Solana (SOL) Ready for $120, Starknet (STRK) Volatility Explosion Incoming, Did Cardano (ADA) Became King of Alts?

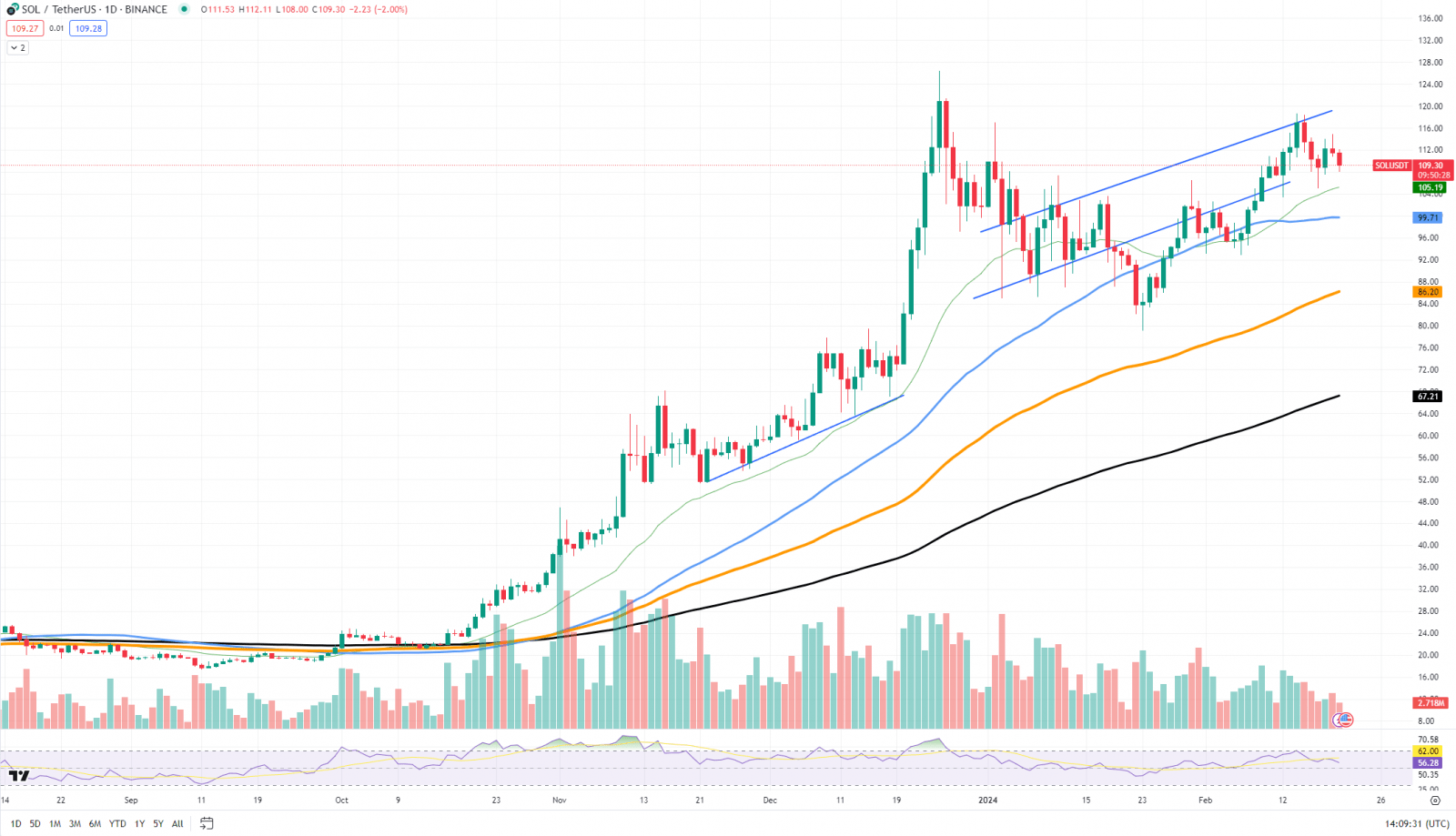

Solana has been capturing the attention of investors with its robust blockchain platform, and recent price action suggests that it may be gearing up for a move toward the $120 mark. A deep dive into its price analysis reveals that SOL is currently trading in an ascending channel, hinting at bullish sentiment among traders.

The support and resistance levels are crucial to understanding Solana’s potential trajectory. The asset has established a strong support base around the $100 level, indicated by the lower boundary of the ascending channel and reinforced by the 50-day moving average. This level has been tested multiple times, making it a significant psychological and technical stronghold for the price.

Resistance, on the other hand, can be seen near the upper trend line of the channel, which currently sits just above the $110 mark. A convincing break above this resistance could open the gates toward the $120 target. The 100-day and 200-day moving averages, currently at $88.21 and $67.23, respectively, continue to slope upwards, providing additional layers of support and affirming the long-term uptrend.

Should the bullish momentum continue, a push past the current resistance could see Solana test $120 in the foreseeable future. This would represent a significant psychological level and a new foothold for the cryptocurrency.

Starknet is here

Starknet is listed on Binance, a development that has triggered a significant surge in volatility for the asset, just as expected. Starknet is witnessing dramatic price movements that invite a close examination of its performance and future potential.

An analysis of the recent price chart for STRK reveals a remarkable spike in trading activity, with prices briefly touching a high before settling at around $3.0625. This peak, which can be attributed to the initial excitement surrounding the Binance listing, acts as the current resistance level. The sharp increase in volume that accompanied this surge is a classic indicator of heightened investor interest and market volatility.

Support levels, in the wake of this listing, appear to be forming around the $2.8624 mark, which aligns with the price just before the listing announcement. It is essential to monitor this level closely, as a sustained fall below could signal a bearish outlook, while stability above it may indicate consolidation before a potential uptrend.

However, it is important to keep in mind that any projects that airdrop a significant amount of tokens usually face significant selling pressure after market listings.

Cardano’s dominance

Cardano is contending for the crown in the altcoin market. Its trajectory has been marked by significant gains, making it one of the standout performers across the cryptocurrency landscape.

A technical analysis of ADA’s price chart reveals a compelling bullish trend. The asset has recently broken out of a consolidation pattern, with its price now hovering around the $0.6376 level. This breakout is indicative of strong buying pressure and could signal the start of a new uptrend.

The support levels for ADA are well established, with the most immediate one at the $0.5017 mark, which aligns with the 50-day moving average. This level has served as a springboard for the price in recent times, and its strength will be critical in maintaining the upward momentum. Further support is found at the $0.4446 level, near the 200-day moving average, providing a robust safety net for any potential pullbacks.

On the resistance side, the first significant level to watch is around $0.7. This price point has acted as a psychological barrier in the past and could again serve as a test for ADA’s bullish case. A sustained move above this level could open the door to higher valuations, with the next resistance possibly forming around the $0.8 to $0.9 range.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  OKB

OKB  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Ontology

Ontology  Huobi

Huobi  DigiByte

DigiByte  Nano

Nano  Hive

Hive  Bitcoin Gold

Bitcoin Gold  Status

Status  Lisk

Lisk  Waves

Waves  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond