Sandbox (SAND) Price Forms Double Bottom: Buying Opportunity?

Despite signs of bottoming out, Sandbox (SAND) price has struggled to trigger a significant reversal and remained below the key moving averages.

Typically, a double-bottom formation near the demand zone might lead to a surge. Retail investors are willing to rise and accumate SAND.

In addition, a bullish engulfing candlestick was spotted, and a substantial price surge of over 2.90% was recorded in the last 24 hours.

However, the declining moving averages conveyed that SAND was in a significant downtrend, and sellers have maintained their upper hand.

SAND price has corrected more than 50% in the last two months, conveying that bulls stayed on the back foot.

Are Sandbox (SAND) Bears Losing the Fight?

A double-bottom, a famous bullish signal, was spotted on the chart, signaling a short-term price reversal. Its confirmation can be seen above the $0.3000 mark, which could lead to an upswing.

With a surge of over 3.30%, SAND price was $0.2525 at press time. However, the trading volume looked unfavorable; it dropped by over 30%, representing a lack of investor interest.

SAND price has seen a series of oscillations between $0.2300-$0.300, which is a consolidation pattern. The token is struggling below the 20-day EMA mark, indicating a lack of strong directional movement.

To gain an edge, bulls must clear the roadblock of $0.3000. Amid the market rebound, a decline of over 30% in trading volume was noted, which indicates low investor optimism.

$Sand on the verge of breakout!

Send it too pic.twitter.com/aArAQUh4Bn

— Digital Nomad Woman (@taqwaayub) September 2, 2024

@taqwaayub that the SAND price is approaching the trendline hurdle and is ready to take off ahead.

The RSI index line is below the midline region, underlying neutrality. Similarly, the MACD indicator was still projecting red bars on the histogram, conveying the bearish cues.

Notably, the development activity data also started moving upwards, indicating the significant growth in the ecosystem which might fuel the price surge in the short term.

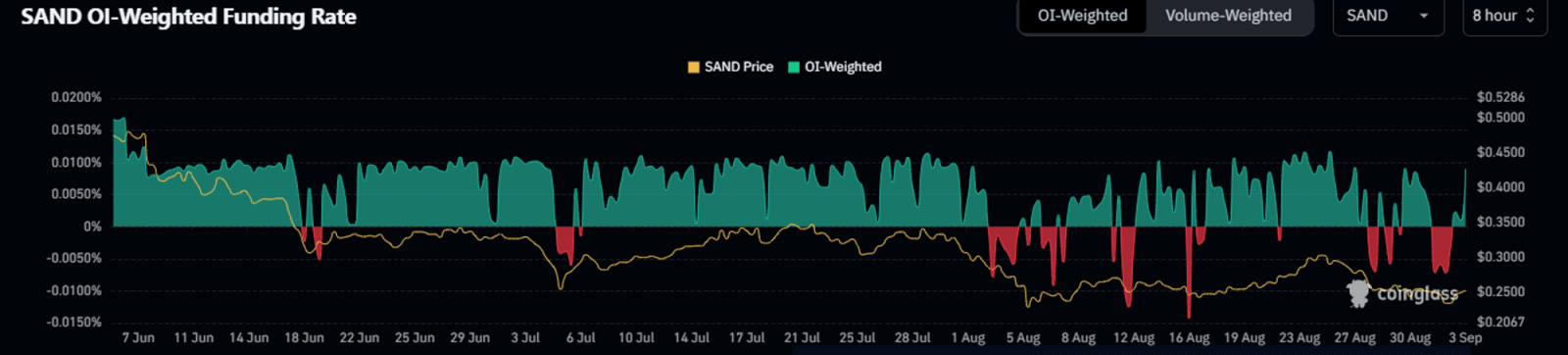

However, the SAND OI-Weighted Funding rate was 0.0090% at press time, which supported the increased demand for long positions.

Weighted Funding Rate | Source: Coinglass

This suggested that the market sentiment is bullish and SAND could experience a significant upswing shortly.

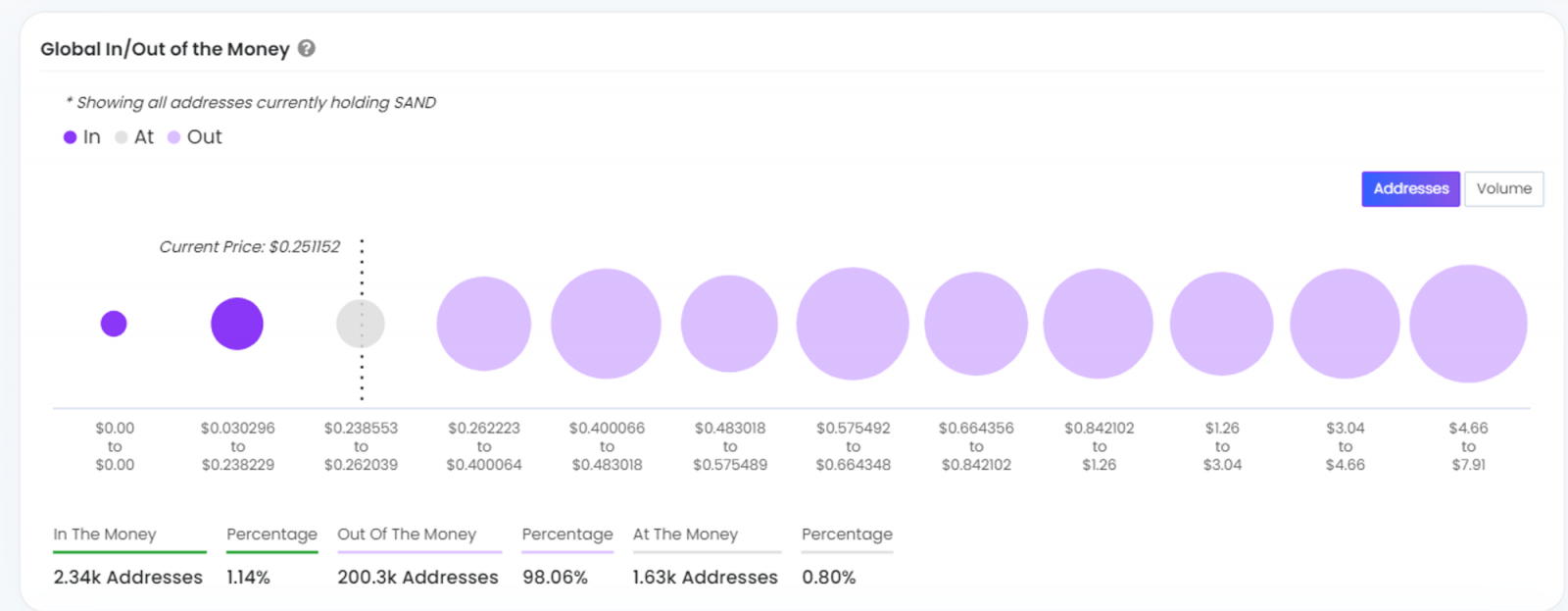

SAND Investors are Losing Money

According to IntoTheBlock data, only 1.14% of holders are making money at current price levels. Meanwhile, more than 98% of the holders are losing their money.

GIOM Indicator | Source: IntoTheBlock

Selling SAND at the current price would result in a loss for 98% of the wallet addresses holding the altcoin. Thus, it signals that a buy-on-dips opportunity and a bullish reversal could be seen.

Futures Open Interest has increased by 1.30%, indicating a minor add-ons. SAND bulls need much more than that to flip the barriers successfully.

If the SAND price crosses the 20-day EMA barrier, it could rally toward $0.2800, followed by $0.3000 in the short term. On the other hand, if a retracement happens, the token may slip toward $0.2200, followed by $0.2000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Huobi

Huobi  Status

Status  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD