Is the Bitcoin Power Law model more realistic than Stock-to-Flow?

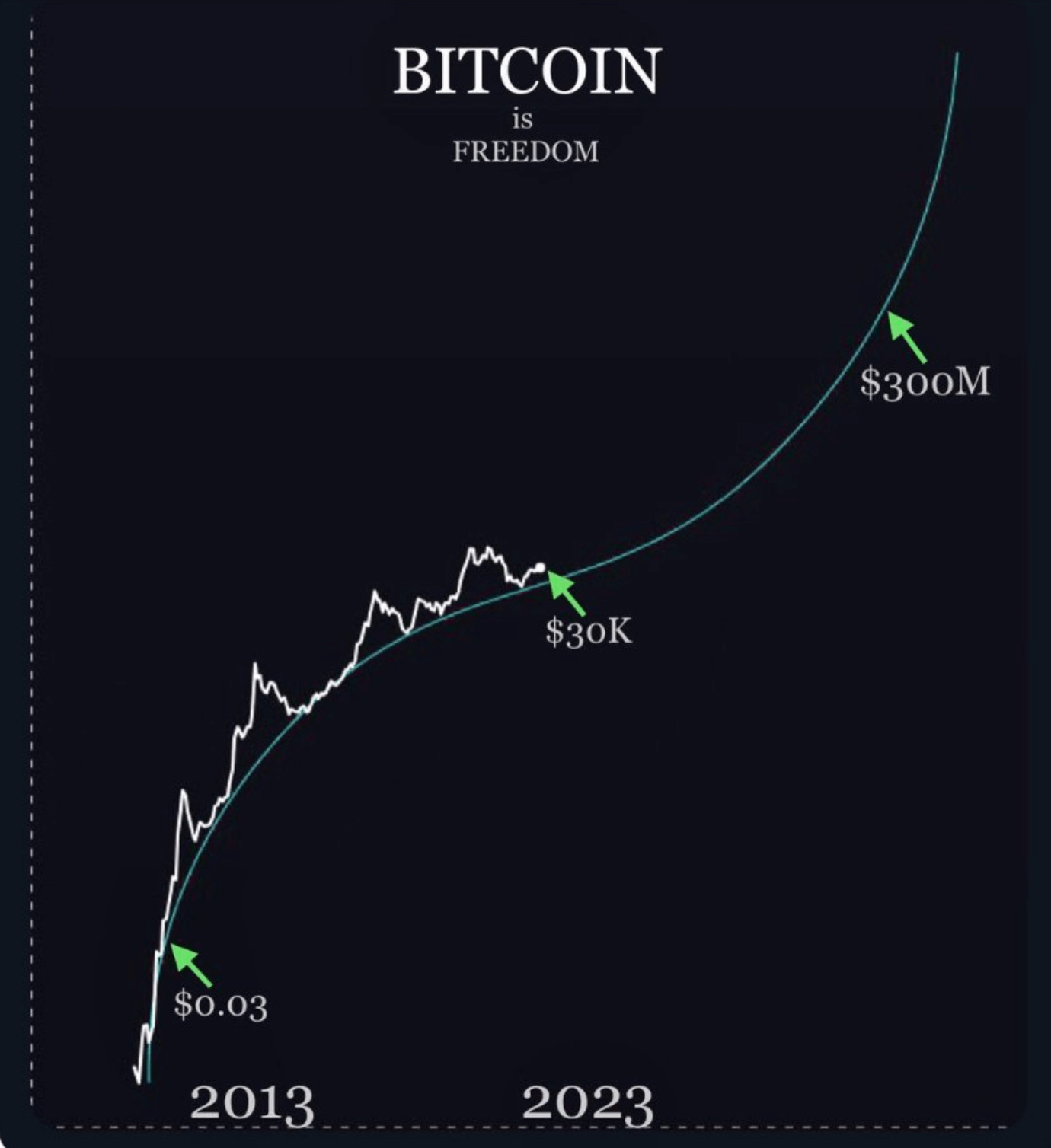

Since finance YouTuber Andrei Jikh recently covered the so-called Bitcoin Power Model, there has been a notable debate within the Bitcoin community around its viability.

Jikh opened his video entitled “2024 Bitcoin Price Prediction (CRAZY!)” by stating,

“Today I want to show how a simple math rule that’s able to predict patterns of the universe has also accurately tracked the last 15 years of Bitcoin’s price, and I want to show you what this formula says Bitcoin should be worth 10 years from now.”

He mentions a ‘rule’ based on a model that describes Bitcoin’s price growth as following a power law principle over time. The model is based on the work of astrophysicist Giovani Santasi, who has analyzed 15 years of Bitcoin data.

A power law is a statistical relationship between two quantities, where a relative change in one quantity results in a proportional relative change in the other, independent of the initial size of those quantities. This means that one quantity varies as a power of another. For example, if you double the length of a side of a square, the area will quadruple, demonstrating a power law relationship.

Jikh discusses how power laws have been used to predict various phenomena, including Bitcoin’s price patterns. The video suggests that Bitcoin’s price could potentially reach $200,000 in the next cycle and $1 million by 2033.

The significance of power laws in this context is that they allegedly allow for accurate predictions across different domains. In the case of Bitcoin, Santasi claims they explain its price patterns with a high degree of accuracy, as indicated by a 95.3% accuracy based on regression analysis.

In a blog post from Jan. 12, Santasi suggested renaming the model the BTC Scaling Law for reference.

Unsurprisingly, comparisons with PlanB’s Stock to Flow (S2F) quickly emerged as both models depict bullish scenarios for the world’s leading digital asset. On Jan. 30, Santasi shared a graph comparing the Power Law prediction for Bitcoin to S2F and commented,

“I wish S2F was true. But I rather count on a more realistic model that seems correct than on a model that is too optimistic and then to get disappointed. Also it is not good for BTC PR for the community to make these unrealistic claims.

I don’t think it is possible to get to tens of millions by 2033 (as S2F predicts). 1 M is already amazing (more realistic Power Law in time prediction).”

There has been a sizeable debate on X regarding which model is more accurate. Some believe the S2F model has been invalidated along with the rainbow chart, while others assert that global adoption will activate a return to the trend.

However, there has been little to discuss the other power law models used to analyze Bitcoin over time.

Other power law models for Bitcoin.

Santasi is not the first to utilize power laws for Bitcoin analysis. In 2014, Alec MacDonell at the University of Notre Dame introduced the Log Periodic Power Law (LPPL) model, which has been influential in understanding a Bitcoin bubble. This model focuses on asset price growth leading up to a crash.

Central to the LPPL model is the concept that Bitcoin’s price growth follows an exponential trend relative to log-time. Essentially, a consistent percentage increase in time correlates with a proportional increase in Bitcoin’s price. This model has proven useful in establishing critical support and resistance levels, guiding Bitcoin’s upward price trajectory. Despite the model’s predictive success, it’s crucial to recognize its foundational assumption that Bitcoin’s growth will continue to decelerate over time.

In 2019, Harold Christopher Burger built upon this foundation with the Power Law Oscillator (LPO), a tool designed to pinpoint optimal moments for Bitcoin investment, effectively predicting all four of Bitcoin’s all-time highs. Notably, Santasi suggests that Burger’s PLO model was inspired by his own work from 2018, citing this Reddit thread. The thread includes Santasi’s model against Bitcoin at the time. In the top comment, the OP claimed that “BTC will be around 150K in 2025.”

The Power Law Oscillator gauges Bitcoin’s relative valuation. With a range of 1 to -1, it signals whether Bitcoin is overpriced or underpriced at any given time. This tool’s efficacy stems from its alignment with several key factors: historical data analysis, network value correlation, complex system dynamics, and resistance to traditional financial models.

Bitcoin price and power/scaling laws.

When plotted on a log-log graph, Bitcoin’s price trends reveal a power law relationship. A regression model based on this data can account for much of Bitcoin’s price behavior, underscoring the model’s predictive capabilities. The model resonates with Metcalfe’s Law, which posits that a network’s value is proportional to its users’ square. This relationship has been validated in Bitcoin’s case, especially over medium to long-term periods.

The prevalence of power laws in complex systems, such as urban growth and network development, suggests that Bitcoin, following a similar pattern, is more than a mere financial asset; it’s a complex system in its own right. Bitcoin’s unique characteristics, including its decentralization and detachment from traditional financial controls, render conventional currency models less effective. In contrast, the power law model offers an arguably more accurate representation of Bitcoin’s market behavior.

The Stock-to-Flow (S2F) model offers a different yet complementary perspective. Popularized by an anonymous figure known as Plan B, this model assesses Bitcoin’s value based on its scarcity, a concept intrinsic to commodities. The S2F model calculates the ratio of Bitcoin’s total supply (stock) to its annual production rate (flow). This model’s relevance is amplified by Bitcoin’s predetermined supply schedule, characterized by halving events that reduce mining rewards and, thus, the flow, increasing the stock-to-flow ratio.

The S2F model gained significant attention, especially during the pandemic, as Bitcoin’s price seemed to follow its predictions. However, this model focuses solely on the supply side, omitting demand, a vital component in price determination. Its predictions, sometimes reaching astronomical figures, have sparked debates in the financial community.

While the S2F model provides a standardized measure of scarcity, helping compare Bitcoin with other scarce assets, it’s essential to consider it as one of many factors in evaluating Bitcoin’s investment potential. Market acceptance, technological advances, regulatory changes, and macroeconomic conditions are equally crucial in shaping Bitcoin’s price.

Interestingly, Santasi’s models are more conservative than other predictions. Many argue that Bitcoin is in the early phase of S-curve exponential growth. Santasi rejects such models, stating that exponential growth on log charts is not feasible.

“Because the middle part implies exponential growth given in a log linear chart a straight line is an exponential. BTC has never gone through an exponential growth (I mean the general trend), the bubbles are exponential.”

Thus, while all of these models are used to predict Bitcoin’s price, they differ in their specific methodologies and assumptions. The S2F model focuses on supply and demand, Santasi’s model uses regression analysis to predict future prices, MacDonell’s LPPL model uses a calibration approach, and Burger’s Power Law Oscillator is used chiefly as a technical analysis tool that varies over time within a particular band.

If the BTC Scaling Law (power law model) continues to be validated, Bitcoin’s current value is closer to $60,000, and the next all-time high will be around March 2026, above $200,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  Theta Network

Theta Network  KuCoin

KuCoin  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  DigiByte

DigiByte  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD