Solana (SOL) Risks Falling to $137: An In-depth Look

Solana (SOL) price is currently under the microscope, with a mix of technical indicators and network activity trends fueling discussions about its future direction.

Amidst an increase in DEX trades and a challenging technical setup, SOL finds itself at a critical crossroads.

Challenges and Operational Capacity on Solana

The ascent as a favored blockchain for new Solana-based meme coins brought with it an uptick in network activity, but not without its drawbacks. Recent weeks saw a spike in failed transactions, a concern for users and developers alike.

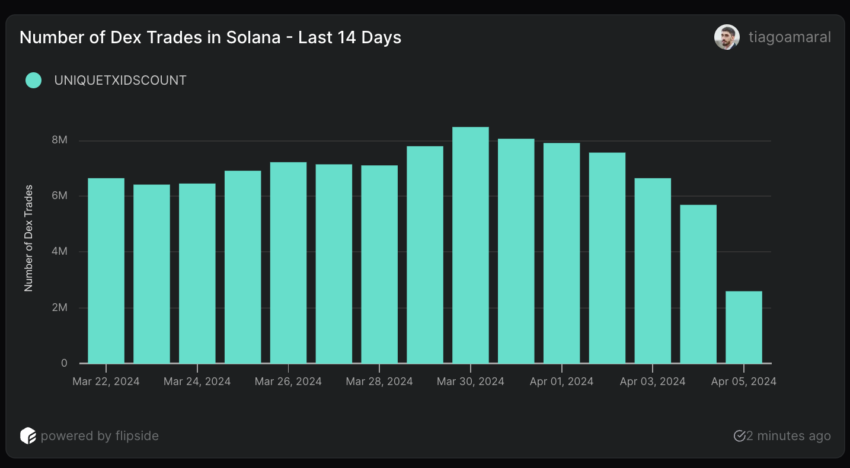

Despite reaching a peak of 8.5 million DEX transactions on March 30, activity has since tapered off to 5.6 million by April 4, indicating possible operational limits and growing user frustration.

Daily DEX Trades in Solana. Source: Flipside

Moreover, the Average Directional Index (ADX) on Solana presents a stark picture for its price. With a current reading of 36, it indicates a solid bearish trend.

This uptick from a reading of 9 to 36 in a short span underscores the growing strength of the downtrend, possibly setting the stage for further price drops.

Read More: 6 Best Platforms To Buy Solana (SOL) in 2024

Solana ADX. Source: TradingView

SOL Price Prediction: Can It Get Back to $137?

Solana’s price is at a crucial juncture. The recent technical patterns, including a death cross, coupled with declining DEX trades and a robust ADX reading, paint a bearish picture.

If the trend continues, SOL could see it $167 support level tested, potentially dropping to as low as $137, especially if operational issues persist and shake investor confidence further.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

Solana Price Chart. Source: TradingView

However, should Solana manage to effectively address these operational challenges, there is a chance for a reversal in fortunes. A successful resolution could pave the way for Solana price to challenge higher resistance levels. Therefore, it could potentially aim for $205 or even $210, as market sentiment improves.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  KuCoin

KuCoin  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD