RNDR Price Hovers Near $10: Can It Resume The Bull Run?

- 1 Render token price sustained gains near the $10 mark throughout the month.

- 2 Amidst the market recovery, the token halted its gains in the last few sessions.

Render (RNDR) price took support at the 20-day EMA mark and stayed close to the $10 mark. For the past few sessions, the token remained in a range and witnessed range-bound moves.

However, the token sustained a bullish trajectory and is above the significant moving averages. If the token breaches the neckline hurdle of $11.50, it will reach the supply region of $13 shortly.

In a recent tweet by @Crypto Tony, the RNDR token price is near its range support mark of $9.80; below it, the bulls will lose their strength.

$RNDR / $USD – Update

Hold $9.80 is key for the bulls. Losing that and i will close my short term long pic.twitter.com/XKs3zZdeZp

— Crypto Tony (@CryptoTony__) May 29, 2024

Source: X

At press time, the Render token price traded at $10.04 with an intraday drop of 1.23%, reflecting neutrality on the charts. It has a monthly return ratio of 28.38% and a yearly return ratio of 293.20%.

Could Render Price Skyrocket Above the $12 Mark?

After a sharp uptick of over 52% this month, the buyers have paused, with the price consolidating in the last few trading sessions. Still, the token trades are in an uptrend and look bullish.

The bullish trend remained intact until the downside mark of $9.20 was not breached. Conversely, a sharp upsurge may be seen if the buyer succeeds in breaking the $12 mark.

Source: Santiment

Amidst the crypto market recovery, Render price action conveys the range-bound moves and stays close to the crucial support mark. The Momentum Indicator (RSI) curve stayed in the overbought zone and witnesses a negative chart divergence.

Price Volatility and Weighted Sentiment Outlook

The price volatility curve spiked over 12% to 0.016, but the price remained narrow, which meant a dilemma among the investors.

Source: Santiment

The weighted sentiment data remained neutral and stayed below the midline region, noting around the -0.403 mark, which means the investors are not looking confident.

Render (RNDR) Popularity on the Decline

Since the beginning of this month, the social dominance value signified a decline and dragged to 0.287%, conveying the drop in volatility.

Source: Santiment

Similarly, the development activity data slipped from the top and dragged over 45% to the 0.167 mark, revealing a neutral outlook.

Can Sellers Enter Renter the Game?

The ongoing price action signifies that the token has stuck around the round mark of $10, and sellers are looking to push the token below the 20-day EMA to trigger a retracement move.

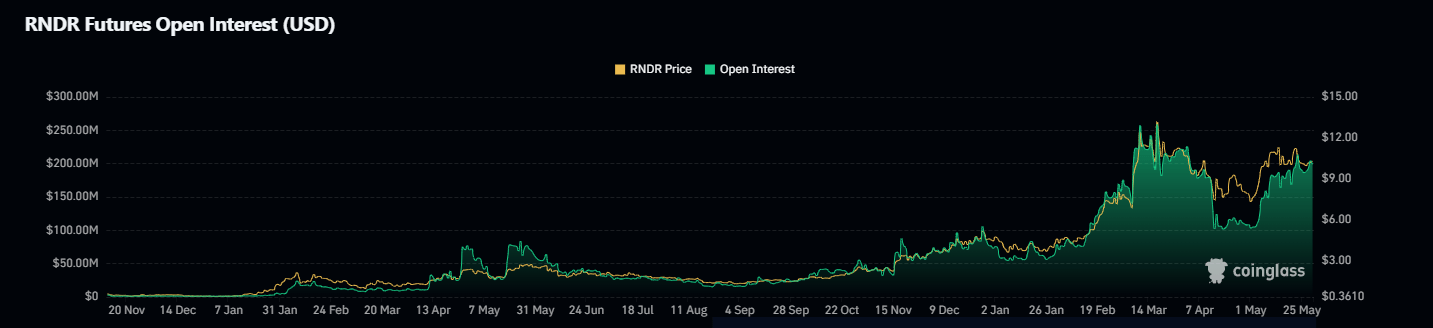

Futures OI Data Reveal Long Unwinding Move

Following the price decline of over 1.80%, investors started booking profits, and long unwinding activity was noted.

Source: CoinGlass

The open interest data dropped over 3.52% to $198.90 Million in the last 24 hrs, revealing the short-term retracement can be seen ahead.

The immediate support levels for the Render token are $9.60 and $9, whereas the resistance zones are $11 and $11.80.

What’s the Next Move for Render (RNDR)?

The Render token price saved gains near the $10 mark and might reflect a retracement toward the $9 mark in the upcoming sessions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom