Making sense of the AI agent meta

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

The AI agent frenzy was kickstarted by GOAT. GOAT is a Solana memecoin that spawned from an experiment by creator Andy Ayrey when he pitted two Claude AI models in an endless debate. GOAT still sits today at a comfortable $404 million market cap, but no longer dominates the mindshare it once did.

First to copy GOAT’s success was the AI agent Luna (LUNA). It’s a busty anime girl chatbot that streams 24/7 on social media — need I say more? Chat with her, tip her with her own LUNA token (why does anyone do that?), or be like A16z-backed Story Protocol: Hire Luna for social media marketing.

The Luna virtual companion was launched on Virtuals Protocol, an “AI Agent launchpad” on Base that is the most recognizable brand name in this meta right now.

Formerly the PathDAO gaming guild, Virtuals took pump.fun’s successful formula and applied it to AI agents. Launch an agent token, hit a target market cap on a bonding curve, and pair the agent’s token in a liquidity pool on Uniswap.

What Virtuals did differently, however — and what has gotten investor-types bullish on its token — was tying its native VIRTUALS token to the cost of launching agents and running inferences, as well as pairing it with agent tokens in a Uniswap liquidity pair (rather than SOL).

Within the Virtuals ecosystem, Luna faces competition for speculative capital from other similarly looking chatbots like Airene, or more “utility-based” agents like aixbt, an agent that scrapes troves of social media data to surface trading alpha (aixbt is incidentally bullish on everything).

Loading Tweet..

Just as agents face competition, so too do the picks-and-shovels of agents. Besides Virtuals, a myriad of AI agent launchpads already exist, such as vvaifu.fun, Creator.Bid, MyShell.ai, Zentients and more.

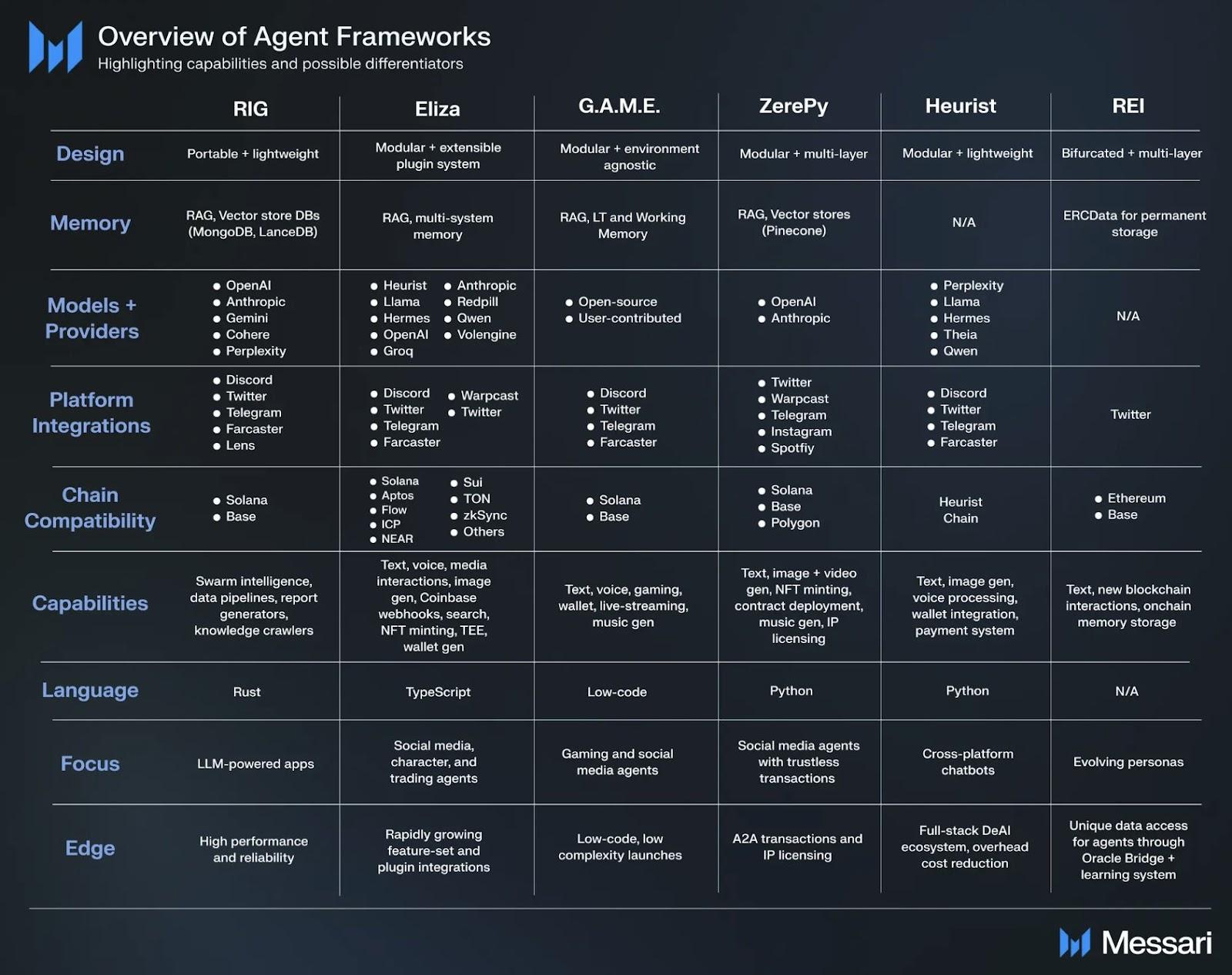

Then we have the AI agent “frameworks.” These are simply code libraries that make it easy for devs to customize their agents and integrate them into the virtual Wild West.

The leading agent framework is ai16z’s “Eliza,” but there’s also Virtual’s G.A.M.E (Generative Autonomous Multimodal Entities), the Python-based ZerePy, the Solana-focused RIG, and more. And of course, each one of these frameworks has its own token that speculators are furiously aping into.

Source: Messari

Finally, we have the AI investment DAOs. The idea is simple: Deposit SOL/ETH and receive a DAO token that lets you share in the “hedge fund’s” upside.

Ai16z was the first investment DAO to launch on Solana, now with an AUM of $23.4 million. People apparently really trust the investor acumen of AI agents. Presently, its native AI16Z token is valued at an astounding $1.4 billion market cap.

Daos.world and VaderAI are two upcoming AI investment platforms on Base that have gained steam in the past week. At least six funds have already emerged on both platforms, with about a collective million in capital raised.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Decred

Decred  DigiByte

DigiByte  NEM

NEM  Ontology

Ontology  Huobi

Huobi  Nano

Nano  Status

Status  Hive

Hive  Lisk

Lisk  Waves

Waves  Bitcoin Gold

Bitcoin Gold  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond