Is this the Bitcoin ETF supply squeeze playing out already?

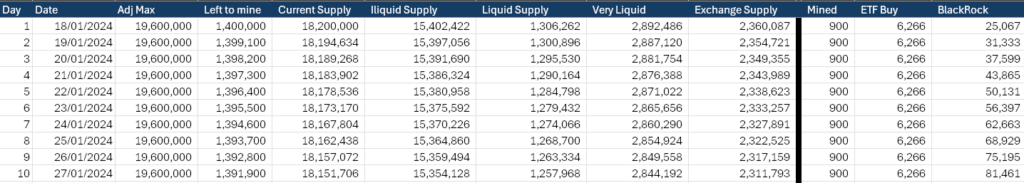

Seven days after the new Bitcoin ETFs launched, I analyzed how they could put pressure on Bitcoin’s supply dynamics in an article called “If BlackRock continues 6k BTC daily buys, we get a supply crunch within 18 months; here’s why.’ On the day of publication, Jan. 18, Bitcoin closed at $41,248 after falling from a high of $49,000 on Jan. 11. Since then, the flagship digital asset has soared 37% to break $57,000.

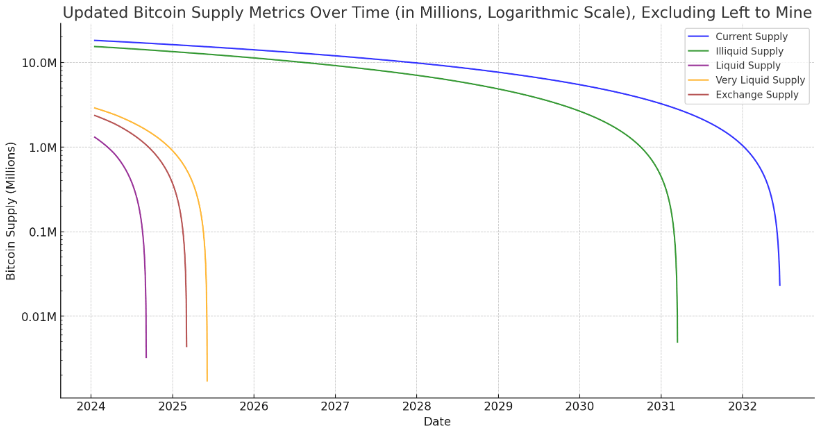

While Bitcoin had fallen consistently after the ETF launched, CryptoSlate noted the persistent BTC inflows, which, at the time, averaged around 6,266 BTC per day for BlackRock alone. The analysis identified that were such inflows continue, the liquid supply of Bitcoin could be absorbed this year, with the exchange balances or very liquid supplies targetable by mid-2025.

As noted at the time, the analysis was purely hypothetical and did not consider the outflows from Grayscale GBTC. Additionally, it only looked at BlackRock, the largest fund’s inflows, to simplify the data at that point. The exercise aimed to emphasize the potential for a supply squeeze and the lack of liquid Bitcoin to facilitate persistent ETF pressure on the supply. On Jan. 18, BlackRock had 25,067 BTC under management, valued at $1 billion.

Interestingly, while the inflows into BlackRock did not maintain the 6,266 BTC daily average pressure, inflows into the Newborn Nine have surpassed this level. BlackRock currently has 130,231 BTC under management, whereas the fund would have 275,707 BTC if it continued at 6,266 BTC daily. However, on Jan. 18, 6,266 BTC was valued at $258 million, which would now represent an inflow of $357 million, given the dramatic price surge.

It’s important to remember that the spot Bitcoin ETFs are purchased with dollars and denominated in dollars in a brokerage account. Thus, while inflows into the ETF have been consistent in dollar terms, they have been reduced in terms of Bitcoin purchases.

Across the Newborn Nine, 303,002 BTC is now held under management per K33 Research. Looking at the CryptoSlate table used for the Jan. 18 article, this aligns with inflows projected for BlackRock by March 2, 2024.

Using this data, should the Newborn Nine continue to absorb Grayscale’s declining outflows and purchase additional Bitcoin from the broader market at this pace, 1 million BTC could be under management by June. Further, this rate would swallow the BTC equivalent of the entire current liquid supply of Bitcoin (roughly 1.3 million BTC) by September.

On Feb. 8, I discussed the potential for the ‘Mother of all Supply Squeezes‘ for Bitcoin, which is akin to the GameStop saga but even more effective. The price has surged 29% since that article went live in just 19 days, an average of 0.65% per day. Bitcoin ETFs have continued to buy, and Grayscale’s outflows are slowing.

The requirements for a supply squeeze appear to be present; the only question I see is, at what level does the demand become affected by the price? Do Bitcoin ETF purchasers continue to buy if Bitcoin is at $100,000? Well, at that price, BlackRock’s IBIT would be around $60 per share. That doesn’t sound quite as expensive to new investors now, does it?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  Theta Network

Theta Network  KuCoin

KuCoin  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  DigiByte

DigiByte  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD