Repeated Rejections from Solana Signal Potential Reversal Towards $55

Solana (SOL) has encountered consistent challenges in breaking above its bull market support band, raising concerns about potential price declines.

According to market veteran Benjamin Cowen, SOL continues to face rejection from this critical resistance zone, which has been a key factor in its price trajectory. The bull market support band, represented by moving averages, acts as a key resistance level that SOL has struggled to surpass.

This pattern raises questions about whether Solana may fall back into its previous technical formations, potentially echoing movements demonstrated by Ethereum (ETH).

#SOL keeps getting rejected by its bull market support band. If it’s behaving as just a more volatile version of #ETH, then it could fall back into its prior wedge, just like ETH did. pic.twitter.com/0umkp4uiZ1

— Benjamin Cowen (@intocryptoverse) September 4, 2024

Bull Market Support Band Rejection

In the analyst’s chart, the bull market support band represents key medium-term trends, often defined by the 20-week and 21-week exponential moving averages (EMAs). SOL has repeatedly faced rejection when attempting to break above this band, signaling strong resistance in this range.

With the current price sitting at $129, SOL has been unable to sustain its upward movement, most recently being rejected near the $190 mark in July.

Wedge Pattern Suggests Potential Reversal

The rising wedge pattern on Cowen’s chart suggests a possible reversal. This pattern, often a precursor to price breakdowns, has shown that SOL may soon retest lower levels. Initially breaking out of the wedge to the upside, SOL now risks falling back into this formation.

Should this occur, the bottom of the wedge around the $55 mark may act as a new support level. This coincides with Cowen’s prediction that SOL could behave similarly to Ethereum, which also retraced after a rejection.

Development Activity and Whale Selling Pressure

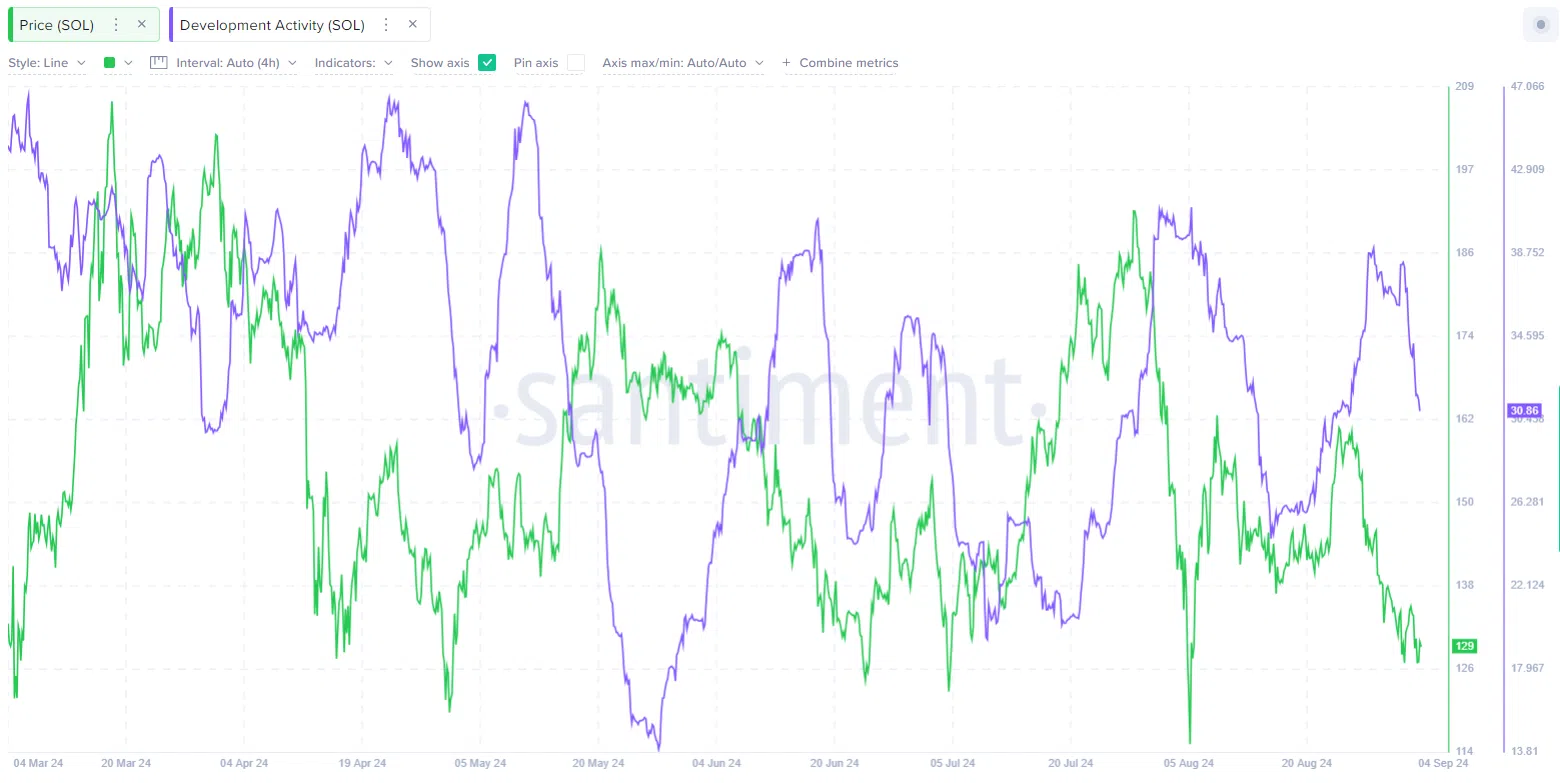

Beyond technical patterns, SOL’s development activity has also seen notable fluctuations in recent months. While development activity remained steady from March to May, a spike occurred in June, coinciding with upward price movement.

SOL Development Activity

However, by late August and early September, development activity began to taper off, falling to 30.86. This decrease in development activity aligns with SOL’s price decline.

Adding to the downward pressure, major Solana whales have been offloading their holdings throughout 2024. Notably, a large Solana whale, possibly an institutional entity, has sold 695,000 SOL since January 1, worth $99.5 million.

Despite these sales, the entity still holds 1.88 million SOL, valued at approximately $255.89 million, which remains staked. The steady liquidation of large holdings contributes to speculation of further price declines, particularly if whale selling continues at its current pace.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  NEO

NEO  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Holo

Holo  Decred

Decred  Ravencoin

Ravencoin  Siacoin

Siacoin  Enjin Coin

Enjin Coin  NEM

NEM  DigiByte

DigiByte  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Bitcoin Gold

Bitcoin Gold  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy