Solana (SOL) Trading Volume Rises 6% as Uptober Hopes Rise

As the broader cryptocurrency market grapples with consolidation, Solana (SOL) continues to experience sideways price movement, dampening the optimism of those hoping for a stronger October rally. Historically, the market has seen major price increases this month, a trend the crypto community calls “Uptober.”

However, this year has not mirrored the anticipated gains, and frequent price declines across various altcoins, including SOL, have led to some dubbing the current period “Rektober.” Despite this, there remains notable activity surrounding the token, with trading data signaling potential hope among investors.

According to CoinGlass, the cryptocurrency’s 24-hour trading volume spiked by 6.52%, reaching $4.84 billion. The token’s trading volume uptick highlights a continuing belief in the possibility of an upward trend as October progresses, even amid broader market stagnation.

Open Interest Gains Amid Growing Optimism

Solana’s Open Interest (OI), another key market indicator, has also surged. Recent figures show a 1.55% jump in OI, now at approximately $2.29 billion. This rise in OI suggests growing investor confidence, reinforcing a bullish sentiment despite the broader market’s lack of significant upward momentum.

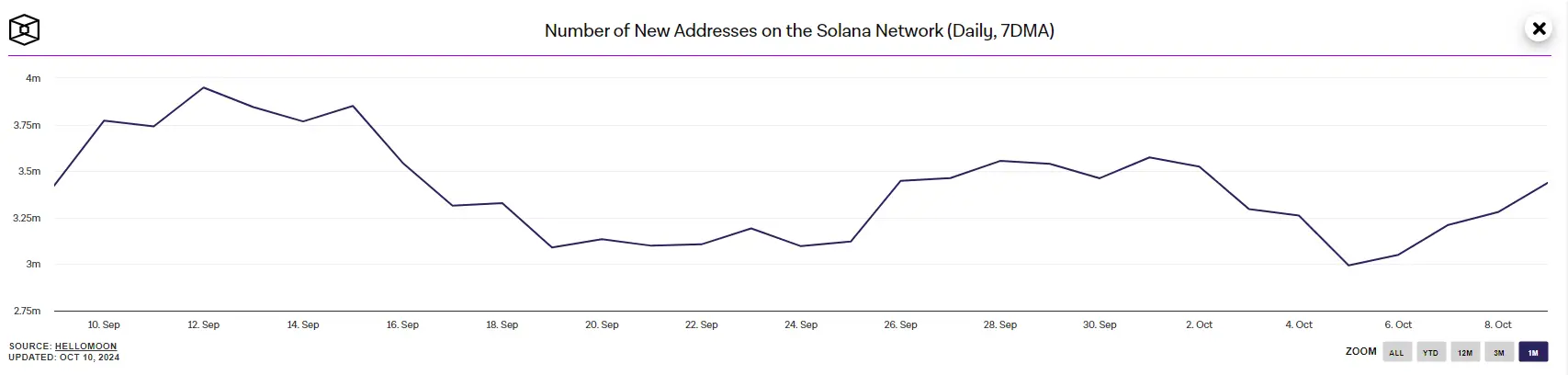

Moreover, several other factors are contributing to the surge in the cryptocurrency’s market activity. For instance, the number of new addresses interacting with the Solana blockchain has increased. Data from HelloMoon shows a rise in new wallet addresses, from a monthly low of 2.99 million on October 5 to a current count of 3.44 million. This uptick in network activity could signal a renewed interest in the altcoin, further supporting market optimism.

Technical Indicators Reflect Consolidation

Analyzing Solana’s price movement, it appears the token remains locked in a consolidation pattern. A TradingView chart analysis shows that the cryptocurrency has formed a symmetrical triangle pattern. This formation typically indicates a continuation of the existing price trend, suggesting that Solana may remain range-bound in the short term.

While the current trend shows no immediate upward movement, the pattern hints at potential volatility once the token breaks out of this range. A closer look at technical indicators further supports the consolidation narrative. The Relative Strength Index, currently at 45.81, suggests that neither buyers nor sellers exert intense pressure on the market.

As a result, the token may continue trading within its current price range until more precise market signals emerge. The MACD also reflects a market in balance. While bears have maintained dominance over the SOL market, the MACD line is trending along the zero line, and the histogram bars are flattening.

This indicates that bearish momentum may be waning, opening the possibility for price stability. Yet, a market momentum shift could see the cryptocurrency test resistance at the $156.17 level, while support might be found around $125.68. As of press time, Solana is priced at $139.98, reflecting a slight 0.20% increase over the last 24 hours.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom