Meme Stock Mania Returns? GameStop and AMC Trading Halted 38 Times

Could a single tweet reignite the meme stock frenzy that took over Wall Street three years ago? GameStop and AMC’s shares are again surging, with trading on these stocks being halted multiple times just this week.

Such suspensions are a standard mechanism to protect against excessive volatility, but some retail trader are complaining about their service providers, accusing them of blocking trades. This frustration is unsurprising, given that major players like Robinhood implemented similar measures in 2021.

“Roaring Kitty” Returns

Keith Gill, known online as “Roaring Kitty” and considered the catalyst of the pandemic-era stock craze, reappeared on Twitter after three years. On Sunday, he posted an image depicting a man sitting in a chair. While this might seem insignificant picture, gamers recognize it as a meme indicating that “things are getting serious.”

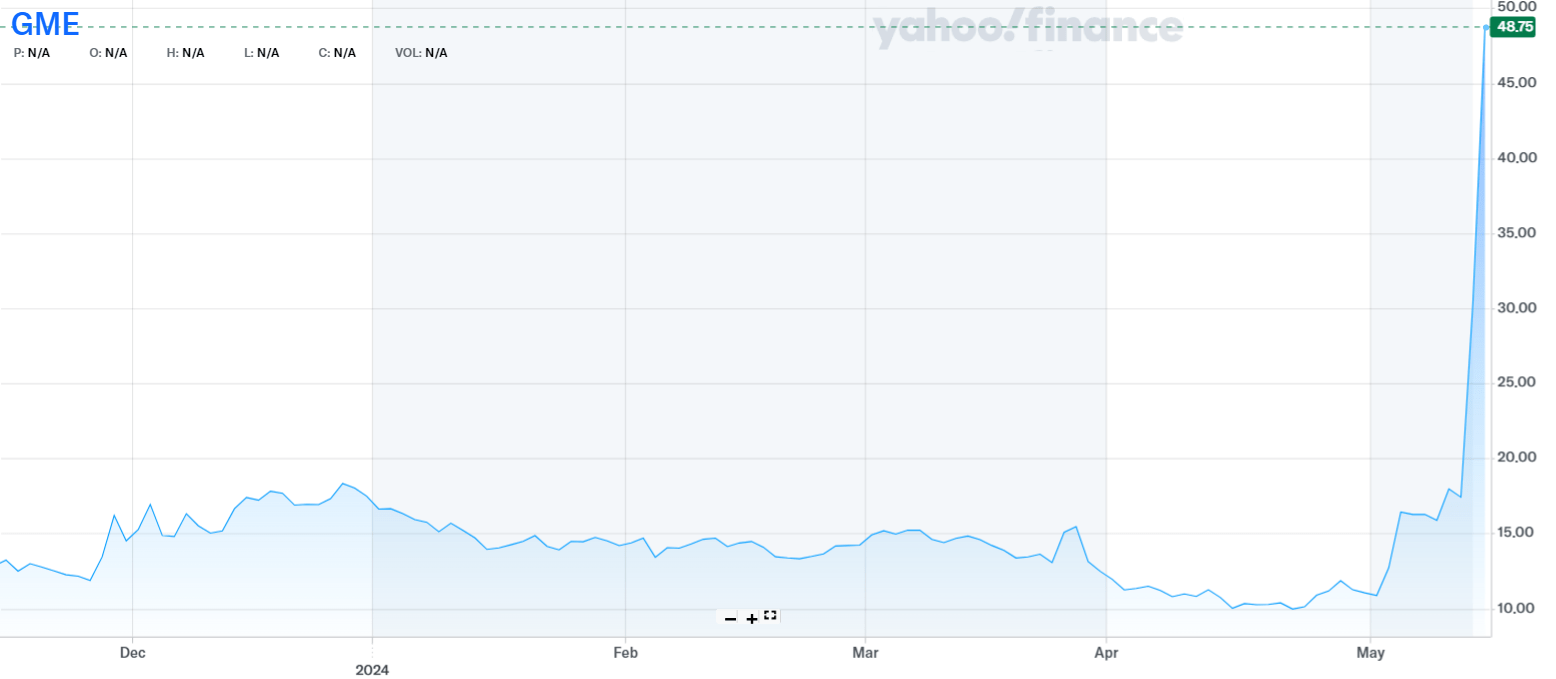

The result? GameStop shares (NYSE: GME) opened with a significant gap on Monday, ending the day up 74%. By Tuesday, they surged another 60%, peaking at a 114% gain. Similarly, AMC shares (NYSE: AMC) rose 78% at the start of the week and added another 32% on Tuesday.

Throughout May, AMC shares increased by 133%, while GME shares soared by 340%, surpassing Bitcoin’s annual gains.

GameStop shares are once again booming. Source: Yahoo Finance

“There are a couple of differences between 2021 and 2024, not least that the stock price is far higher now than it was before the meme stock craze in 2021,” said Kathleen Brooks, Research Director at XTB. “Back then it was trading around $5, today it is trading at $30, so it may not be as much of a bargain as it once was.”

Trading Halts on AMC and GameStop

With such high volatility comes heightened investor interest and increased intervention by exchanges. According to Evan Gold, the founder of Stock Market News, the NYSE halted trading on these two meme stocks 38 times during Tuesday’s session. As a result, retail trading platforms also temporarily halted trading on AMC and GameStop.

Trading in GameStop $GME and $AMC was halted a combined 38 times today

— Evan (@StockMKTNewz) May 14, 2024

eToro issued a statement to reassure users that these halts are a normal “safety mechanism.”

„Please note that these halts are part of standard market dynamics and are not initiated by eToro. We continue to reflect the pricing we receive, however, you may experience interruptions in trading due to these exchange-imposed suspensions,” eToro explained

Have other platforms made a similar move? It is hard to find more information on this; one X user only reported encountering a similar problem with Trading212.

Trading suspended @Trading212 #GameStop #nyse #Nasdaq pic.twitter.com/uZeEsFHg6m

— Parth Patel (@Parthyoofficial) May 14, 2024

The renewed attention on meme stocks has left users wary, especially given the 2021 events when platforms like Robinhood blocked access, citing the need to protect users from excessively volatile markets. Back then, traditional brokers like TD Ameritrade, IG Group, and Charles Schwab also restricted trading on these stocks. Now, the current trading halts are due to the exchanges’ automatic defensive mechanisms.

What You Should Know about GameStop, AMC, and Meme Stocks?

The phenomenon of meme stocks, particularly involving companies like GameStop and AMC, captivated the financial world in early 2021. It began with a group of retail investors, mainly organized on social media platforms like Reddit, who collectively decided to buy shares of these companies.

GameStop, a struggling video game retailer, and AMC, a movie theater chain severely hit by the pandemic, became the focal points of this movement. These investors aimed to drive up the stock prices, partly to profit but also to challenge institutional investors, particularly hedge funds that had heavily shorted these stocks, betting that their prices would fall.

The sudden and dramatic increase in GameStop’s and AMC’s stock prices led to significant volatility in the stock market. This movement, driven by what many called “meme stocks,” saw prices rise to levels far beyond what traditional financial metrics would justify.

This surge forced short sellers to buy back shares at much higher prices to cover their positions, resulting in substantial losses for these hedge funds. The retail investors saw this as a form of financial rebellion, leveraging their collective power to challenge the norms of Wall Street.

Is the meme stock mania returning? For now, it seems too early to answer this question definitively.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Gate

Gate  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD