Shiba Inu (SHIB) Profitability Crashes: What’s Happening?

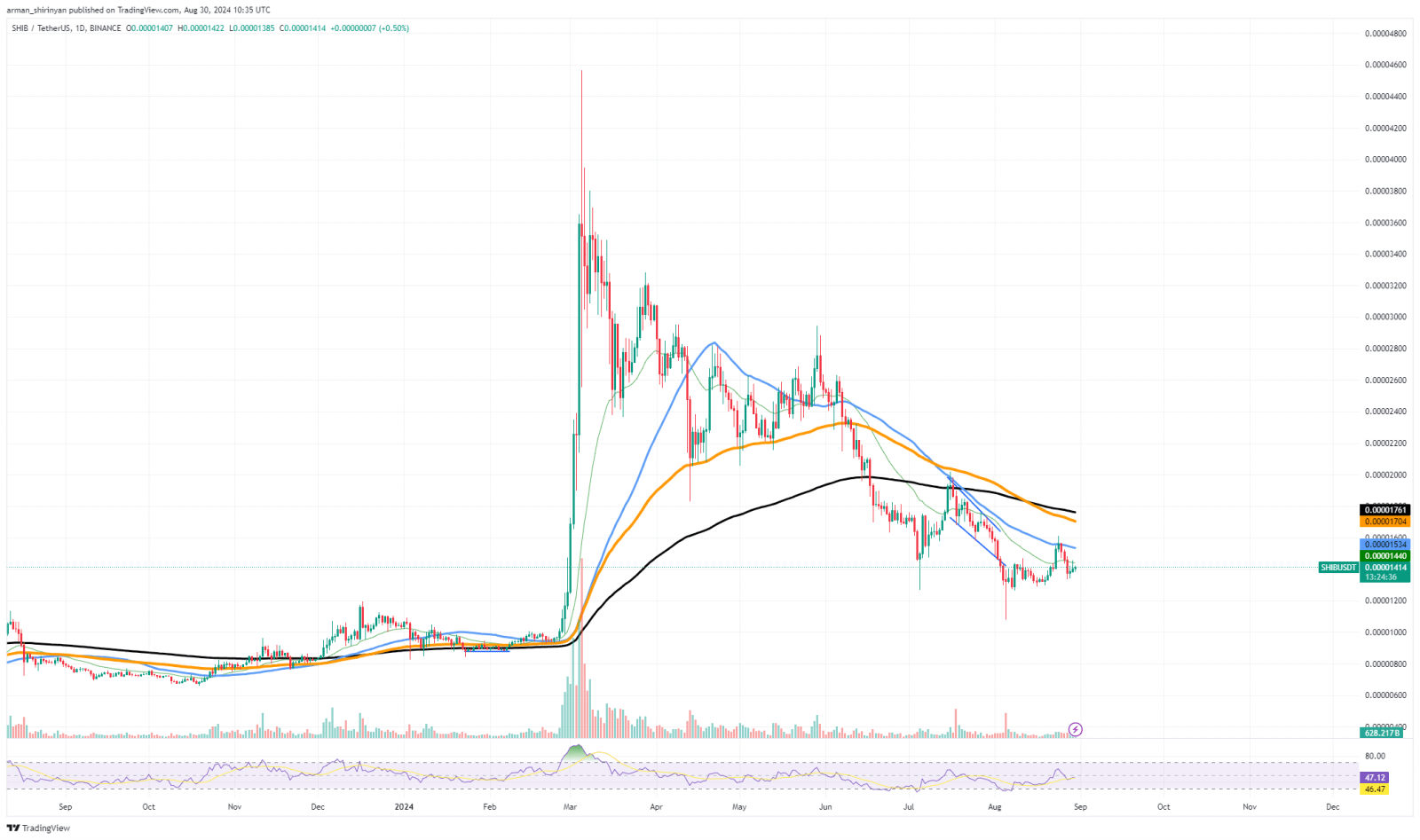

This year, Shiba Inu has experienced a major 60% decline in its profitability metric below 50%, indicating a difficult time ahead for most of its investors. The marked price decline seen on the given chart is closely related to this decline in profitability.

Understanding the on-chain metrics and general market sentiment is essential for speculating about what might happen next as SHIB struggles on. In the past the profitability metric — which shows the proportion of holders who are profitable at the current price — has been a crucial gauge of investor mood and market health.

More than half of SHIB holders are currently losing money, as indicated by the metric’s current drop below 50%. This could potentially increase selling pressure as investors attempt to reduce losses. This change is in sharp contrast to SHIB’s performance earlier in the year, which was higher for a greater percentage of its holders. Upon examination of the on-chain data, we can observe that SHIB’s substantial transaction volume has experienced a downturn, particularly in the quantity of transactions surpassing $100,000 in value.

This decline in major transactions can be a sign that the whales, or large investors, who usually cause the most significant price movements on the market, are losing interest. With 82 big transactions in the last 24 hours and a low of just 56 over the previous seven days, there has been a noticeable downward trend.

Moreover, SHIB’s concentration by large holders is still high at 73%, indicating that a sizable portion of the supply is held by a small number of wallets. This may be interpreted as a vote of confidence from large investors, but it also implies that any sizeable sell-off by these holders could have a big effect on the market.

All of the signals combined — exchange-based and on-chain — point to a bearish outlook. Significant decreases in large transactions are observed, and net network growth is slightly negative. If any encouraging catalysts do not surface, the market looks to be preparing for more declines, as evidenced by the negative bid-ask volume imbalance.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Huobi

Huobi  Status

Status  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom