Solana Buy Chance Emerges, But Here’s the Catch

Solana (SOL) has presented a buying opportunity for those looking to trade against the market trend.

However, its technical setup suggests that any coin acquired at current prices might suffer a brief devaluation. This is because SOL bears do not appear ready to relinquish control.

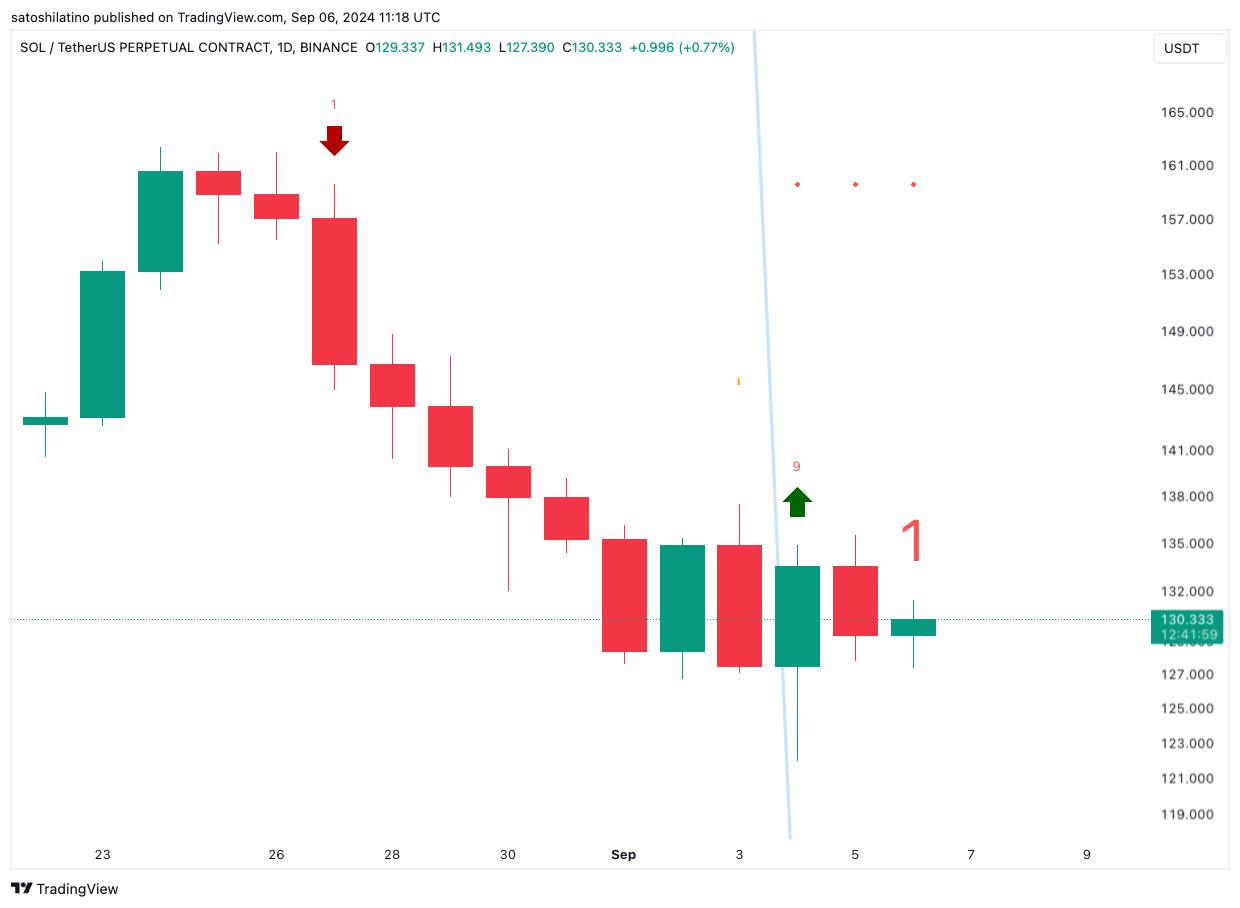

SOL’s Buy Signal, But There Is a Catch

The Tom DeMark Sequential indicator on the daily chart reveals a buy signal, suggesting Solana may witness a rebound if accumulation gains momentum.

The indicator measures the time of an asset’s trend exhaustion and identifies potential price reversal points. It does this by tracking the price action over a series of nine candlesticks. A buy signal is generated when the indicator reaches nine on a downtrend.

Although this presents a bullish opportunity for those who have been waiting to buy Solana at a low and sell high, other key indicators hint at the possibility of a further decline in the coin’s value.

Solana TD Sequential. Source: TradingView

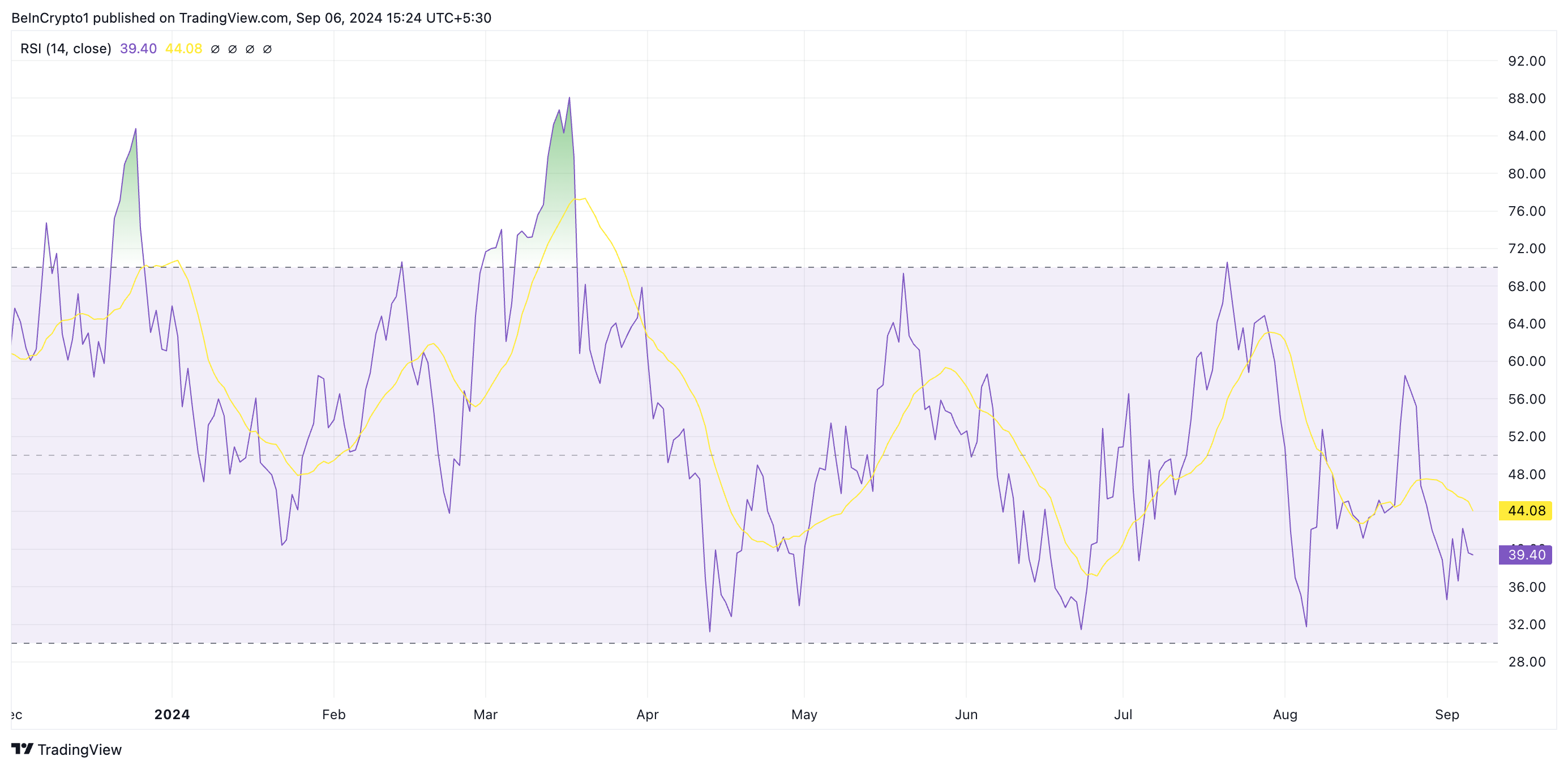

For example, general buying pressure in the market is too weak to sustain a rally, as evidenced by its Relative Strength Index (RSI). This indicator, which measures SOL’s overbought and oversold market conditions, is at 39.07 as of this writing.

It indicates that many market participants prefer to sell their Solana holdings over accumulating new coins.

Solana Relative Strength Index. Source: TradingView

Additionally, the coin’s price continues to trend further from the Leading Span A and B of its Ichimoku Cloud, which now forms critical resistance levels.

The Ichimoku Cloud indicator identifies trends, support and resistance levels, and potential market reversal points. When an asset’s price trades below the cloud, it is under significant resistance. This indicates that the market is in a bearish condition and that the downtrend may continue.

Solana Ichimoku Cloud. Source: TradingView

Solana Price Prediction: Time to Watch

Mosy Alpha, a crypto trader and analyst on X, has shared an optimistic projection for Solana ahead of the Breakpoint conference on September 20-21. He notes that historically, SOL’s price tends to perform well during this event.

If traders heed the buy signal in preparation for this, it may push SOL’s price past the resistance formed by the Ichimoku Cloud to trade at $171.91.

Solana Price Analysis. Source: TradingView

However, Mosy emphasizes that the outcome will depend on “the market’s liquidity and marginal capital, as well as whether Solana Breakpoint can surpass market expectations.” Therefore, if traders fail to supply the market with enough liquidity, the bullish projection will be invalidated.

If this is the case, a sustained close below $126 could trigger a correction toward the August 5 low of $110, and if this level fails, the losses may extend to $90.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Gate

Gate  EOS

EOS  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  IOTA

IOTA  Synthetix Network

Synthetix Network  Holo

Holo  Zilliqa

Zilliqa  Dash

Dash  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Status

Status  DigiByte

DigiByte  Waves

Waves  Nano

Nano  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy