Ripple (XRP) Price Wavers as Whales Remain on the Sidelines

Ripple (XRP) price has been under considerable pressure recently, driven by bearish technical indicators and legal challenges. Despite a recent decline, some signs hint that the selling pressure could be easing, as indicated by a recovery in RSI levels.

However, XRP whales remain cautious, showing little change in their holdings, suggesting uncertainty about a strong price surge. For now, XRP’s future hinges on whether it can overcome resistance levels and gather bullish momentum.

XRP Whales Are Still Not Convinced

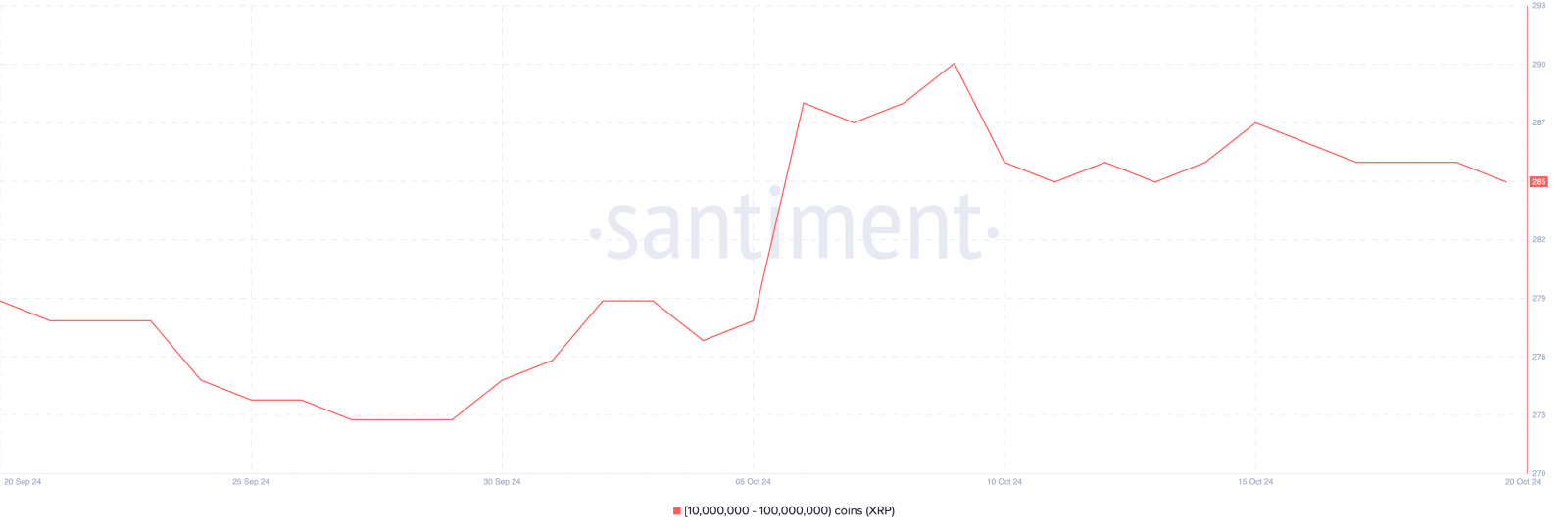

The number of wallets holding between 10 million and 100 million XRP has shown little fluctuation since October 9. Currently, there are 285 such wallets, and the count has remained within a narrow range of 284 to 287 over the past week.

This consistency suggests that these large holders, or “whales,” are taking a cautious stance and are not making significant moves either into or out of their positions.

Read more: Everything You Need To Know About Ripple vs SEC

Wallets with between 10 million and 100 million XRP. Source: Santiment

This metric is crucial because whale activity often provides insights into market sentiment. Whales have the power to move markets, and their buying or selling decisions can be strong signals for upcoming trends.

The stable count of these large wallets implies that these major players are not yet convinced that XRP is ready for a significant price surge. Until whales start accumulating more aggressively, a strong upward move for XRP seems less likely.

Ripple’s DMI Shows a Potential Uptrend

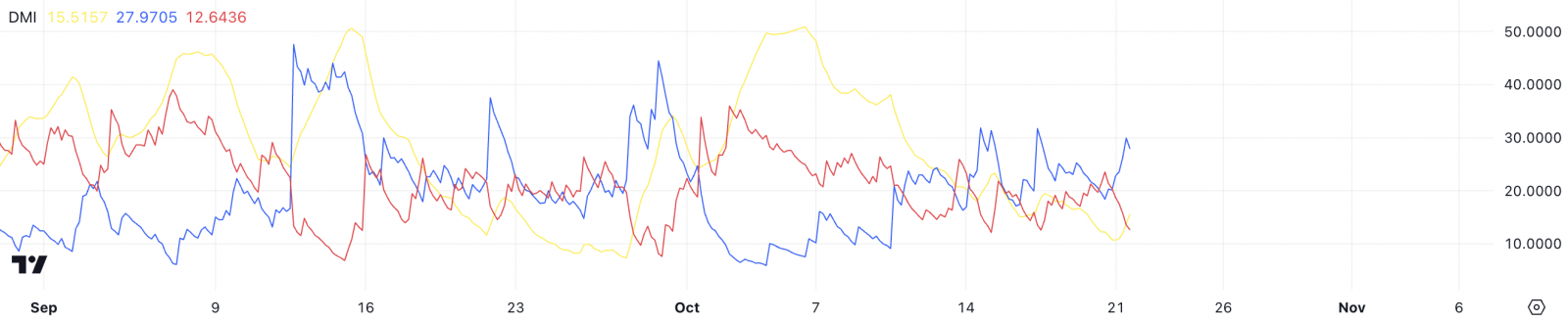

Ripple’s Directional Movement Index (DMI) chart currently shows the positive directional line (D+) at 27.9, the negative directional line (D-) at 12.6, and the ADX at 15.5. The higher D+ value compared to D- suggests that buying pressure is greater than selling pressure.

However, the ADX, which measures trend strength, is at a relatively low value, indicating that the trend is weak despite the buying momentum.

XRP DMI. Source: TradingView

The DMI is a technical indicator used to determine both the direction and strength of a trend. It consists of the D+ and D- lines, which indicate buying and selling pressures, respectively, along with the ADX, which measures the overall strength of the trend.

The current setup shows that XRP’s price has been attempting to break above key resistance levels in recent days. However, for a successful breakout to occur, the uptrend needs to gain more strength, as indicated by a rising ADX.

XRP Price Prediction: Can It Get Back to $0.66 In October?

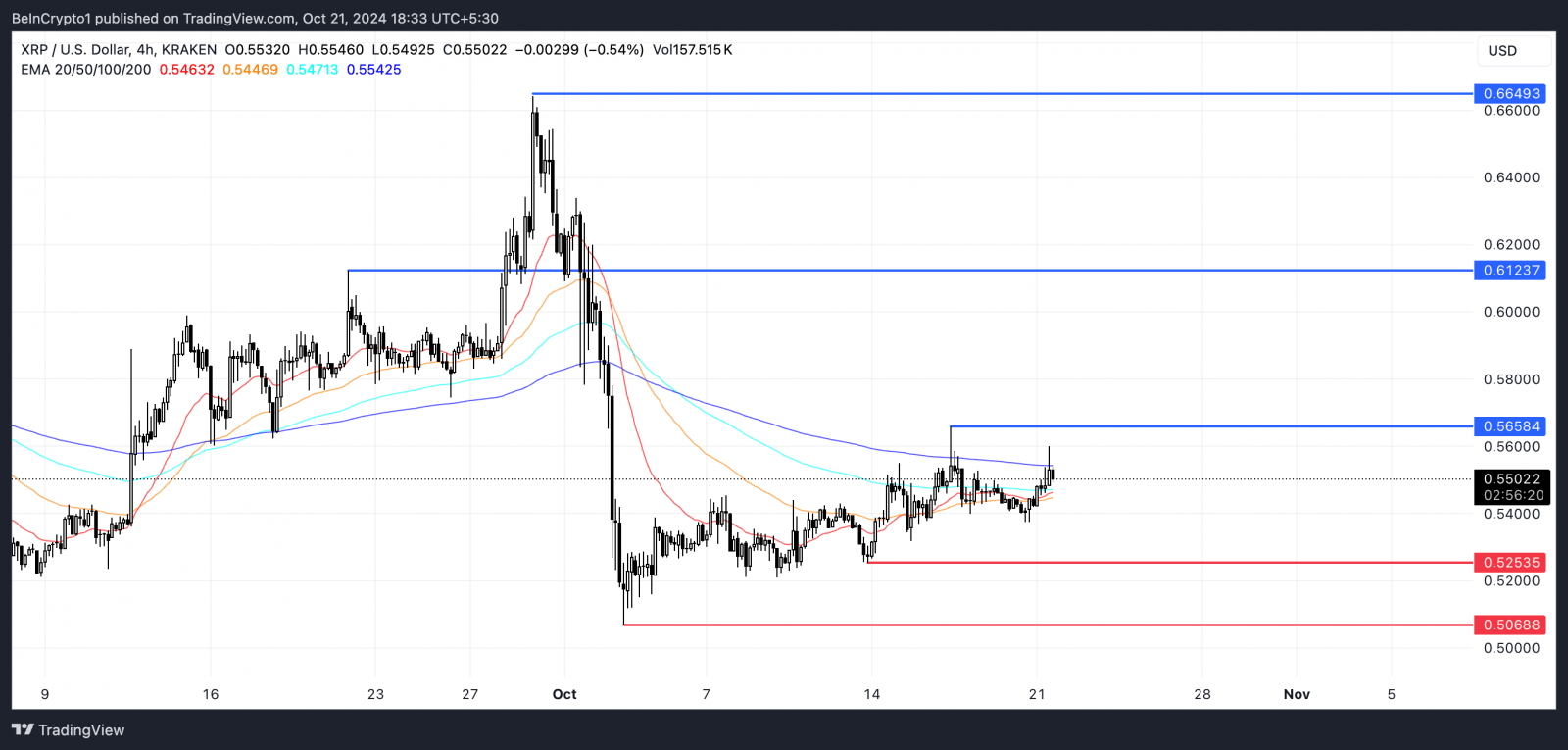

XRP’s EMA lines currently show a bearish setting, with the long-term line positioned above the short-term lines. However, the short-term lines are trending upwards, indicating potential bullish momentum.

If the short-term EMAs manage to cross above the long-term EMA, it could ignite a strong uptrend, reversing the current bearish sentiment.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP EMA Lines and Support and Resistance. Source: TradingView

XRP is also facing significant resistance levels at $0.56 and $0.61. If these levels are broken, the price could climb to $0.66, which would represent a potential 20% increase.

Conversely, if the uptrend does not materialize and bearish momentum gains strength, XRP will likely test support levels at $0.52 and $0.50. This pivotal point will determine whether XRP breaks out to the upside or remains under pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom