Solana Price Plunges Below $150 as Bear Traders Mount $195M SHORT Positions

Solana price slipped below $150 on Monday, August 13, down 12.68% in the last four days. Derivatives markets data suggest ongoing SOL traders are positioning for further downside in the coming days.

Solana Price Loses $150 Support Amid Sluggish Market Demand

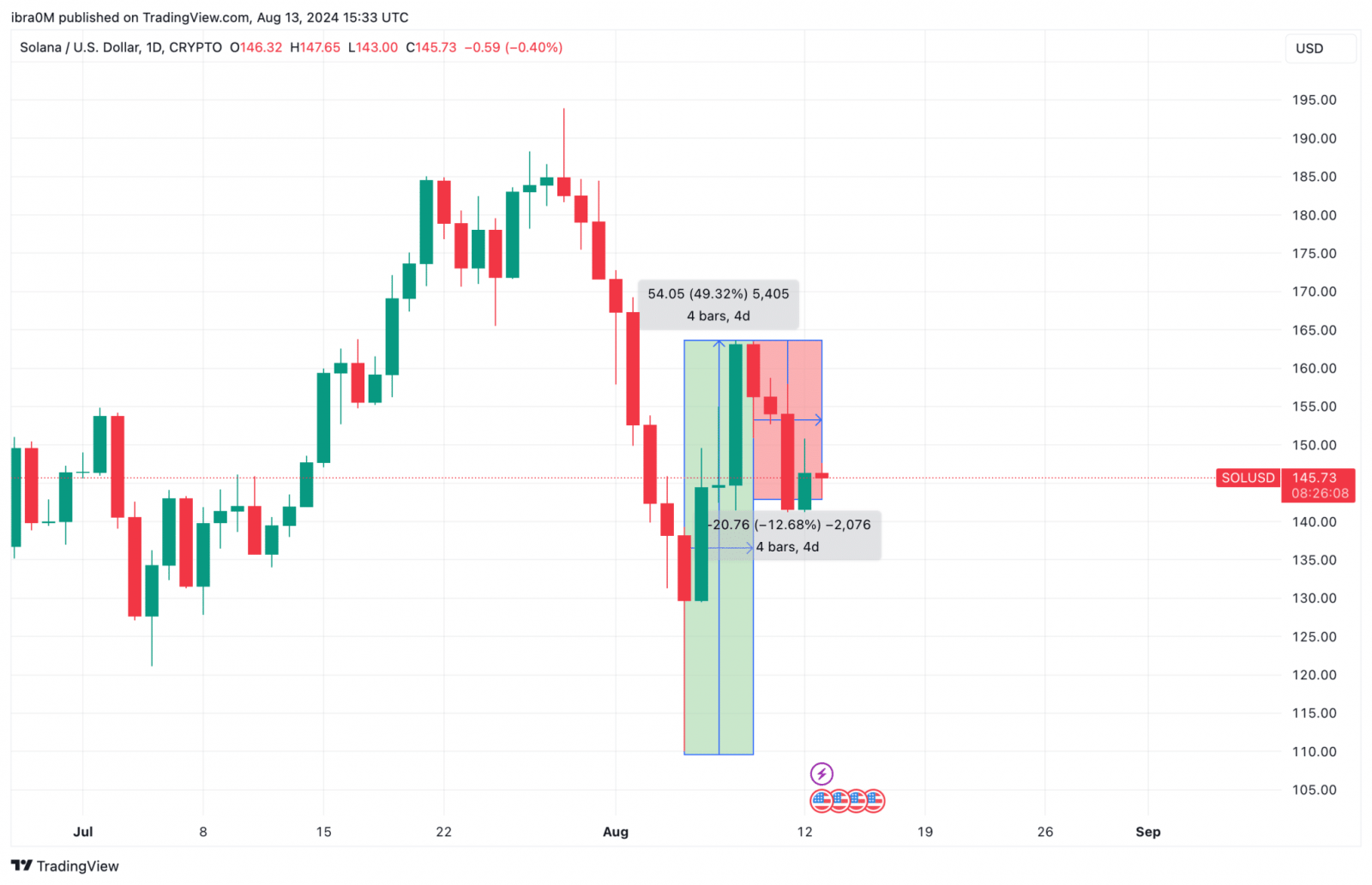

Last week, Solana’s price saw significant upside momentum, with bullish news driving investor enthusiasm. The approval of Solana ETFs in Brazil catalyzed a 49.32% rally between August 5 and August 9. The SOL price peaked at around $163 on August 9, fueled by optimism and increased investor interest.

However, rather than hold out for a potential breakout above $170, short-term traders began taking profit as Solana’s price approached the $165 resistance level.

Solana Price Action SOLUSD | TradingView

The SOL/USD price chart above illustrates weakening market demand after recent profit-taking activity. As of August 13, Solana is trading below $148, representing a 12.68% correction from last week’s peak. The psychological support at $150, once a stronghold for bullish sentiment, has now been breached. This loss could signal a shift in market sentiment as investors reassess their positions amid the current bearish outlook.

Bears Regain Control With $172M SHORT Positions.

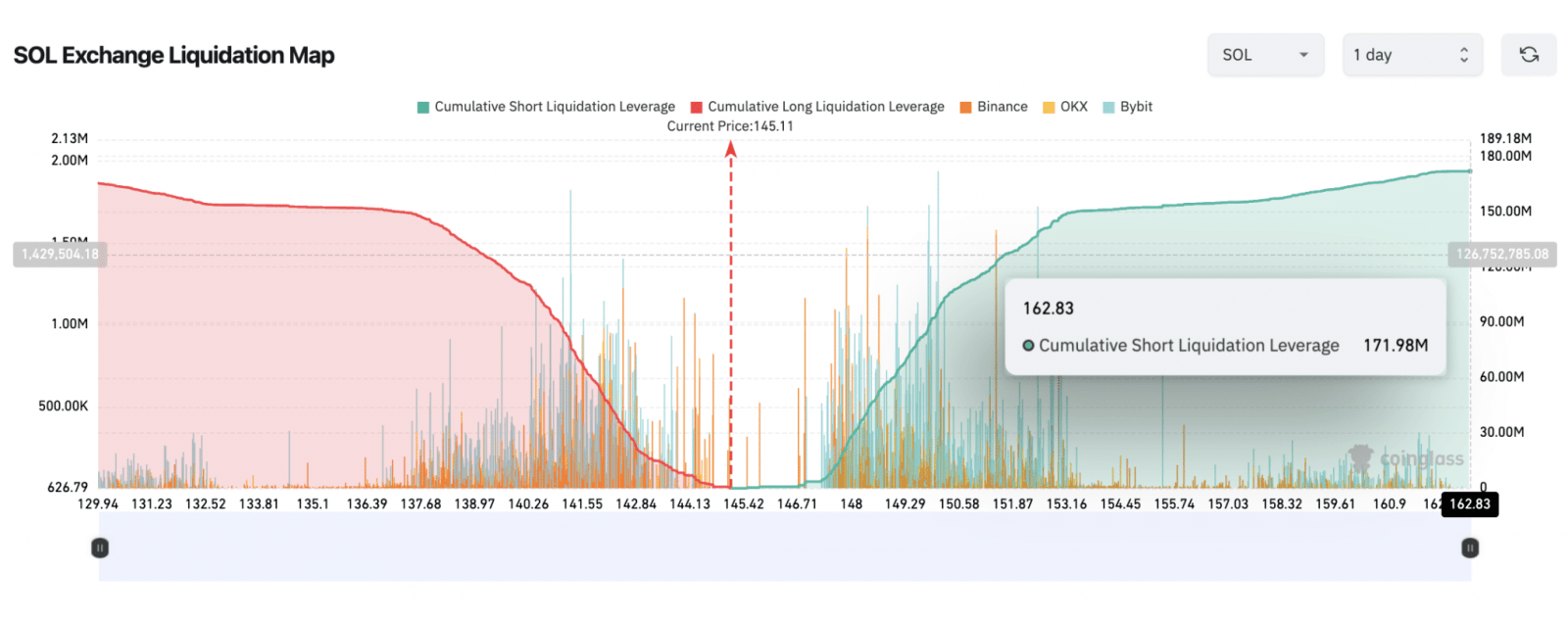

The breach of the $150 support level on August 13 appears to have emboldened bear traders. According to Coinglass Liquidation Map data, SOL traders have mounted $171.98 million in short positions, while active long contracts stand at $165 million. This indicates a significant shift in market sentiment, with bearish positions outweighing bullish ones.

Solana Liquidation Map SOLUSD as of Aug 13 2024 | Coinglass

The current landscape suggests that many long traders, who initially benefited from the rally, have now closed their positions amid the 12.68% decline in SOL price over the past four days. With the number of short positions exceeding longs, bear traders could capitalize on this momentum, potentially pushing the price further down now that SOL has lost the critical $150 support.

SOL Price Forecast: Bulls Must Hold $140 Support

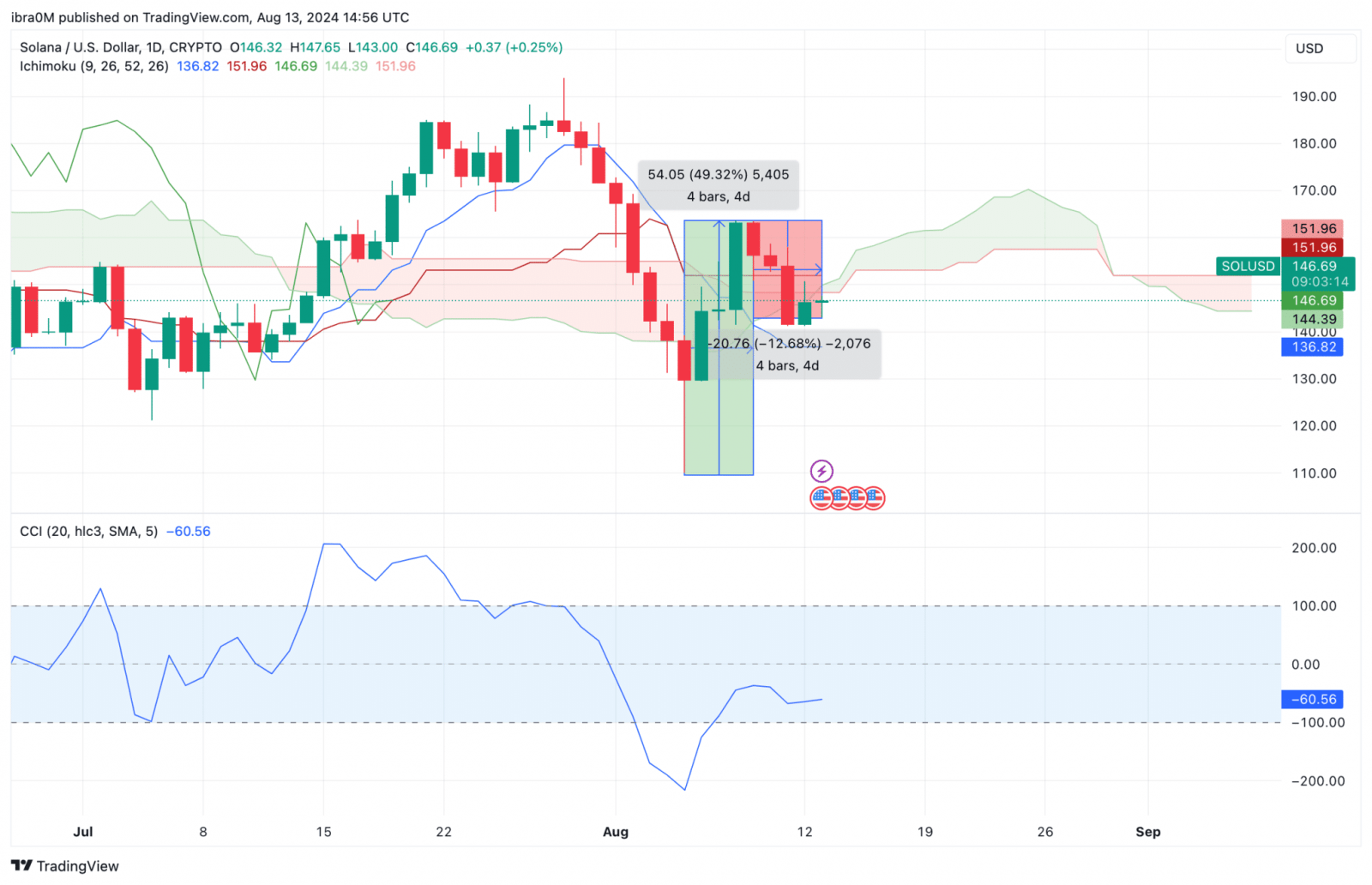

The analysis of recent market data points toward a bearish outlook for Solana’s price. The breach of the $150 support level and the growing dominance of short positions suggest that the bearish sentiment may continue to prevail.

Solana Price Forecast SOLUSD | TradingView

Based on the technical indicators in the SOLUSD chart, Solana could face further downside pressure. The key support level at $140 must hold to prevent a steeper decline. If the price falls below this level, it could open the door for a further drop toward $136.82, the next major support level.

On the upside, resistance is now expected to be around $151.96, and only a sustained move above this level would signal a potential reversal of the current downtrend.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Ethereum Classic

Ethereum Classic  Gate

Gate  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Holo

Holo  Decred

Decred  Ravencoin

Ravencoin  Siacoin

Siacoin  NEM

NEM  Enjin Coin

Enjin Coin  Nano

Nano  Waves

Waves  DigiByte

DigiByte  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  Bitcoin Gold

Bitcoin Gold  OMG Network

OMG Network  Ren

Ren  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD