.25 profit per share (the difference between $1 and your purchase price of $0.75).

- If Trump loses: Your “Yes” shares become worthless, and you lose the $0.75 you spent on each share.

Shares: Polymarket

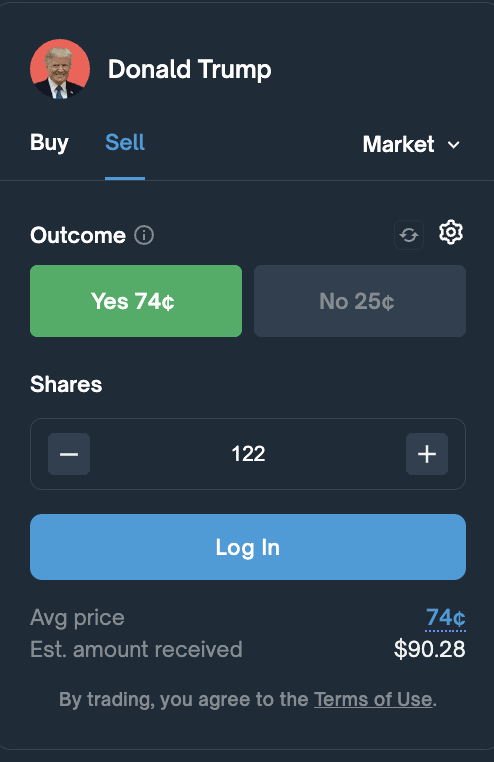

4. Sell shares before the outcome is final

Polymarket allows you to sell shares at any time before the final outcome, giving you flexibility to adjust your position as election odds shift:

- Lock in profits if the outcome is leaning toward your prediction.

- Limit losses by selling if the odds turn against you.

How to use Polymarket for selling shares: Polymarket

Here is an example that explains it better:

Imagine you bought Trump “Yes” shares at $0.75. As time passes, new developments (like a poll favoring Trump) cause his “Yes” share price to rise to $0.90. Here’s where selling comes into play:

- Selling early for profit: At $0.90, you can sell your shares even before the election results are known. Selling now locks in a $0.15 profit per share (the difference between the current price of $0.90 and your original buy price of $0.75).

- Cutting losses: Alternatively, if circumstances turn against your prediction (e.g., Kamala gains popularity), the price might drop to $0.65. You could sell at this lower price to recover part of your investment and cut your losses rather than risk a total loss if Trump doesn’t win.

It is worth noting that at any point before the outcome, both “Yes” and “No” shares hold value.

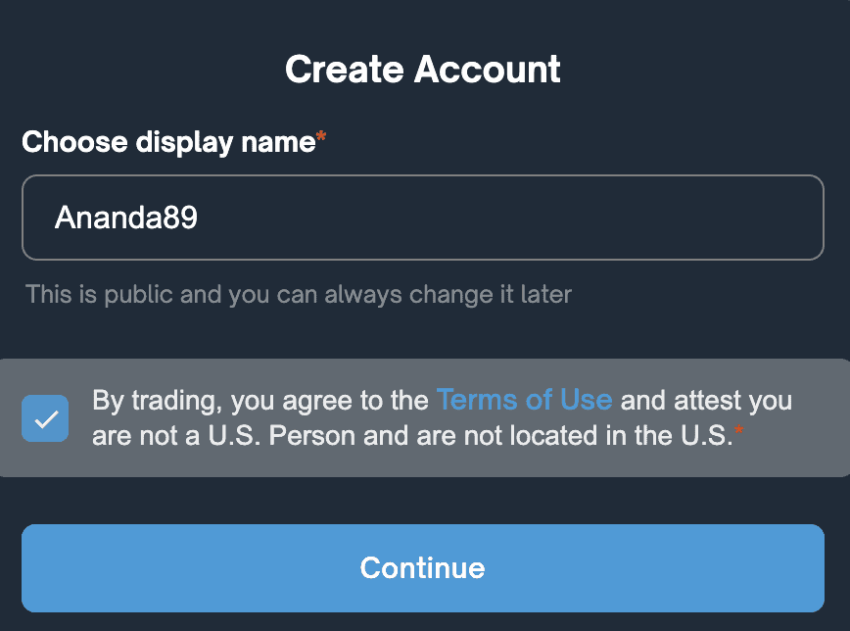

Getting started with Polymarket in the U.S.

Due to U.S. regulatory laws, residents are restricted from making trades on the platform, but they can still access Polymarket to view markets and data. This means that while you can explore political predictions and current odds, active participation — like buying or selling shares — isn’t available in the U.S.

Do note that even though bypassing restrictions using a VPN can be a possibility, we usually advise against it. As for usage, U.S. citizens can view the Polymarket markets and place the predictions elsewhere on seeing and identifying trends.

Polymarket in the U.S: Polymarket

For non-U.S. users, the process involves a few steps:

- Create an account: Register using an Ethereum-compatible wallet, like MetaMask.

- Fund your account: Add USDC for trading and a small amount of MATIC to cover transaction fees.

This setup lets international users easily access prediction markets, while U.S. residents can explore the site to stay informed about real-time event probabilities.

Tips for making money on Polymarket

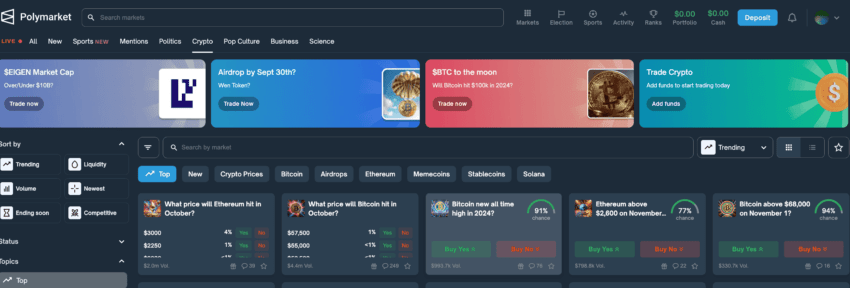

Polymarket isn’t just for traditional market predictions — it lets you predict outcomes in crypto, sports, pop culture, and business events. Here’s what makes it unique and how you can make the most out of it:

- Predict without timing the market: Unlike typical crypto predictions, Polymarket allows you to predict if a price will reach a specific level (like Bitcoin hitting $30,000) without needing to worry about timing your entry and exit. This feature keeps things simple for those who don’t want to track minute-to-minute price changes.

- Tap into events beyond finance: Polymarket users can speculate on sports games, movie box office hits, political outcomes, and even trending topics. This diversity means there are always new opportunities based on current events and pop culture.

- Stay informed for better odds: Staying up-to-date with news around your prediction market increases your chances of profiting. For instance, if you’re following a sports game, knowing the teams’ stats or current form gives you an edge.

- Use real-time odds to adjust your position: Since Polymarket odds fluctuate with public sentiment, you can track share prices to know where the crowd stands. If you sense a market shift, you can sell early to lock in profits or minimize losses.

- Diversify predictions: Spread your predictions across different markets — crypto, pop culture, and sports — to manage risks and increase potential returns. A diversified approach means you aren’t fully reliant on a single outcome, and it can give you steady gains over time.

- Follow market sentiment: Prices on Polymarket are determined by supply and demand, reflecting other users’ overall sentiment. By watching price movements, you can get a sense of the broader market view and make more informed decisions.

Supported verticals: Polymarket

What can go wrong with Polymarket?

While Polymarket can be profitable, it’s important to be aware of potential pitfalls. Here’s a quick breakdown of what can go wrong and how to mitigate risks:

- Market volatility: Prices on Polymarket change based on real-time sentiment. Rapid shifts in demand can cause significant price swings, potentially leading to losses.

Solution: Regularly monitor share prices and exit positions early if market sentiment turns. - Liquidity issues: If a market has low participation, it can be trickier to buy or sell shares at your desired price.

Solution: Stick to popular markets with high trading volumes for smoother transactions. - Limited U.S. access: U.S. residents face restrictions and can’t participate directly, limiting accessibility.

Solution: Use Polymarket primarily for data insights if based in the U.S. - Outcome disputes: Some markets may face disputes over outcomes, especially in less clear-cut events.

Solution: Stick to markets with objective outcomes to avoid disputes over results. - Dependence on wallet security: If your crypto wallet is compromised, funds can be at risk.

Solution: Use secure wallets, activate two-factor authentication, and avoid phishing scams to protect your assets.

Why Polymarket stands out among prediction platforms

Polymarket has created a name for itself within the prediction market space by focusing on transparency, user control, and a wide range of event categories.

While it’s not the only platform out there, it has several unique advantages and trade-offs that set it apart from others like PredictIt, Augur, and Kalshi.

| Platform | Blockchain technology–powered | Market resolution | Focus area |

| Polymarket | Yes (Polygon) | Decentralized Oracle (UMA) | Politics, crypto, sports, pop culture |

| PredictIt | No | Centralized | U.S. politics, global events |

| Augur | Yes (Ethereum) | Decentralized | Open market creation, sports |

| Kalshi | No | CFTC-regulated | Politics, finance, weather |

How to trade safely on Polymarket

To use Polymarket safely, start small with diverse predictions across crypto markets or the political arena. Secure your USDC wallet, monitor real-time price changes, and stay informed on events. Set limits on trades and consider exiting early to lock in gains or minimize losses. By following these steps, you can ensure you use Polymarket effectively and confidently manage risks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Litecoin

Litecoin  Stellar

Stellar  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Gate

Gate  Cronos

Cronos  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Stacks

Stacks  Theta Network

Theta Network  Tezos

Tezos  IOTA

IOTA  Tether Gold

Tether Gold  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Dash

Dash  Synthetix Network

Synthetix Network  Qtum

Qtum  Zilliqa

Zilliqa  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Holo

Holo  Enjin Coin

Enjin Coin  Decred

Decred  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Waves

Waves  Ontology

Ontology  Nano

Nano  DigiByte

DigiByte  Hive

Hive  Lisk

Lisk  Status

Status  Huobi

Huobi  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Steem

Steem  Bitcoin Gold

Bitcoin Gold  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD