Is $525 Level Within Reach For AAVE Crypto As Whales Re-enter Market?

The analysis of the price action chart of AAVE crypto showed consolidation within a symmetrical triangle, indicating potential market equilibrium between buyers and sellers.

AAVE’s price fluctuated between well-defined support around $280 and resistance near $525, suggesting significant volatility within this consolidation zone.

The triangle’s apex appeared near the current price of $352.76, serving as a crucial breakout point that could define AAVE’s short-term price trajectory.

If AAVE breaks upward from the triangle, price movement could extend to the triangle’s height added above the breakout point, potentially propelling past $525, reinforcing bullish sentiments.

AAVE/USDT daily chart | Source: Trading View

The Moving Average Convergence Divergence (MACD) indicators, currently nearing a bullish crossover beneath the zero line, support the possibility of an upward breakout.

This bullish signal, if confirmed, could catalyze further buying pressure. A decisive close above the triangle could attract heightened trading activity, pushing AAVE towards the $525 level.

– Advertisement –

Conversely, failure to surpass this resistance could lead to a retest of lower support levels. Watching the MACD and volume can provide additional confirmation on whether the breakout will sustain, offering traders insights into upcoming price dynamics.

This analysis provides a structured outlook on AAVE’s possible future movements based on its current market behavior.

AAVE Crypto Whale Accumulation

In the recorded transaction, a newly created wallet withdrew 19,000 AAVE, valued at $6.6 million, from Coinbase Prime, indicating a potential accumulation phase.

This large movement suggested growing investor interest, which could increase buy pressure on the AAVE token.

Source: X

If this trend continues, coupled with broader market acceptance and favorable trading conditions, AAVE could experience a significant price rally.

Similar large transfers have often correlated with increased market activity and price spikes, making a surge past $525 a plausible scenario, particularly if followed by continued institutional or whale interest in AAVE.

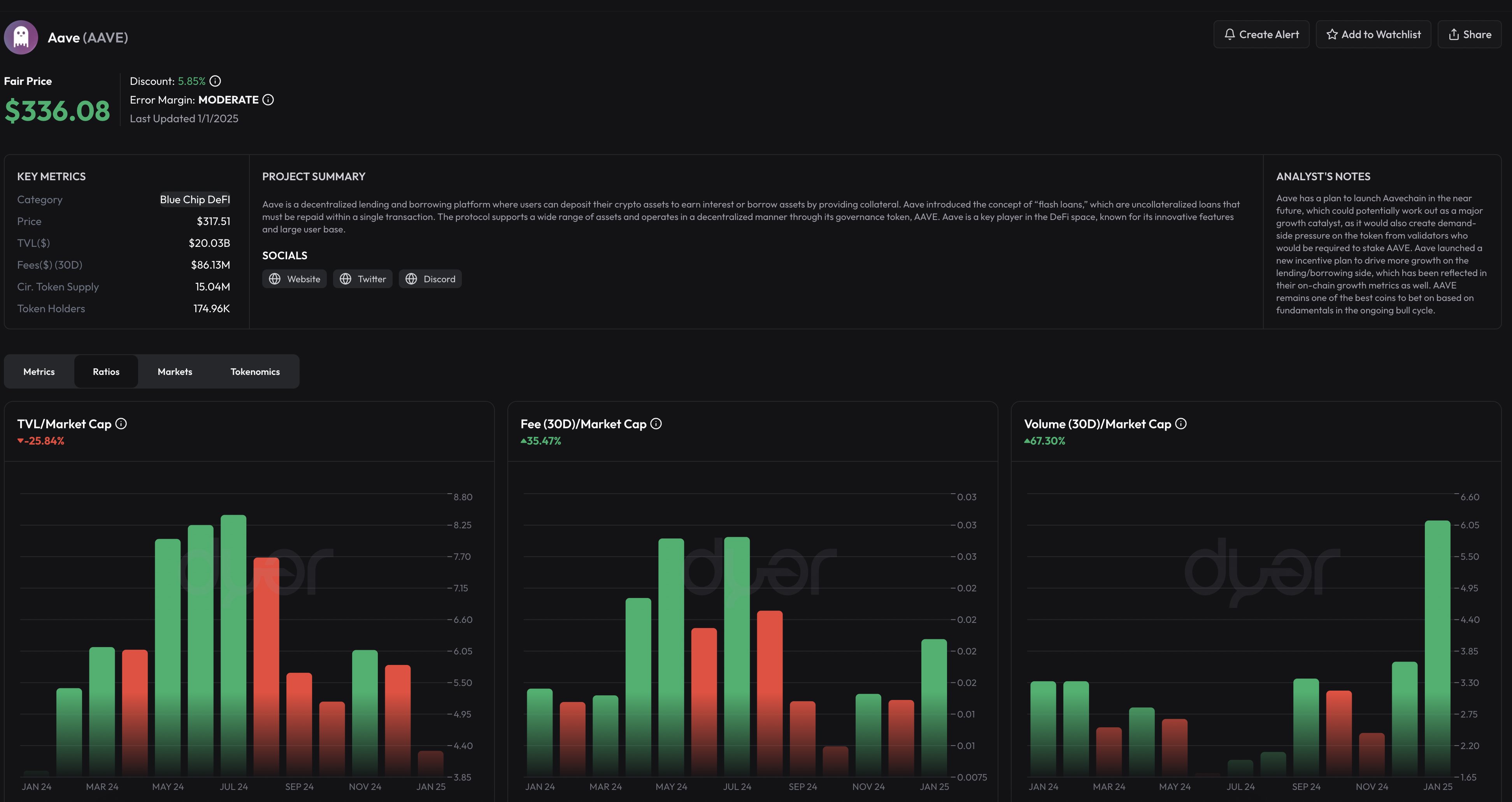

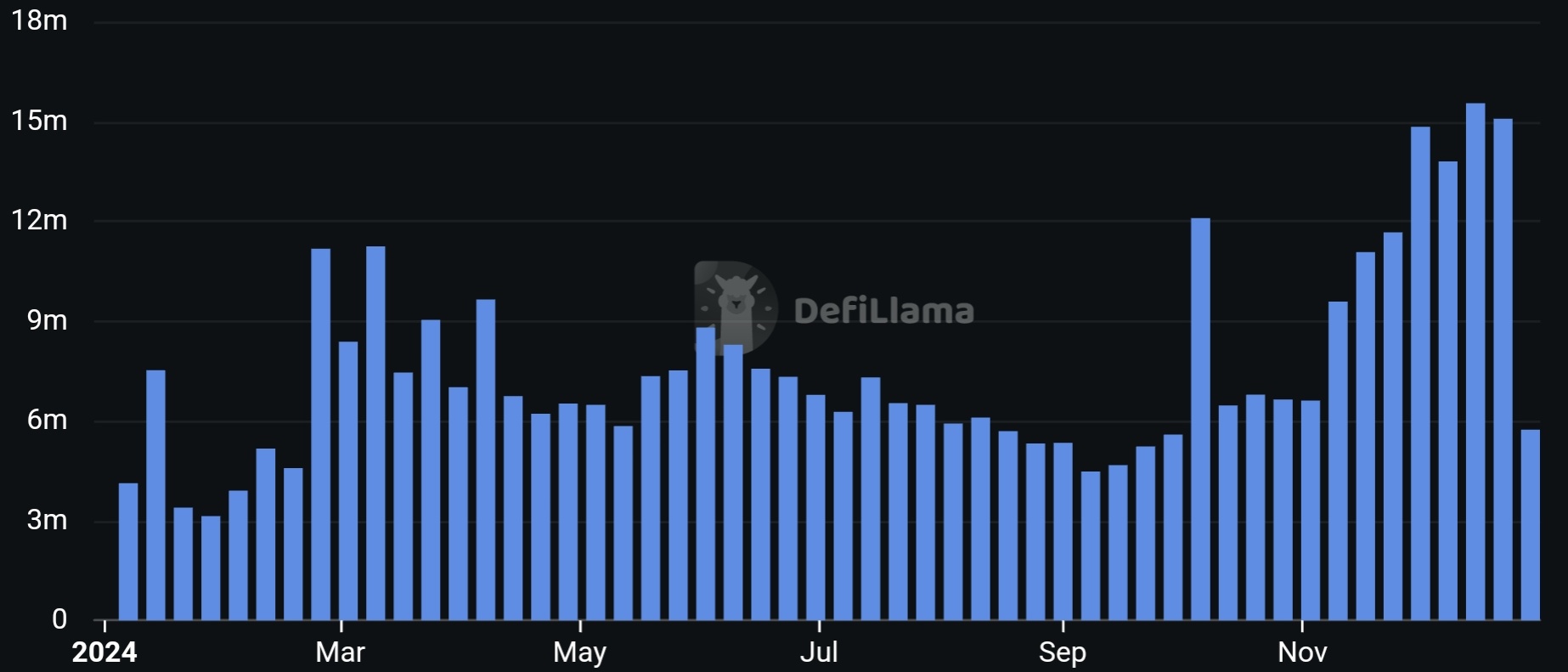

Yearly Revenue of AAVE

AAVE’s revenue trajectory over the last year, showed an uptrend with significant peaks and troughs. Each peak correlated with market optimism and subsequent utility spikes.

The November peak stood out, showing huge increase before a sharp decline, hinting at a volatile yet robust growth period for AAVE in terms of transactional throughput.

The Fees/Market Cap ratio has increased by 35% over the last 30 days, reflecting a growing revenue stream against a stable or slightly increasing market cap. This suggested efficient capital utilization, boosting investor confidence.

The Volume/Market Cap has also seen a 67% increase in the same period, a significant surge, demonstrating heightened trading activity which often precedes price volatility or a bullish trend.

These collectively suggested a robust economic condition within the AAVE ecosystem. As transaction volumes and fee contributions to the market cap increase, AAVE’s financial health appears strong.

Should these trends persist, AAVE could witness substantial price action, potentially rallying beyond the $525 mark as market conditions favor further growth driven by solid fundamentals and increasing trader and investor engagement.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Algorand

Algorand  Dai

Dai  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  Hive

Hive  Decred

Decred  DigiByte

DigiByte  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Ontology

Ontology  Huobi

Huobi  Nano

Nano  Status

Status  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond