Imminent breakout? XRP whales accelerate accumulation around $0.5

In recent weeks, XRP has increasingly consolidated around the $0.5 mark as investors await a possible breakout.

Notably, amid the dormancy in XRP’s price, new on-chain data indicates that whale investors have been accumulating the token, possibly in anticipation of a rally. Particularly, addresses with at least 100 million coins have been buying more XRP tokens during the dip in the first ten days of June.

Adding weight to this observation is the Mean Dollar Invested Age (MDIA) metric, which provides further insight into investor behavior. As of June 1, the 90-day MDIA for XRP stood at 1,812, indicating investors prefer to hold onto their XRP holdings rather than engage in active trading.

XRP’s next price movement

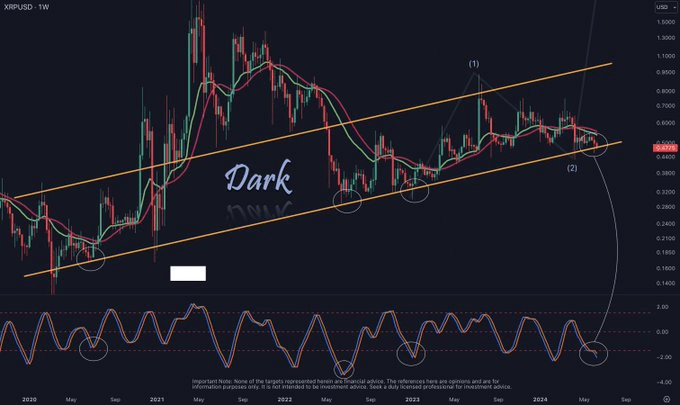

When looking at the next XRP price target, crypto analyst Dark Defender has suggested that the token might be lining up for a possible rally. In an X post on June 12, the analyst noted that the cryptocurrency had formed a familiar pattern from 2017.

The analyst observed that on the weekly time frame, XRP had positioned itself above a critical support level, echoing past instances where the token demonstrated resilience amid market turbulence.

Moreover, indicators suggest the possibility of a forthcoming reversal, with sentiment teetering on the brink of oversold territory. According to the analyst, crossing above $0.6640 and breaching the $1 resistance mark are pinpointed as pivotal moments that could pave the way for a sustained uptrend.

“The other side of the orange line, the resistance stands around $1. It will be easy above $0.6640 and $1,” the expert said.

At the same time, the expert provided a chart indicating that the price is testing the support line of the ascending channel, an area that has historically provided a good entry point for bullish positions.

The stochastic oscillator is near the oversold region, suggesting potential for upward movement if historical patterns repeat. If the support line holds, a bounce back towards the upper trendline could occur, potentially aiming for the $0.70 to $1.00 range over the next few months.

Although XRP has failed to replicate the movement of assets such as Bitcoin (BTC), the cryptocurrency has several underlying fundamentals likely to spur a breakout. For instance, if the ongoing Ripple and Securities Exchange Commission (SEC) case is ruled in favor of the blockchain firm, it could act as a catalyst for XRP’s rally.

Additionally, Ripple’s continuous expansion of its network of partnerships with financial institutions worldwide brings much-needed credibility from institutional involvement. Indeed, the market also anticipates that XRP will likely rally once Ripple rolls out its stablecoin pegged to the US dollar.

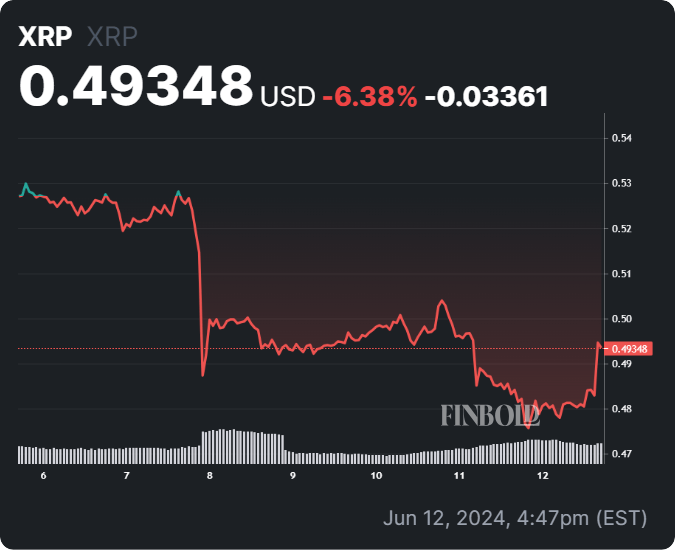

XRP price analysis

At the time of reporting, XRP was trading at $0.49, having rallied by over 2% in the last 24 hours. On the weekly timeframe, XRP was down 6%.

In the short term, XRP appears to be consolidating between the $0.47 support and the $0.50 resistance. Notably, a breakout above $0.50 could signal a potential move towards the next resistance at $0.52. On the other hand, a breakdown below $0.47 could lead to further declines, with the next support levels likely around $0.45 or lower.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  Cronos

Cronos  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Synthetix Network

Synthetix Network  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  NEM

NEM  Ontology

Ontology  Waves

Waves  Nano

Nano  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD