October Bitcoin Price Analysis: Is the Next Move Up or Down For BTC Price?

Bitcoin price has fluctuated in recent months, with analysts debating whether it will climb to new heights or suffer a deeper decline. Factors such as market sentiment, technical Bitcoin indicators, liquidation events, and geopolitical influences contribute to Bitcoin’s uncertain future. This article will explore several key market indicators and BTC price predictions from experts, providing insight into Bitcoin’s possible price trajectory in the coming months.

Bitcoin Price Analysis: A Bearish Outlook With A Potential Fall to $52,000

Bitcoin price is caught in a downward channel, signaling a potential bearish movement. According to an expert in crypto markets, Bitcoin could drop to $52,000. Geopolitical tensions, particularly in the Middle East, have already pushed Bitcoin price this week below $60,000, demonstrating the asset’s vulnerability to global events. Although there are BTC price predictions of a bullish recovery, with some analysts forecasting a rise to $86,428 by November 2024, Bitcoin’s future remains uncertain.

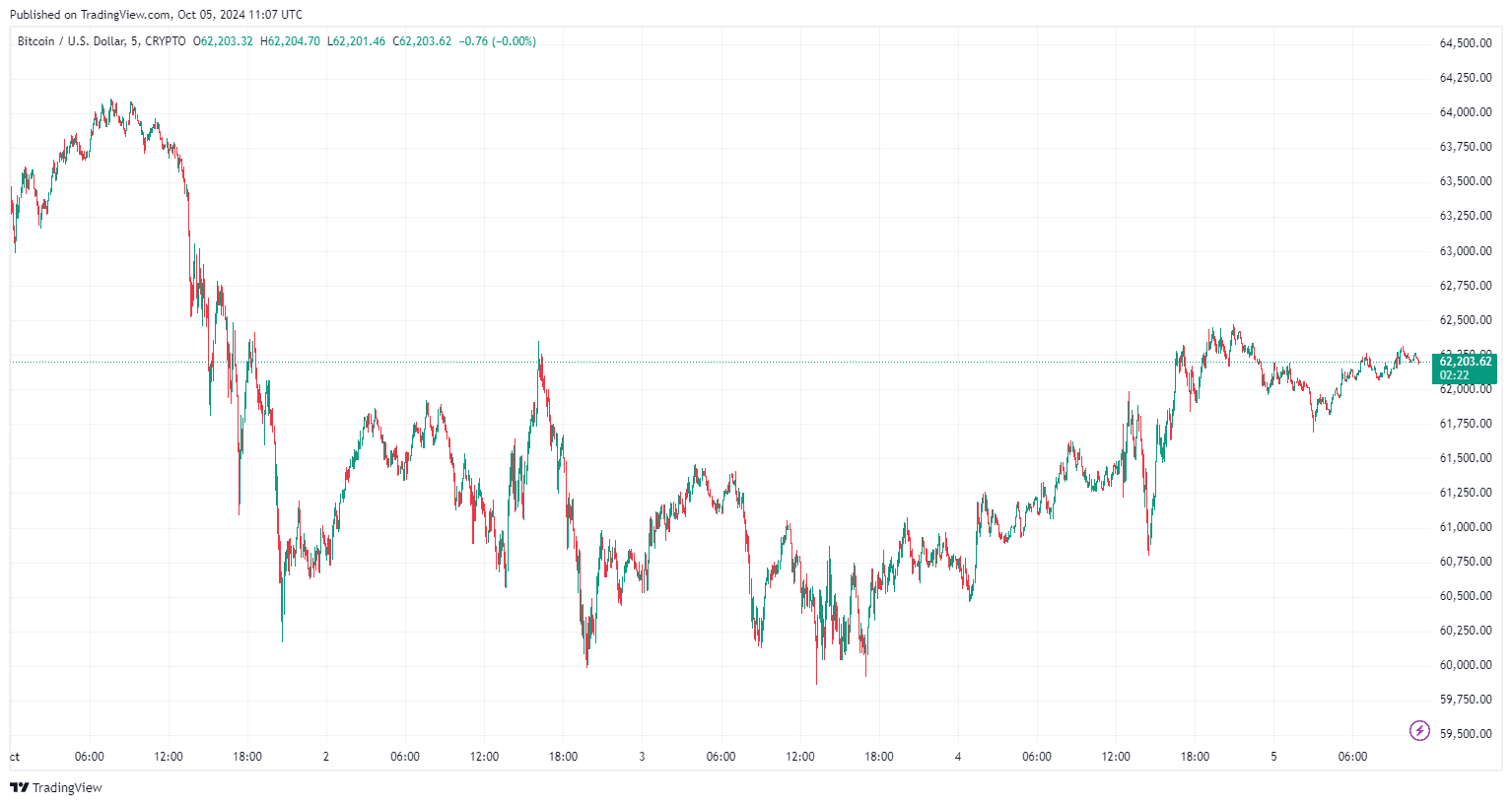

By TradingView – BTCUSD_2024-10-05 (1M)

Market sentiment plays a crucial role in shaping BTC price momentum. The Long/Short Volume to Open Interest Ratio from CryptoQuant shows trader positioning, with an increase in long positions indicating optimism. However, extreme optimism often leads to Bitccoin price corrections. At present, Bitcoin’s sentiment is neutral, as reflected in the Fear & Greed Index at 41, indicating investor caution despite recent stability.

Signs of a Local Bottom For BTC Price: Could a Recovery Be Near?

Amid the bearish sentiment, some analysts believe Bitcoin price may have hit a local bottom. A recent post by a CryptoQuant analyst highlights a significant liquidation of long positions, which could set the stage for a short-term recovery. More than 4,000 BTC long positions were liquidated on October 1st, marking the second-largest liquidation event of 2024. This reduction in selling pressure often signals a potential market reversal, creating opportunities for a price rebound.

In addition, data from the OKX exchange shows increased buying activity, evidenced by a surge in the Taker Buy/Sell Ratio. This uptick in aggressive buying suggests renewed market confidence, hinting at a potential upward trend in Bitcoin price.

October Bitcoin Price Analysis: Could ‘Uptober’ Historical Patterns Return?

The 2024 October Bitcoin price behavior bears a striking resemblance to its movements in October 2023. Last year, Bitcoin experienced a sharp decline at the start of the month before rallying by over 33% to close October at $35,000. As of early October 2024, Bitcoin dropped by 6.5%, similar to the pattern observed the previous year. If history repeats itself, Bitcoin could rebound, possibly reaching $75,000 to $76,000 by the end of the month.

Many investors are eagerly watching for signs of another “Uptober,” a term coined to describe Bitcoin historical patterns of strong performance in October. Despite the early drop, some analysts remain hopeful that the current market downturn will reverse, leading to significant gains.

By TradingView – BTCUSD_2024-10-05 (1Y)

MVRV Ratio: A Key Technical Bitcoin Indicator For BTC Price Predictions

Another important indicator for the October Bitcoin price analysis of its trajectory is the Market Value to Realized Value (MVRV) ratio. According to another CryptoQuant analyst, the MVRV ratio has historically been useful in identifying market tops and bottoms. Currently, the ratio sits around 1.9, with support at 1.75. A breach of this support could push Bitcoin price lower, while a reversal could propel it toward the 4-6 range, historically associated with market peaks.

Despite the recent market correction, Bitcoin has shown signs of recovery, with a modest 1.9% gain in the past 24 hours. If the MVRV ratio breaks its downtrend, Bitcoin price could experience another significant rally, much like previous cycles.

A Mixed Outlook for The October Bitcoin Price

The October Bitcoin price analysis remains vague, with both bullish and bearish signals present. On one hand, technical Bitcoin price analysis suggests the potential for further downside, with BTC price predictions falling to $52,000. On the other hand, liquidation events, Bitcoin historical patterns, and key metrics like the MVRV ratio provide hope for a recovery or even a rally. As always in the volatile world of cryptocurrency, investors should closely monitor market sentiment and technical Bitcoin indicators to make informed decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Huobi

Huobi  Status

Status  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD