More Bitcoin (BTC) Whales to Appear in 2024: Reason Disclosed

Whales are stacking up on Bitcoin. This trend is anticipated to not only continue but also become more common, given the increased accessibility of Bitcoin for institutional investors. One pivotal reason for this surge is the release of the Bitcoin ETF, which has streamlined the process of gaining exposure to Bitcoin, making it more appealing and accessible than ever before.

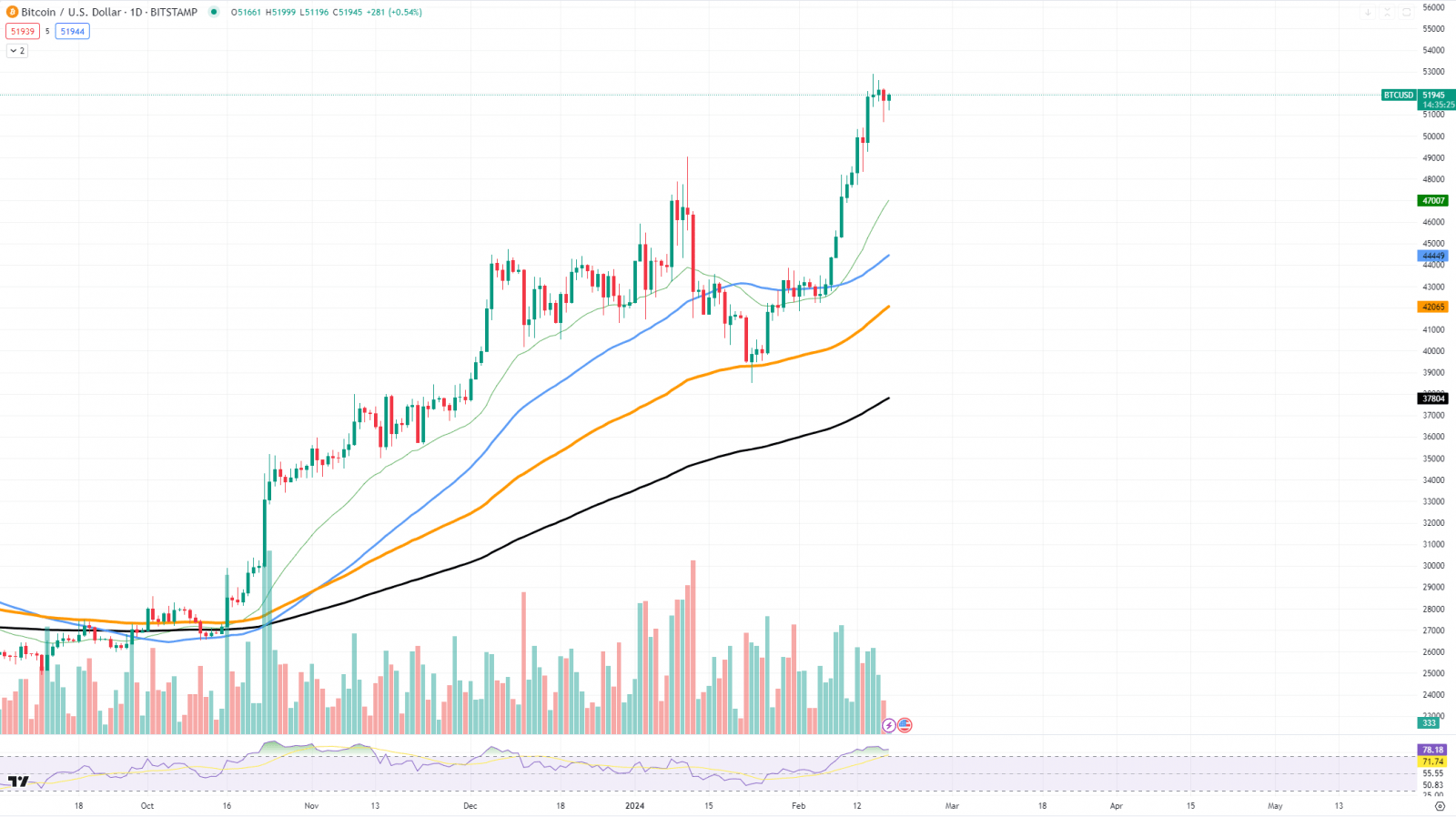

The price chart for Bitcoin shows that the cryptocurrency has been maintaining a bullish momentum, which is likely to attract more high-net-worth investors and institutions looking to diversify their portfolios. The price has been respecting the upward trendline, with the 50-day moving average acting as dynamic support.

This trendline and moving average, currently sitting around the $45,000 level, serve as significant support zones. A sustained price above this level could solidify investor confidence and potentially lead to further influxes from whales.

On the flip side, resistance is spotted near the recent highs around $52,000. This level has acted as a temporary ceiling for price action, and a break above this could signal a continuation of the upward trajectory. Moreover, with the RSI hovering around the mid-range, there’s room for upward movement before the asset is considered overbought.

Institutional interest in Bitcoin is not an isolated phenomenon. The same thesis applies to Ethereum, especially with the increasing likelihood of Ethereum ETFs receiving regulatory approval. Such developments would further validate the asset class and could lead to a comparable uptick in whale activity for Ethereum, mirroring Bitcoin’s institutional adoption.

The significance of these trends cannot be overstated. As more institutional investors and large-scale traders take positions in Bitcoin, their influence on market dynamics intensifies.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom