Peter Schiff preaches Bitcoin FUD: here’s why he is wrong

Bitcoin’s post-halving consolidation has prompted cynical rhetoric from popular crypto naysayer Peter Schiff.

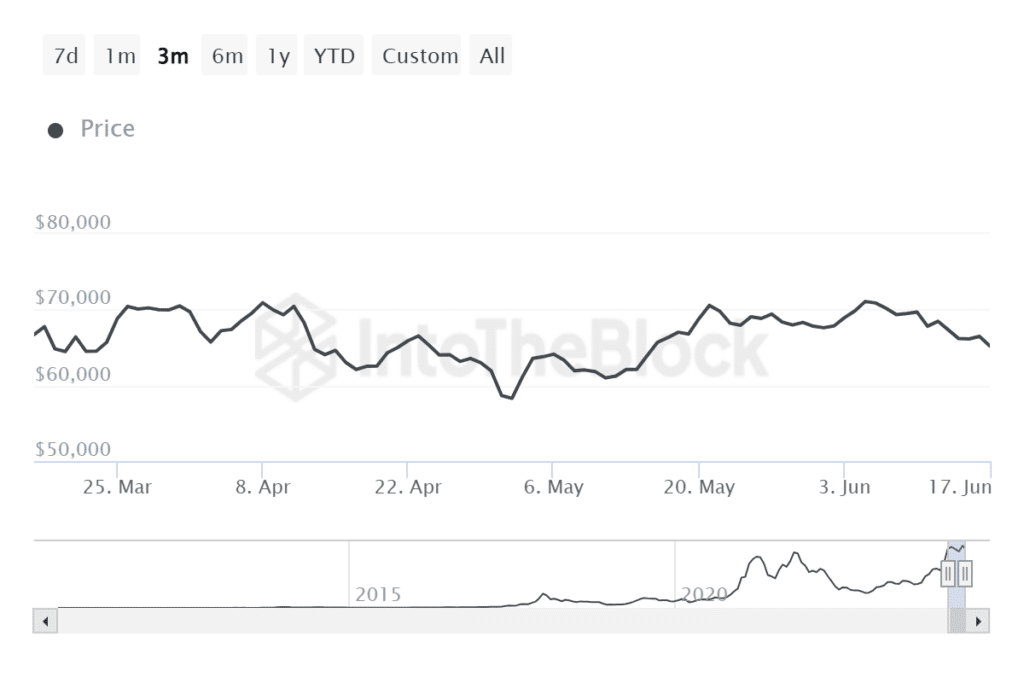

Bitcoin (BTC) skeptic Peter Schiff suggested that the value proposition driving spot BTC ETF demand might quickly fade, contradicting expert predictions and market performance so far. BTC has grown over 55% year-to-date (YTD), but Schiff noted that the token has traded sideways for over three months and posted minuscule gains for spot Bitcoin ETF investors.

BTC price movement in the last three months | Source: IntoTheBlock

Spot exchange-traded funds track the price of an underlying asset. In this case, the asset is BTC, and profits are tied to increments in the cryptocurrency’s price.

Schiff’s statement about BTC’s sideways price patterns may be true, but the assertion perhaps lacks context. Bitcoin has surged nearly 70% since the U.S. Securities and Exchange Commission (SEC) approved spot BTC ETFs.

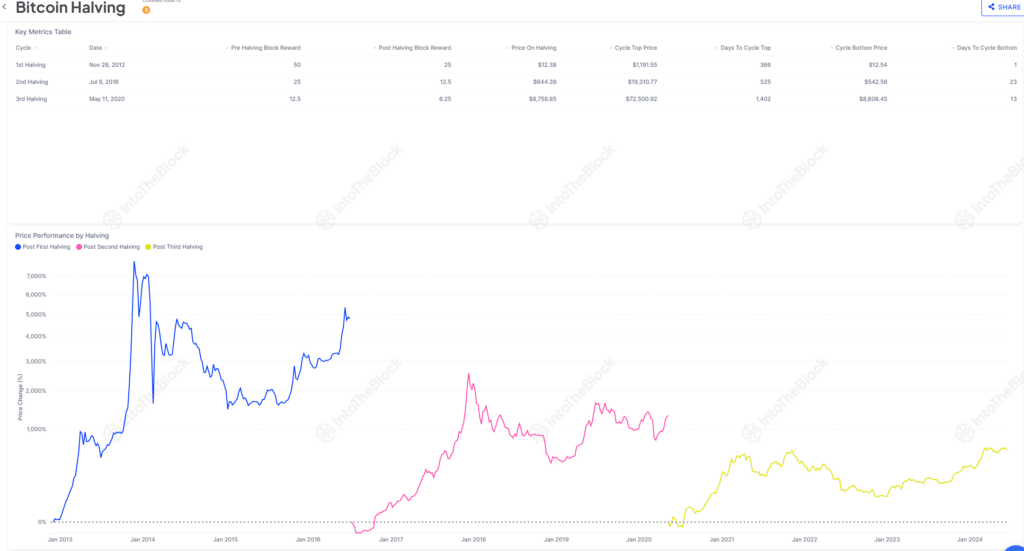

Additionally, BTC’s multi-week consolidation is not new following a halving. The asset transitioned from an accumulation phase into a parabolic run during the last two cycles at least.

BTC post-halving progression | Source: IntoTheBlock You might also like: Analyst: Global ETF market could hit $35t by 2035

Growing institutional Bitcoin demand

BlackRock and Fidelity’s respective spot BTC ETFs made the best debuts in over 30 years on Wall Street. Within weeks, both funds amassed over $10 billion in assets under management (AUM). Despite billions in demand, Schiff scrutinized Bitcoin’s bullish thesis and price progression. “ If ETF investors have been buying, who has been selling, and why?”

Meanwhile, Bloomberg’s ETF expert Eric Balchunas has repeatedly spoken about capital flows from futures ETFs into spot BTC funds. The halving’s change in dynamics also saw some sell-offs from crypto miners to maintain cash reserves.

I’ve said it before and I’ll say it again, the call is coming from inside the house holmes. This is not ETFs doing, obv bc they buying like crazy lately, it’s bitcoin holders selling or leveraged flushers or whatever. Time and again ETFs go on flow-a-thons and its met with… https://t.co/iuGNayrLgd

— Eric Balchunas (@EricBalchunas) June 6, 2024

However, on-chain data showed that Bitcoin balances on centralized exchanges hit a four-year low, meaning that spot holders are not selling but rather holding on for dear life, commonly known as “hodling” in the digital asset industry.

Schiff surmised that ETF buyers could become tired of waiting and start liquidating shares as the asset continues in a consolidation range. While the scenario remains a possibility, growing institutional demand suggests otherwise.

Entities like the Wisconsin Investment Board have parked hundreds of millions into spot BTC ETFs, likely with a long-term view on the asset considering its growth over the years.

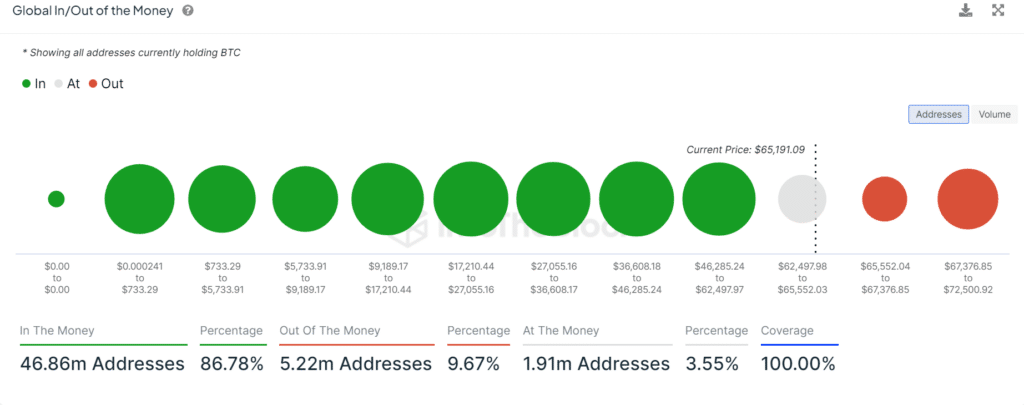

BTC jumped over 145% in the past year. In comparison, the S&P 500 has returned 85% in the last five years, bolstering the reward argument for investing in the top cryptocurrency by market cap. Furthermore, IntoTheBlock data showed that over 80% of BTC buyers are in profits.

BTC profit data | Source: IntoTheBlock

Balchunas and other experts also opined that major institutions have yet to enter the spot BTC ETF scene. Yet, the market is over $40 billion strong and growing. As crypto adoption rapidly increases and analysts expect the global ETF market to nearly triple by 2035 to a $35 trillion market, the bullish thesis behind Bitcoin’s ascent is arguably stronger than ever.

I will say for bitcoin to have penetrated the discussion on this kind of tv show says a lot about the accessibility and cover the ETFs have brought to the asset class. And it hasn’t even been six months.

— Eric Balchunas (@EricBalchunas) June 3, 2024

Read more: Greenpeace: Bitcoin mining companies are hiding energy data, Wall Street is responsible

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom