Ripple to sell $500 million as XRP struggles in the 4th position by market cap

Ripple has moved its entire December reserves of 200 million XRP, worth $500 million, as XRP recovers from a crash. This selling pressure could impact the recovery and further price appreciation, absorbing a significant part of the incoming demand.

Notably, the asset went through an aggressive correction after an impressive rally up to the 3rd position by market cap. XRP Ledger’s (XRPL) native token started crashing last week after dismissed rumors and concerning technical indicators, reaching the 4th position.

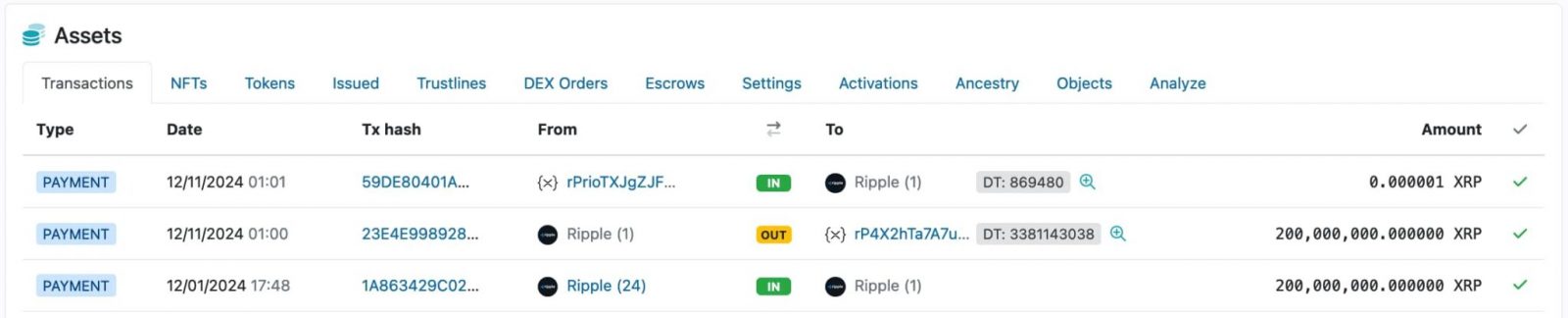

Now, as XRP again struggles behind Tether’s USDT, its largest token holder, Ripple, has initiated a massive sell operation. On December 11, the company moved all the 200 million XRP reserved for December’s budget, following Finbold’s warning last week.

Repeating previous month’s pattern, Ripple (1) sent the tokens to ‘rP4X2h(…)’ that works as an intermediary address for its sales. This account also received 380 million XRP from Ripple (29) and moved 200 million tokens to Ripple (50).

XRP price analysis amid potential Ripple’s selling activity

At the current prices, Ripple’s 200 million XRP potential sale is worth nearly half-a-billion dollars. Precisely, if the company were to sell the entire stash at $2.43 per XRP, Ripple would get $486 million.

On November 29, XRP crossed the $100 billion market cap level, threatening to surpass Solana (SOL), as Finbold reported. A few days later, Ripple’s token reached a $165.74 billion all-time high capitalization, at $2.90 per XRP. This granted the asset the 3rd position, surpassing Solana and Tether’s USDT in all crypto market indexes, in an unprecedented move.

On December 4, Finbold warned that technical indicators like the Relative Strength Index (RSI) indicated a potential crash for XRP. The forecast consolidated, and the token crashed down to $2.00, primarily driven by Ripple dismissing RLUSD-related rumors.

Despite some speculation, $RLUSD isn’t launching today. We’re in lockstep with the NYDFS on final approval and will share updates as soon as possible.

We are fully committed to launching under the supervision of NYDFS and upholding the highest regulatory standards. Stay tuned…

— Ripple (@Ripple) December 4, 2024

As of this writing, XRP has a $138.8 billion market cap, slightly behind USDT, which has a little more than $139 billion. Should XRP maintain the strong momentum it has displayed since November, the digital asset could regain the 3rd position in crypto indexes.

However, overall capital inflow into the cryptocurrency ecosystem can also boost Tether’s stablecoin capitalization, leveling up the game against XRP. On that note, Circle’s USDC, a USDT direct competitor, also fights for higher ranks in a groundbreaking partnership with Binance.

Featured image from Shutterstock.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom