Safer, smoother payments can be AI’s ‘killer app’ | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Over $200 billion is expected to flow into the global AI industry by 2025—roughly five times more than the current GDP of smaller nations like El Salvador. However, the outcomes (products, services, and profits) must justify the capital inflow and frenzy. It has not happened so far. AI companies would need about $600 billion to profitably pay back investors at this point.

You might also like: Bridging TradFi and DeFi: The opportunities of complaint stablecoins | Opinion

AI needs a ‘killer app to prove it’s not a bubble.’ Combining AI with blockchain and crypto for secure, seamless, and user-centric payments can be the use case to redeem AI. Things like Amazon One’s palm recognition feature which has already shown decent results. Plus, AI combined with blockchain will solve persistent issues like high centralization, bias in training data, lack of transparency, etc.—it will be a holistic improvement.

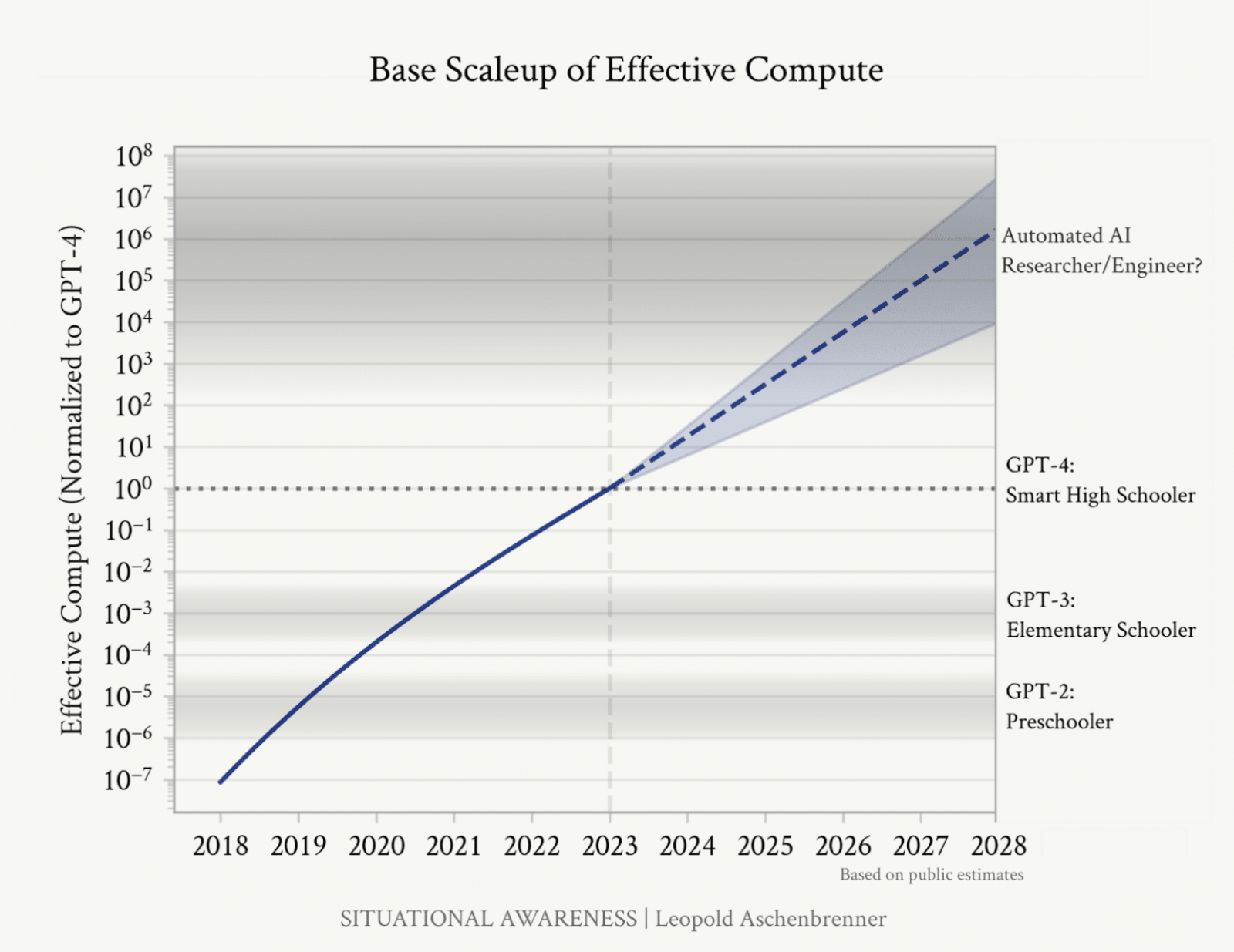

The best part is that such goals are pretty achievable today. The blockchain-crypto stack has become substantially performant and user/dev-friendly. And AI models are likely to reach human-level intelligence by 2027.

Source: Situational awareness

Experiences, over methods

About 96% of US adults shop or pay online at least once a year, according to Forrester’s ‘The State Of The US Consumer and Payments’ report for 2024. The digital payment adoption rates are higher among younger adults who use more than four connected devices across four online platforms on average. They’re also comfortable with emerging touchpoints and transaction channels, like voice assistants, chatbots, etc.

Given this demographic, retail merchants must focus on offering a rich and seamless payment experience. It’s more important than the range of available payment methods at times. While younger consumers are usually open to trying/adopting new methods, compromising on the experience isn’t an option.

AI—both predictive and generative—can help payment service providers and merchants serve new-age consumers efficiently. For example, Microsoft’s Co-Pilot for Finance can be integrated with finance apps, so users can ‘converse’ with their financial data. From identifying key spending areas to asking budget-related questions, these AI-powered tools let users make more informed payments/spending choices.

Likewise, retail merchants and online platforms can offer personalized payment options, offers, and so on, using AI to analyze the users’ interaction patterns, etc. Offering timely discounts can also boost sales.

Besides UX and accessibility, integrating AI significantly boosts the security of payment rails. Advanced machine learning, natural language processing, etc., unlock efficient anomaly detection and help detect financial frauds in real time or even before they occur. AI also enables additional user-facing layers of security, such as biometric verification.

Leading financial institutions like HSBC and PayPal are already using AI-based systems to combat money laundering and other payments-related crimes. And as the tech evolves, over 61% of companies worldwide are excited about using AI to streamline and secure their payment rails.

Securing the securer

Safeguarding digital payments with predictive security mechanisms and data analytics is one of AI’s main contributions to the global financial industry. However, developing and training AI models requires a lot of resources. OpenAI spent “over $100 million” to train GPT-4, which is almost impossible for any average mid-small company.

More and more potential builders will get priced out of the AI race as the development and training costs continue to rise in the coming years. This will result in more centralization in an industry where the balance is anyway tipped in favor of a big few. For context, two-thirds of all funds raised by emerging AI projects went to Big Tech companies.

Web3-native payment infra is necessary to offset the potential negative impact of increased institutional adoption and participation. This also applies to AI-powered payment systems. More AI means more data creation/extraction. Managing these vast data sets—often containing sensitive information—on hyper-centralized servers seriously threatens security, privacy, and end-user autonomy.

That’s partly why web3-oriented entrepreneurs and VCs are pushing for decentralized AI—for payments and otherwise. So much so that the sector attracted over $207 million in funding in less than 96 hours in early July.

As a globally distributed, transparent, and tamper-proof database tech, blockchain perfectly complements AI systems. Decentralized payment rails can benefit from AI’s ability to ensure a seamless and interoperable UX, but aspects are currently blocking the mass adoption of web3-native payment rails.

AI in payments is an over $55 billion opportunity by 2031, and blockchain/crypto are critical to achieving this in reality. The combination will allow merchants and service providers to offer a rich payment UX along with a broad set of payment methods—fiat, crypto, and more.

If the AI industry is serious about finding the ‘killer app’ for sustained, long-term adoption, it can’t fade the decentralized payments paradigm. This is where solutions to persistent problems co-exist with the scope for futuristic innovation. It’s the obvious way forward.

Read more: Finding blockchain harmony to encourage TradFi participation | Opinion Peko Wan

Peko Wan is the co-CEO of Pundi X. She has over 15 years of experience in the IT industry. Before joining Pundi X, she worked for Opera Software and Ogilvy & Mather. Pundi X has been deploying a blockchain-based point-of-sale solution and solidifying partnerships with governments, payment companies, and retailers. They were selected as one of the top 50 Innovative Fintech Startups in 2018 by KPMG and H2 Ventures, cool vendors in the blockchain business by Gartner, and one of the top 10 Fintech leaders by the Singapore Fintech Association in 2019.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Zcash

Zcash  IOTA

IOTA  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Holo

Holo  Enjin Coin

Enjin Coin  Dash

Dash  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Siacoin

Siacoin  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy