If you put $1,000 into inverse Cramer ETF at the start of 2024, here’s your return now

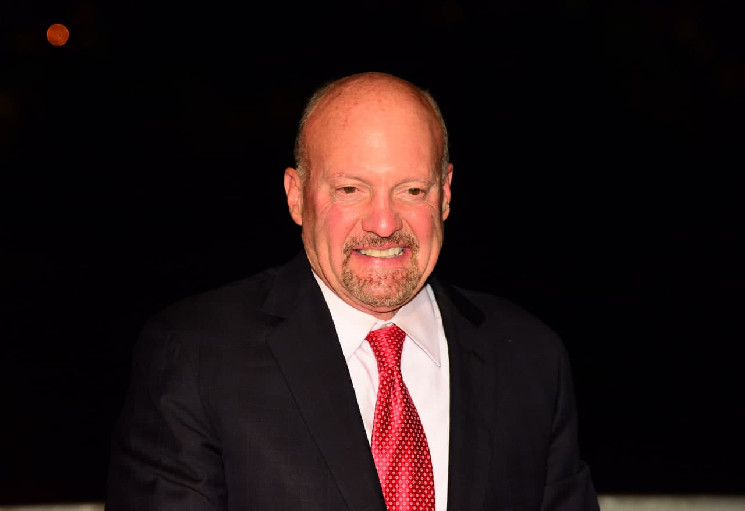

Out of the many memes that emerged in the stock market in recent years, the notion that Jim Cramer – the host of Mad Money and former hedge fund manager – is generally wrong is one of the most persistent.

Such an idea has led to the creation of two exchange-traded funds (ETFs) launched by Tuttle Capital. The first, the Long Cramer Tracker (LJIM), was shut down relatively quickly due to a lack of interest.

The second, arguably due to the popularity of the meme that whichever asset Jim Cramer recommends is bound to crash, drew much attention.

Still, as it turned out, the Inverse Cramer Tracker ETF (SJIM) – the fund that took a short position on whichever stock the famous host endorsed – didn’t succeed as much as many likely hoped.

Here’s how much an ‘inverse Cramer’ investment would be worth now

Specifically, the answer to the question of how much a $1,000 investment into the ‘inverse Cramer’ ETF made at the start of the year would have yielded by press time is both easier and harder to gauge than could be expected.

Indeed, early this year, Tuttle Capital was forced to shut SJIA down due to losses.

Furthermore, despite many trading bots and automated strategies that seek to invest opposite to Cramer’s recommendations, the performance of those tracked publicly reveals why the ETF did not survive – they tend to be substantially down despite 2024 featuring an exceptionally strong stock market.

Looking at some of Jim Cramer’s recommendations, the lack of success for ‘inverse’ strategies becomes quite apparent.

Why the ‘inverse Cramer’ strategy was always likely to fail

Even though the former hedge fund manager certainly made a fair share of blunders of the variety that earned him the reputation – for example, in late 2023, Cramer estimated 2024 would be Boeing’s (NYSE: BA) year – his most stubborn recommendation is simultaneously one of the best performers in the last 24 months.

Jim Cramer has been so bullish about the semiconductor giant Nvidia (NASDAQ: NVDA) that he even named his dog Mr. Everest Nvidia.

Mr. Everest Nvidia meet the world! pic.twitter.com/5GvTecuNyz

— Jim Cramer (@jimcramer) June 20, 2017

Simultaneously, the timing of this furry confirmation of bullishness does much to demonstrate why the Mad Money host is still, despite the online jokes, in business.

Though investing $1,000 in an ‘inverse Cramer’ ETF at the start of the year would have led nowhere, a similar investment made to celebrate Mr. Everest Nvidia’s introduction on June 20, 2017, would have appreciated to approximately $21,000 as NVDA shares are trading close to $140.

Featured image via Shutterstock

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  Zcash

Zcash  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Bitcoin Gold

Bitcoin Gold  Status

Status  Lisk

Lisk  Waves

Waves  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond