Is the ‘Uptober’ Bitcoin rally over? BTC traders turn bearish

After a rocky start to October, Bitcoin (BTC) has taken off quickly, reclaiming its previously stable levels between $65,000 and $67,000, giving investors hope that the world’s premier cryptocurrency might soon aim for new all-time highs (ATH).

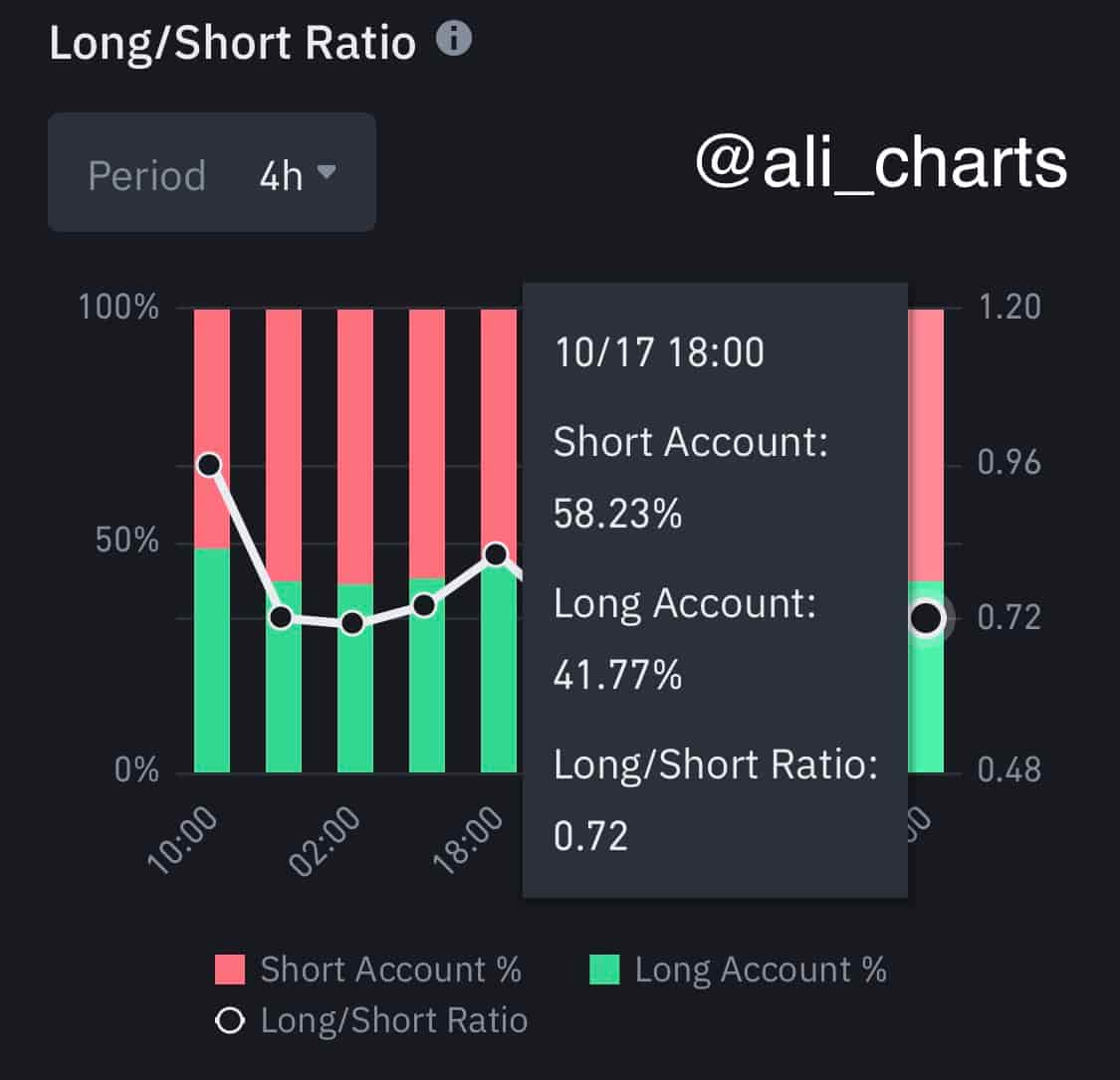

Despite the prevailing optimism, many traders appear convinced BTC is nearing the limits of the current rally, as 58.23% of Binance accounts with open Bitcoin positions have started shorting the cryptocurrency, per the data shared on X by the prominent analyst Ali Martinez.

While Bitcoin is not all cryptocurrency, and Binance hardly corresponds to the entirety of the crypto market, their sheer size and influence have made them shorthand for gauging the overall direction and sentiment.

Indeed, while Binance’s market share in terms of centralized platforms’ volume fell some 20% from August to October, it remains a dominant exchange, handling 36.6% as of early October.

Investors wary of a pullback despite eying new ATH

The uptick in the share of shorts on Binance reflects broader uncertainty about Bitcoin’s next move.

On the one hand, its recent rise – and the staggering surge of inflows for institutions offering Bitcoin exchange-traded funds (ETF) – signal confidence. On the other hand, it is worth pointing out that the recent surge unfolded between October 14 and 16 and that trading has been sideways since.

Nonetheless, the current trend appears overall upward. On October 17, Martinez identified $66,780 as a critical level for BTC to hold, and thanks to the coin’s current price of $67,780, investors are again hopeful that it will rocket to $86,600 – a decisive new ATH.

The month of ‘Uptober’ also bolsters the bull case from a psychological perspective.

Historically, the tenth month of the year has been strong for Bitcoin and has served as a prelude for a period of upward trading – usually lasting until May – as pointed out by several experts when setting their Halloween BTC price targets.

The positivity does not, however, exclude the danger of a sudden pullback. Cryptocurrency markets are known for their high volatility, and Bitcoin has, despite the bullishness persisting through most of 2024, experienced several deep and sudden plunges.

Recent transfers executed by Elon Musk’s electric vehicle (EV) maker, Tesla (NASDAQ: TSLA), have also raised the possibility of imminent and significant selling pressure.

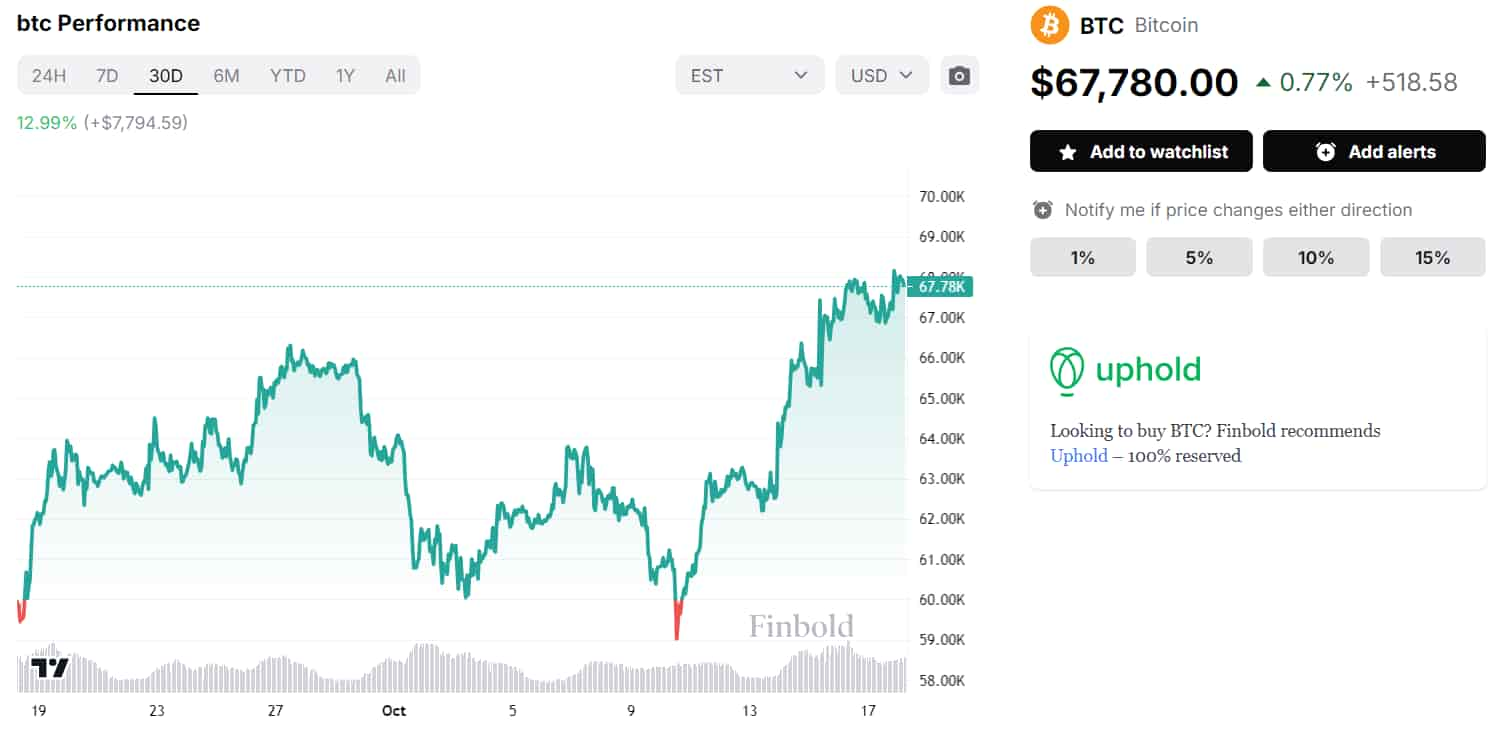

Bitcoin price chart

No matter what Bitcoin’s next move is, its recent performance has been strong overall. Despite a plunge early in October due to external geopolitical concerns, BTC is 12.99% in the green in the 30-day chart and boasts a price of $67,780 at press time on October 18.

Zooming out, the world’s premier cryptocurrency has risen significantly in 2024 and is up 59.55% year-to-date (YTD). Still, it remains below the ATH near $73,000 it had reached in March.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Hive

Hive  Nano

Nano  Status

Status  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom