Is XRP in ‘Crab Market’? Solana (SOL) Reaches Major Resistance Level Before $200, Ethereum (ETH) Really Needs This Price Level

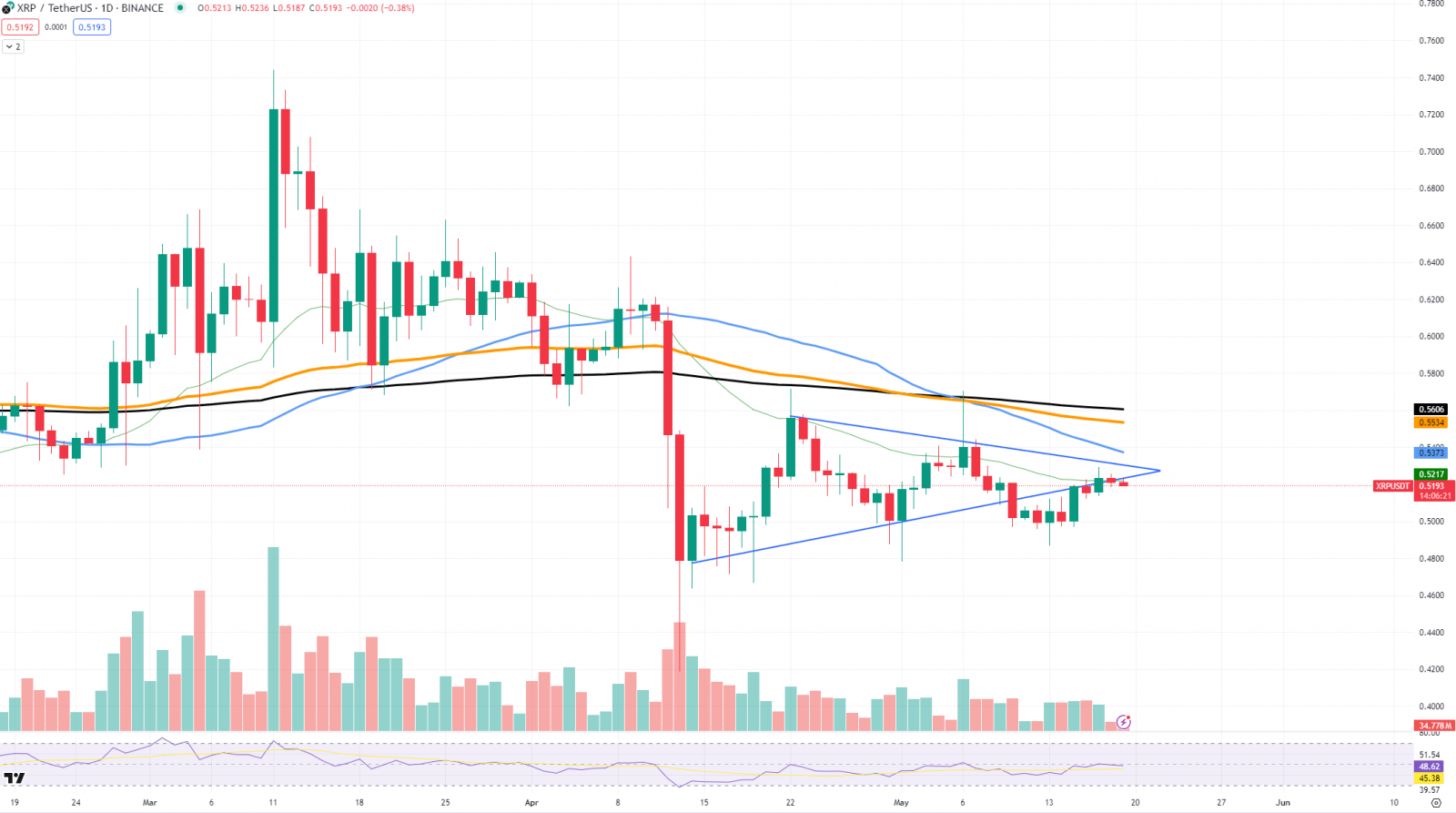

It seems like XRP is not making any attempt to break through the currently shown tendency in the market. The asset has barely moved since the beginning of the month, and the most recent breakthrough attempt at $0.54 only pushed the asset back below $0.50. The cryptocurrency is moving up again, but it will most likely end up in a “crab market.”

The term “crab market” is a state where an asset’s price moves sideways without significant upward or downward trends. XRP’s price action is a textbook example. Despite occasional spikes, the overall movement is horizontal. This lack of direction can be frustrating.

Looking at the chart, XRP has been struggling to break past the resistance levels defined by the 50-day EMA and the 100-day EMA, both of which hover around $0.54 and $0.55, respectively. These moving averages have been acting as strong barriers, preventing any substantial upward movement.

Moreover, the volume is another indicator suggesting a lack of strong buying interest. Over the past weeks, the trading volume has been relatively low, indicating that traders are hesitant to commit significantly in either direction. This low volume typically accompanies a “crab market,” reinforcing the idea that XRP might stay in this pattern for a while.

For XRP to break out of this stagnation, it would need a significant catalyst, either from a fundamental development in the cryptocurrency market or a strong technical breakout above the resistance levels.

Solana’s major resistance

Solana has finally reached a crucial resistance level, which is possibly the last threshold it will have to break in order to come closer to the long-desired $200 mark. However, it is not yet obvious if Solana will be able to break through.

Solana is currently testing the resistance around $175, a level that has previously acted as a strong barrier. This resistance is reinforced by the 50-day EMA, which is converging around the same price point. The recent price action suggests that bulls are trying to push the price higher, but the real test will be breaking above this resistance and sustaining the momentum.

Over the past few days, there has been a noticeable increase in trading volume, indicating growing interest among traders. Increase in volume suggests there is significant buying power backing the recent price surge. For Solana to break past the $175 resistance and aim for $200, it will need continued strong volume.

As for the RSI, it is approaching the overbought territory. While this indicates strong bullish momentum, it also suggests that the asset might be due for a short-term correction or consolidation before attempting another upward move. If the RSI can remain above the midline after a potential pullback, it would signal sustained bullish momentum.

Historically, Solana has faced significant resistance around the $175-$180 range. Breaking this level would be a major milestone and could open the path to $200. However, failure to break through could lead to a retracement back to support levels around $155 or even $143.

Ethereum needs it

Ether has not been the strongest cryptocurrency on the market since the beginning of the year. It struggled to hit an all-time high (ATH), lagged behind Bitcoin’s performance, and the overall ecosystem did not flourish during the bull market. With ETH’s price reaching a critical level, we should all hope bulls will be able to push it just a bit further.

Ethereum is currently facing a significant resistance level around $3,150, marked by the 50-day EMA and the historical zone of surging selling pressure. The last time Ethereum reached the aforementioned area it quickly retraced toward $2,900.

Volume is a key indicator to watch. Over the past few days, there has been a noticeable increase in trading volume, which is a positive sign. Higher volume indicates stronger buying interest and market participation. For ETH to break past the $3,150 resistance, sustained high volume is necessary.

The RSI is currently hovering around the midline, suggesting that ETH is neither overbought nor oversold. This neutral RSI provides room for further upward movement if buying pressure increases. However, if the RSI approaches the overbought territory without a significant price increase, it could signal a potential pullback or consolidation.

Support levels to watch include the 50-day EMA around $3,050 and the psychological support at $3,000. If ETH fails to break the $3,150 resistance, it might retrace back to these support levels. On the other hand, a successful breakout could see ETH targeting higher resistance levels around $3,300 and potentially $3,500.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Gate

Gate  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Holo

Holo  Decred

Decred  Ravencoin

Ravencoin  Siacoin

Siacoin  NEM

NEM  Enjin Coin

Enjin Coin  Nano

Nano  DigiByte

DigiByte  Waves

Waves  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  Bitcoin Gold

Bitcoin Gold  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy