MrBeast investigated for ties to 50+ crypto wallets linked to potential insider trading

James Donaldson, better known as MrBeast, is a veritable YouTube superstar. Once a media darling on account of several charitable videos, he appears to be attracting an endless stream of controversy in 2024.

Donaldson’s stroke of bad luck began when close collaborator Ava Kris Tyson was accused of impropriety involving a minor — just weeks later, a former employee alleged widespread fraud that would amount to running an illegal lottery — one aimed at children.

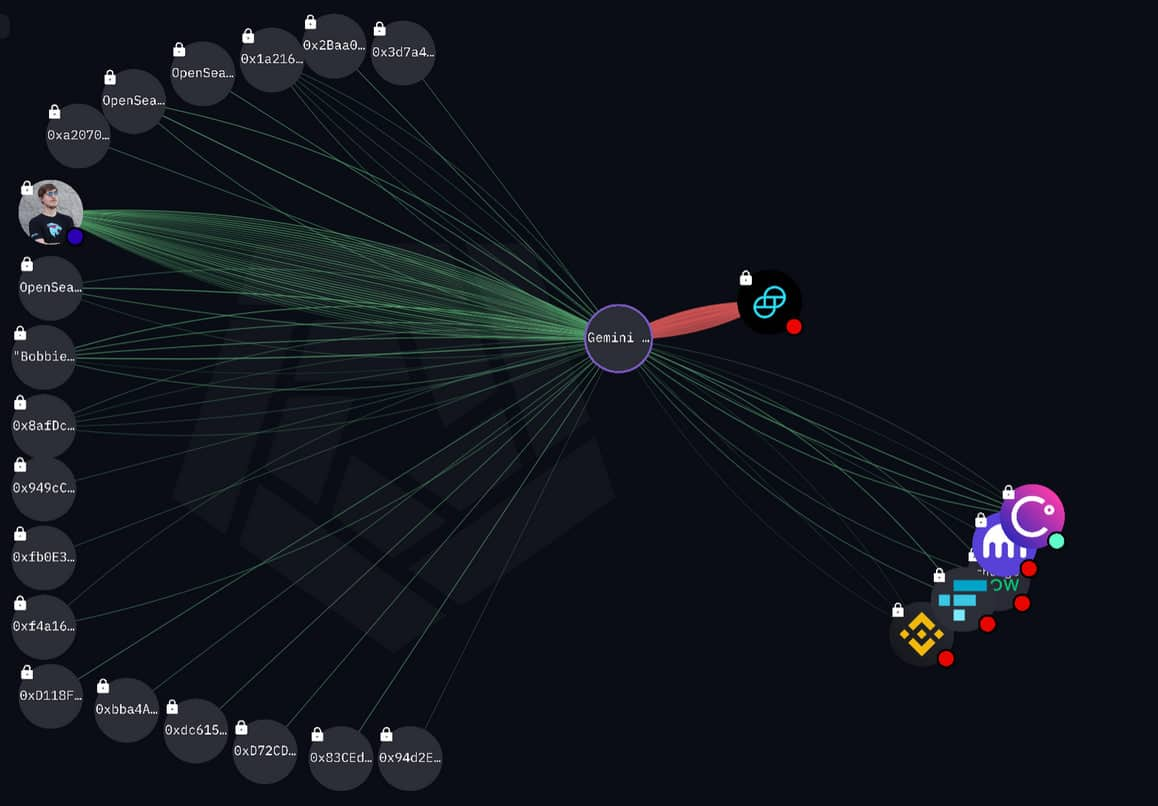

However, this latest development just might prove to be a turning point for the YouTuber’s career. An initial investigation showed that MrBeast profited as much as $10 million from backing low-cap IDO (initial DEX offering) crypto tokens, as per an X post from online-sleuth SomaXBT.

MrBeast made $11.5 million from just one token

Although the roughly 5,000-word report is too lengthy to effectively summarize here, the most attention-grabbing part of the on-chain data is certainly MrBeast’s involvement with SuperVerse (SUPER), formerly known as SuperFarm.

Heavily promoted by marketers like EllioTrades, the project was slated to develop an NFT marketplace that was supposed to integrate with a gaming ecosystem.

Although the games in question suffered from being stuck in ‘development hell’, the pre-sale initial coin offering (ICO) saw SUPER experience a 50x price increase — in part due to Donaldson’s open promotion of the token on social media platforms.

Early public investors, however, were suddenly refunded for their investments by the use of legal loopholes, as alleged in the report.

A leaked screenshot from one of EllioTrades’ streams shows a direct message on X where MrBeast writes ‘So we can do the $100k, thing is that I…’. Although not exactly conclusive, the findings do provide on-chain data that matches the leaked conversation.

After receiving 1 million SUPER tokens on February 22, 2021, Donaldson’s main wallet sends the entire amount to a side wallet on March 30, 2021. A day later, the entire holding was liquidated — netting MrBeast roughly $7.5 million.

Over the course of the next three months, the main wallet would receive eight supply unlocks — all of which would be dumped in short order. Once the initial $100k investment is subtracted, the report claims that Donaldson secured roughly $11,447,453.96 in profits.

We encourage readers to take a look for themselves and draw their own conclusions — the findings suggest that MrBeast also made $4,649,337, $1,724,652, and $484,817 from transactions involving Eternity Chain (ERN), PolyChain Monsters (PMON), and SHOPX respectively, as well as concerted efforts with other popular influencers to profit from a number of these pump and dump schemes.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond