Should You Invest in Filecoin (FIL)? Charts, Stats, Analysis for 2024 – Bitcoin Market Journal

At Bitcoin Market Journal, we invest in crypto tokens as if they were stocks. While there are important differences between the two, we analyze crypto “companies” like traditional companies, and diversify our investments with a mix of both.

Key Takeaways:

- Filecoin is the leader in decentralized storage: it remains far ahead of its peers, particularly in terms of revenue.

- That said, Filecoin’s revenue in 2024 has seen a significant decline compared to the previous year.

- Filecoin faces intense competition from both traditional storage giants like Amazon Web Services and Google Cloud, as well as other decentralized networks like Arweave and Siacoin.

Juan Benet was a visionary entrepreneur who saw an opportunity: there were millions of computers connected to the internet with unused hard drive space. What if users could “rent” storage space on those computers, at a fraction of the cost of cloud providers?

In a 2014 white paper titled “Filecoin: A Cryptocurrency Operated File Storage Network,” Benet laid out his revolutionary concept: a decentralized file system where users could offer to share their unused hard drive space, and be rewarded in cryptocurrency.

Just one year later, Benet’s newly founded company, Protocol Labs, introduced the InterPlanetary File System (IPFS), a peer-to-peer protocol designed to challenge the traditional HTTP protocol. IPFS promised a faster, safer, and more open web, moving away from centralized servers.

2017 marked a turning point for Filecoin, as it launched an Initial Coin Offering (ICO). The timing was excellent: raising over $200 million, Filecoin’s ICO became one of the largest in history.

Finally, in 2020, the moment Filecoin enthusiasts had been waiting for: Filecoin’s mainnet went live. In the years since its launch, Filecoin has become one of the most popular and widely used decentralized storage protocols in the world.

For crypto investors, Filecoin’s journey from a white paper to a market leader is more than just a success story: it’s a testament to the power of blockchain technology to solve real-world problems. In the world of decentralized storage, Filecoin is currently the market leader. But can it hold this lead for the long term?

Key Fundamental Data

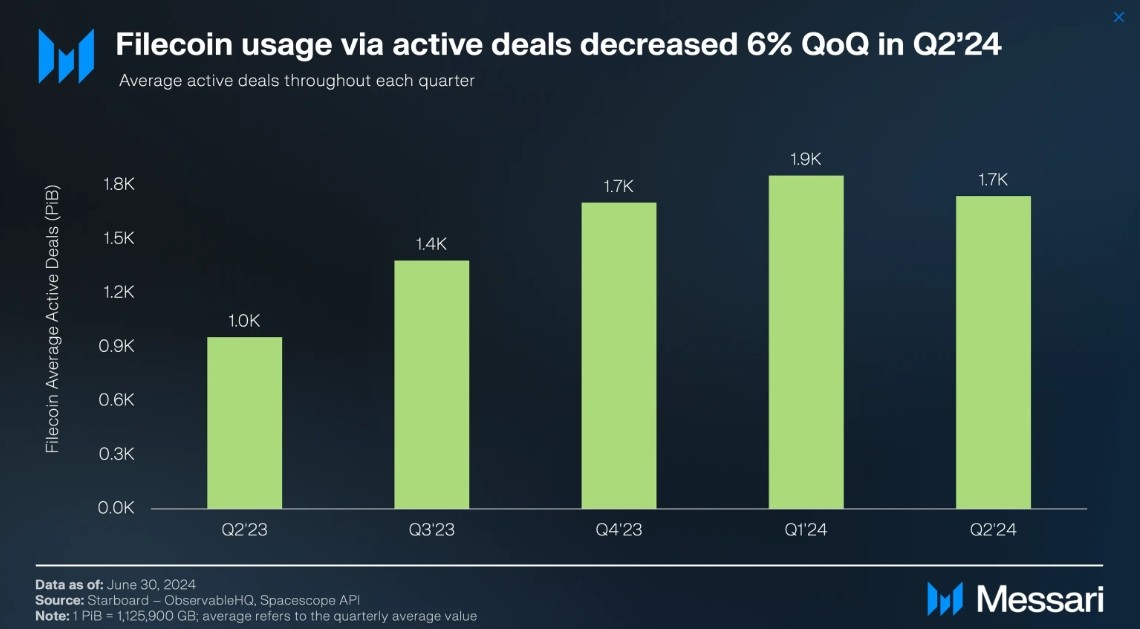

Active Deals: Because Daily Active User counts aren’t available for Filecoin, we are using “Active Deals” as a proxy for this metric. Active Deals refers to ongoing agreements between storage providers and clients for storing data on the Filecoin network. According to Messari’s quarterly reports, the average number of Active Deals in Q2 ‘24 was 1.7K, down slightly from 1.9K in Q1 ‘24. While this represents a minor decrease, the overall trend shows positive growth over the longer term.

Fees and Revenues: Filecoin has established a sustainable financial model that generates revenue through various protocol fees. These include gas-related fees and penalty fees, which are collected when storage providers fail to meet their obligations. Messari reported that Filecoin’s revenue increased by 145% from Q1 ‘24 to Q2 ‘24, reaching $4 million. However, this still marks a significant decline compared to Q2 ‘23, when the protocol generated over $10 million in revenue.

Market Cap: FIL currently has a market cap of $7.7 billion, making it the largest storage token by market capitalization, followed by ICP at $4.2 billion. Despite being off its 2024 highs, this represents a 20% increase from a year ago. However, Filecoin remains well ahead of its more direct competitors, such as Arweave ($1.6 billion) and Siacoin ($245 million).

Market Analysis

Who are they targeting? Is this market large and growing?

Problem that it solves: Filecoin addresses the issue of centralized control over digital storage services by providing a decentralized network where users can rent and purchase storage space.

Customers: Filecoin targets a broad user base, including both individuals and businesses. It seeks to provide access to cheap decentralized storage solutions.

Value creation: By adopting Filecoin, users can benefit from a decentralized storage solution that provides enhanced security and censorship resistance at competitive prices. Plus, they can earn FIL tokens by providing storage.

Market structure: As a decentralized storage solution, Filecoin operates in a market that is still developing and fragmented (there are various players and projects in the decentralized storage sector).

Market size: The potential market for Filecoin is enormous, considering the ever-expanding amount of data (the global cloud storage market size is valued at over $100 billion). As decentralized storage gains traction and becomes more widely adopted, the demand for such services is expected to grow.

Regulatory risks: Filecoin is highly susceptible to regulatory scrutiny, especially since it’s one of the top projects in the space. In addition, the SEC believes Filecoin’s utility token, FIL, qualifies as a security, which makes it a high-risk investment.

Our analysts rated FIL a 3 out of 5 for market analysis. Download the complete scorecard here.

Competitive Advantage

How big is the company moat? Can they defend against competitors?

Technology/blockchain platform: FIL runs on the Filecoin blockchain, which was built from scratch and launched in 2020.

Lead time advantage: Decentralized storage is not a new concept, with projects like BitTorrent launching many years ago. That said, Filecoin is the most popular project to utilize the power of blockchain technology.

Contacts and networks: Filecoin has a well-developed advisory board featuring seasoned professionals such as Joe Lubin, founder of Consensys and co-founder of Ethereum, and Brewster Kahle, founder of Internet Archive.

Our analysts rated FIL a 3.5 out of 5 for competitive advantage. Download the complete scorecard here.

Management Team

Does the team have the experience, intelligence, and integrity to make the company great?

Entrepreneurial team: Filecoin’s team consists of experienced professionals such as Nicole Wong, former Deputy U.S. Chief Technology Officer, and Brian Behlendorf, who is involved with tech companies like Linux and Mozilla.

Industry/technical experience: Filecoin’s team is stacked with experienced professionals who have helped it grow into the most popular decentralized storage solutions, so it’s safe to say that the team has the required technical experience.

Integrity: Filecoin has been generally free from controversy, though in 2023 the project was in the spotlight after the SEC said it believes the token can be considered a security.

Our analysts rated FIL a 3.3 out of 5 for the management team. Download the complete scorecard here.

Token Mechanics

Is the token design favorable to long-term investors?

Is a token necessary? FIL is at the centre of Filecoin’s structure as it is used to incentivize reliable storage from providers.

Value added: At its core, FIL incentivizes network participants to act reliably, similar to Proof of Stake tokens. So, it does not necessarily add a new type of value, but leverages existing ones to make its system work.

Decentralized: Filecoin is governed by the Filecoin Foundation, although its community has a say in the changes that take place in the network.

Token supply: FIL has a maximum supply of 2 billion tokens.

Public exchange: FIL is listed on major exchanges like Binance, Coinbase and KuCoin.

MVP: Filecoin has been running since its mainnet launch in 2020.

Our analysts rated FIL a 4 out of 5 for token mechanics. Download the complete scorecard here.

User Adoption

How easy will it be for the company to grow users?

Technical Difficulty: While more technical than traditional storage providers, Filecoin attracts users by offering competitive storage prices compared with traditional solutions. On top of that, users gain the peace of mind that their files are not controlled by a single entity. Other users can also be attracted by the opportunity to earn FIL for providing storage.

Halo Effect: Filecoin has a strong halo effect, being backed by well-regarded institutions such as Andreessen Horowitz, Sequoia Capital, and Union Square Ventures (some of the notable investors when Filecoin raised over $257 million in a token sale in 2017).

Buzz: Filecoin generates a decent amount of buzz on social media, and its following on Twitter is above average, with over 662k followers, making it one of the most followed projects in that niche.

Our analysts rated FIL a 3.5 out of 5 for buzz. Download the complete scorecard here.

Potential Risks

What risk factors might cause intelligent investors to stay away?

Team: Filecoin’s team risk is low; the team is entirely transparent and composed of highly experienced professionals from both the blockchain and broader tech sectors.

Financial: The project has successfully raised substantial funds: over $258 million across seven rounds of funding. However, the lack of publicly available financial reports introduces uncertainty regarding its current financial standing.

Regulatory: Filecoin faces substantial regulatory risks, particularly as the SEC has classified FIL as a security. Additionally, the Filecoin Foundation is based in the U.S., a jurisdiction where crypto regulations are still unclear and evolving.

Smart Contract: The platform has undergone multiple public security audits by respected firms like Least Authority and Consensys Diligence. Additionally, the project maintains an active bug bounty program that offers up to $150k for reporting vulnerabilities.

Traction: The platform has shown sustained growth through active storage deals, reflecting consistent use from clients and storage providers. Off-chain, Filecoin’s social media presence is solid, with a significant number of followers.

Behavioral: Investors are likely investing in Filecoin due to its long-term potential and vision. It’s one of the most popular decentralized storage providers and has solid backing, so they are likely hoping Filecoin will continue being the go-to decentralized storage solution if adoption increases.

Our analysts rated FIL a 2.3 out of 5 for risk (Note that for this section lower = better). Download the complete Risk Scorecard here.

Investor Takeaway

BULL CASE: Filecoin is an early mover in the crypto decentralized storage space. This advantage, combined with its solid technological foundation, positions the project to benefit as the market for decentralized storage solutions grows. Additionally, Filecoin is backed by prestigious institutions like Andreessen Horowitz, Sequoia Capital, and Union Square Ventures, which have collectively raised over $200 million for the project, demonstrating strong confidence in Filecoin’s vision.

BEAR CASE: Despite its strengths, Filecoin faces substantial challenges that could impact its future success. The competition is fierce, with traditional storage providers like Amazon Web Services, Google Cloud, and Microsoft Azure offering robust and reliable solutions that have dominated the market for years. Additionally, other decentralized storage networks such as Arweave and Siacoin are vying for market share, heating up the competition.

Overall, our analysts rated FIL a 3.5 out of 5 based on its compelling value proposition and significant success to date, balanced against the competitive pressures from both traditional and decentralized storage providers. Download the complete scorecard here.

This analysis is to help make you a better-informed investor; it is not financial advice. The future may look different than the past. All investing involves risk; see our investing approach for how we manage risk through diversification. Never invest more than you’re willing to lose, and see losses as learning.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom