Predict Bitcoin’s Price

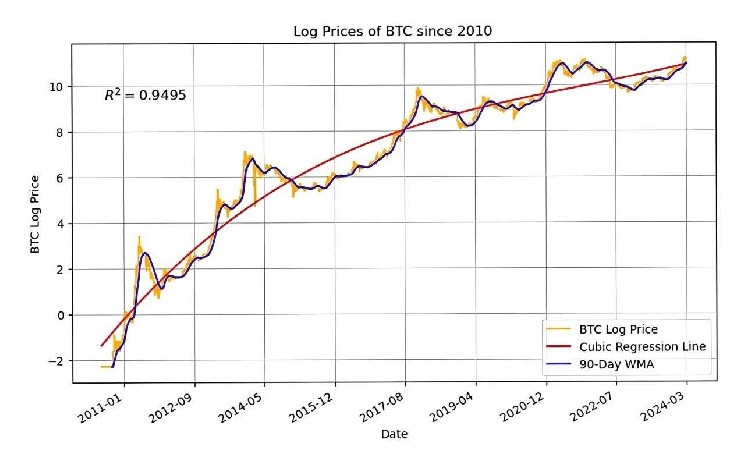

What if Bitcoin keeps on its current trajectory of near-exponential growth? To put this in perspective, consider the chart of the logarithm of Bitcoin’s price, and let’s forecast it forward. I’m calling this approach the exponential model because I am taking the natural logarithm of the Bitcoin price, and then applying the exponential operator to reverse out the predicted price. Logarithms are useful tools for linearizing exponential phenomena, and Bitcoin’s price is one example of such a phenomenon. A phenomenon with exponential growth will look roughly linear in logarithm space, so that chart looks like:

The data runs for the last 13+ years. The orange line is the log of the Bitcoin price, the black line is the 90-day weighted moving average (WMA) of the logged Bitcoin price, and the red line is the curve of best fit. The purpose of the moving average is to smooth out the short-term volatilities in Bitcoin price and expose some of the longer cycles.

To fit the curve, I found the best cubic equation that fit the data. The decision to settle on a cubic rather than quadratic function or even higher order polynomial is somewhat arbitrary. The truth is you can always overfit data by using a high-order polynomial. The problem is that it will have extremely high in-sample predictions but questionable out-of-sample predictions. A cubic has slightly more flexibility than the quadratic, but not so much that no one believes it. Ultimately, the goodness of fit measure of 0.9492 is extremely tight, where 1 is a perfect fit.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Hive

Hive  Status

Status  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom