Solana (SOL) Death Cross Is Canceled

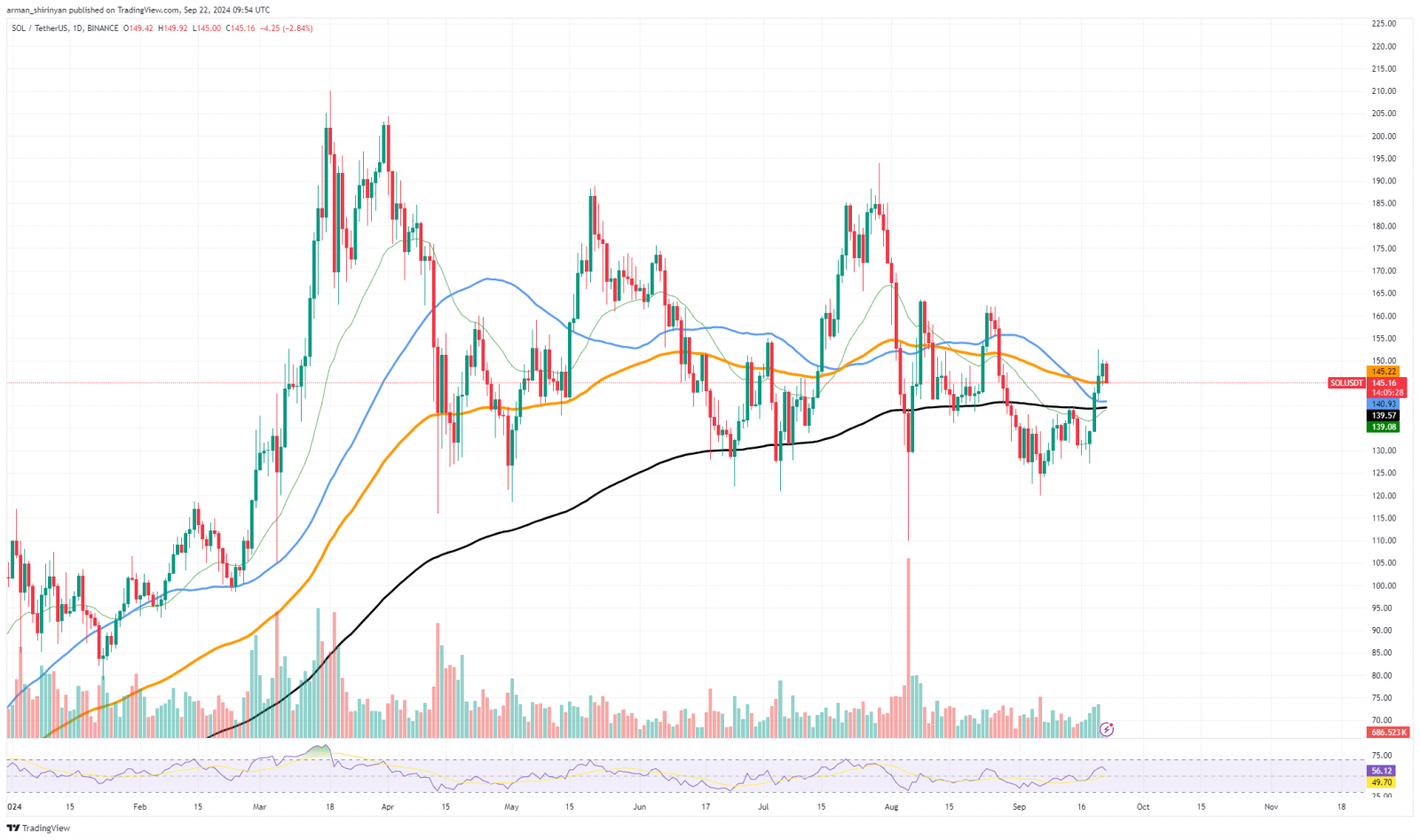

For the time being at least, investors in Solana can exhale with relief as the possibility of a death cross signal has been avoided. Based on the given chart, it appeared that the 200-day moving average and the 50-day moving average were headed straight for each other.

Generally speaking, a death cross is a bearish signal that suggests further downside may be ahead, but luckily Solana avoided that bullet. Right when it was most needed, the price fluctuated between $140 and $145. This rebound was essential to preventing the chart from entering a death cross scenario due to the downward momentum. Solana may therefore be recovering some of its lost value as this technical signal is beginning to show signs of improvement.

A death cross frequently triggers additional sell-offs, so it is critical for SOL to maintain its position that this bounce occurs at this critical juncture. Solana now has an opportunity to level off and possibly even rise higher in the near future thanks to the bounce. In the future, two critical stages need to be closely monitored.

Firstly, SOL is currently trading near the $145 level, which may serve as a temporary resistance zone. Solana could see greater upside potential if it breaks above this level. Second, another important resistance to keep an eye on is the $160 mark. The $180 range that Solana was trading in earlier this year may be attainable if it can overcome these barriers.

This price bounce gave investors a glimmer of hope as Solana just dodged a strong bearish signal that could aggravate the situation on the market in general. The risk of additional decline is diminished as long as SOL maintains current levels and advances toward $160.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom