Illuvium Price Falls After Major Sell-off by luggis.eth

The cryptocurrency market witnessed a sharp decline in Illuvium’s (ILV) price following a significant sell-off by a prominent wallet address, luggis.eth, marking the second major sell-off this year. The trader withdrew 70,764 ILV tokens valued at approximately $2.86 million from the Illuvium platform and subsequently sold 40,000 ILV tokens, equating to $1.54 million, around 45 minutes before the latest market update. This action led to an immediate drop of around 7.8% in ILV’s price.

luggis.eth withdrew 70,764 $ILV($2.86M) from #Illuvium and dumped 40,000 $ILV($1.54M) 45 mins ago, causing the price of $ILV to drop by ~7.8%.

luggis.eth still holds 221,046 $ILV($8.25M).https://t.co/HcnYOc5xcl pic.twitter.com/MH7Khygb2J

— Lookonchain (@lookonchain) September 23, 2024

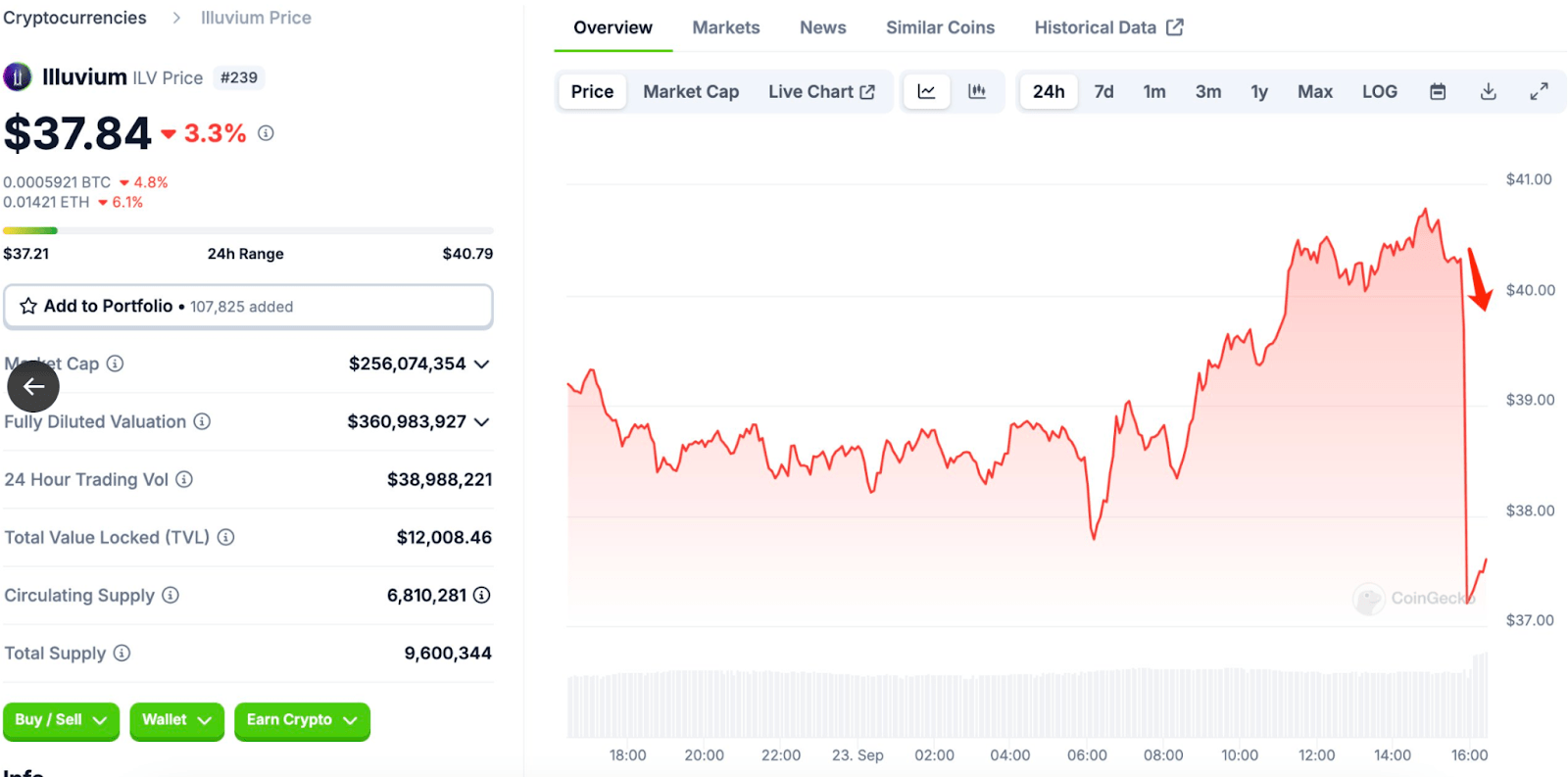

As of the latest data, ILV is trading at $37.84, reflecting a 3.3% decrease over the last 24 hours. The sell-off significantly impacted the market, with the price plunging from a high of $40.79 within the 24-hour range. The market cap stands at $256 million, with a fully diluted valuation of $361 million, while the 24-hour trading volume reached nearly $39 million, indicating heightened trading activity following the dump.

Potential Implications for Illuvium’s Market Stability

The rapid decline in ILV’s price underscores the vulnerability of Illuvium’s market stability when faced with substantial token movements by large holders. The market’s reaction highlights concerns over liquidity and the potential for further volatility if additional tokens held by luggis.eth, which amount to 221,046 ILV ($8.25 million), are sold off in the future. Market participants are closely monitoring the address’s activity as further movements could exert additional downward pressure on the price.

Snap | Source: CoinMarketCap

The recent events underscore the importance of liquidity management in crypto markets, particularly for tokens with relatively lower market caps. Illuvium’s community and investors may need to brace for ongoing volatility as large token holders continue to influence price dynamics.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Gate

Gate  Stacks

Stacks  Theta Network

Theta Network  KuCoin

KuCoin  Tezos

Tezos  Maker

Maker  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Ontology

Ontology  Decred

Decred  Hive

Hive  NEM

NEM  Bitcoin Gold

Bitcoin Gold  DigiByte

DigiByte  Lisk

Lisk  Huobi

Huobi  Waves

Waves  Status

Status  Nano

Nano  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond