NEAR Protocol’s Price Prepares for Major Consolidation

The Near Protocol (NEAR) price analysis presents a complex picture, indicating varied market sentiments.

A mix of indicators paints a nuanced view of NEAR’s short-term trajectory.

Shifting On-Chain Momentum

NEAR Protocol‘s market dynamics have taken a turn, as evidenced by the RSI falling to 66 from a previous 76 on March 27, marking its first dip below 70 since November 23. The RSI, which helps identify overbought or oversold conditions, suggests a weakening in buying pressure as it retreats from previously sustained high levels.

Although the current RSI value does not indicate an oversold condition, the noticeable decrease in momentum could signal a forthcoming period of consolidation for NEAR, highlighting a shift in market dynamics.

NEAR RSI. Source: Santiment

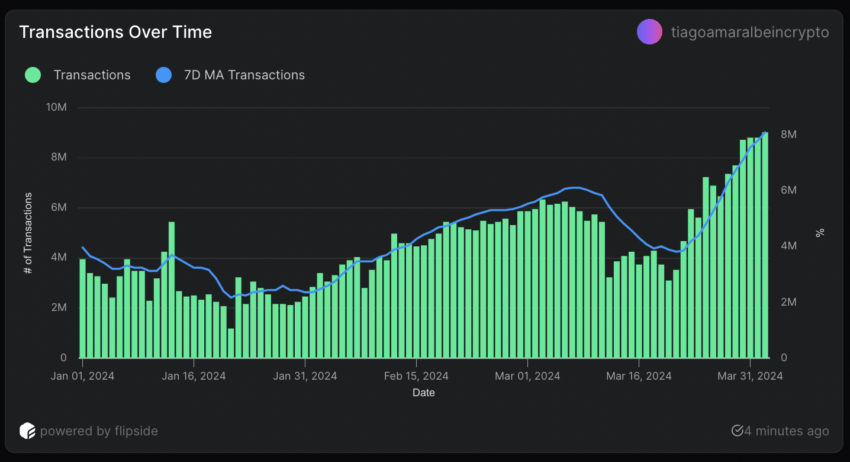

On the other hand, NEAR’s daily transaction count has rebounded, reaching a peak of 9.02 million on April 2—the highest since December 2023. This recovery follows a period from March 12 to 20, where transaction activity and price showed little variation, indicating a phase of stability.

NEAR Transactions. Source: Flipside

The resurgence in network activity, coupled with a modest increase in NEAR’s price from $5.96 to $6.44, suggests a potential alignment of price with transaction volume, possibly signaling the onset of a bullish trend, albeit the tempered by RSI indicator.

NEAR Price Prediction: Consolidation

NEAR’s price chart reveals a death cross within the Exponential Moving Average (EMA) lines, a bearish signal typically indicating a shift from bullish to bearish sentiment. This pattern, characterized by a short-term EMA crossing below a longer-term line, suggests recent price declines may overshadow previous gains, hinting at the beginning of a downtrend.

Yet, the close proximity of NEAR’s EMA lines, alongside the contrasting increase in transaction volumes and a dipping RSI, suggests a complex market sentiment leaning towards consolidation, supported by strong nearby support and resistance levels.

Should NEAR’s price initiate an upward trajectory, overcoming immediate pressures, it could aim for the $8.0 mark.

Read More: Near Protocol (NEAR) Price Prediction for 2024

NEAR Price Chart. Source: TradingView

Conversely, a breakdown below the $6.2 support level could see the price retract to as low as $5.6, indicating a delicate balance between potential gains and losses in the near term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom