Solana to $500? VanEck’s Bold Price Prediction for SOL

Amid the ongoing consolidation in the cryptocurrency landscape, asset management giant VanEck has made a bold prediction for Solana (SOL). This forecast has captured widespread attention from the global crypto community, particularly as it comes during a period when SOL has been struggling consistently.

VanEck Predicts $500 for Solana

In a recent post on X (formerly Twitter), VanEck stressed that the crypto bull market is expected to reach a medium-term peak in Q1 and set new highs in Q4 of 2025. The post also noted that during this bull run, Solana’s (SOL) price could hit a new high of $500.

VanEck 🤝10 Crypto Predictions for 2025

Prediction #1: Crypto bull market hits a medium-term peak in Q1, sets new highs in Q4. We project Bitcoin to be valued at around $180,000, Ethereum to trade above $6,000, Solana to exceed $500, and Sui to surpass $10.

— VanEck (@vaneck_us) December 13, 2024

This prediction appears achievable, as SOL is poised for a massive rally, having formed a bullish price action pattern.

Solana’s (SOL) Bullish Breakout Levels to Watch

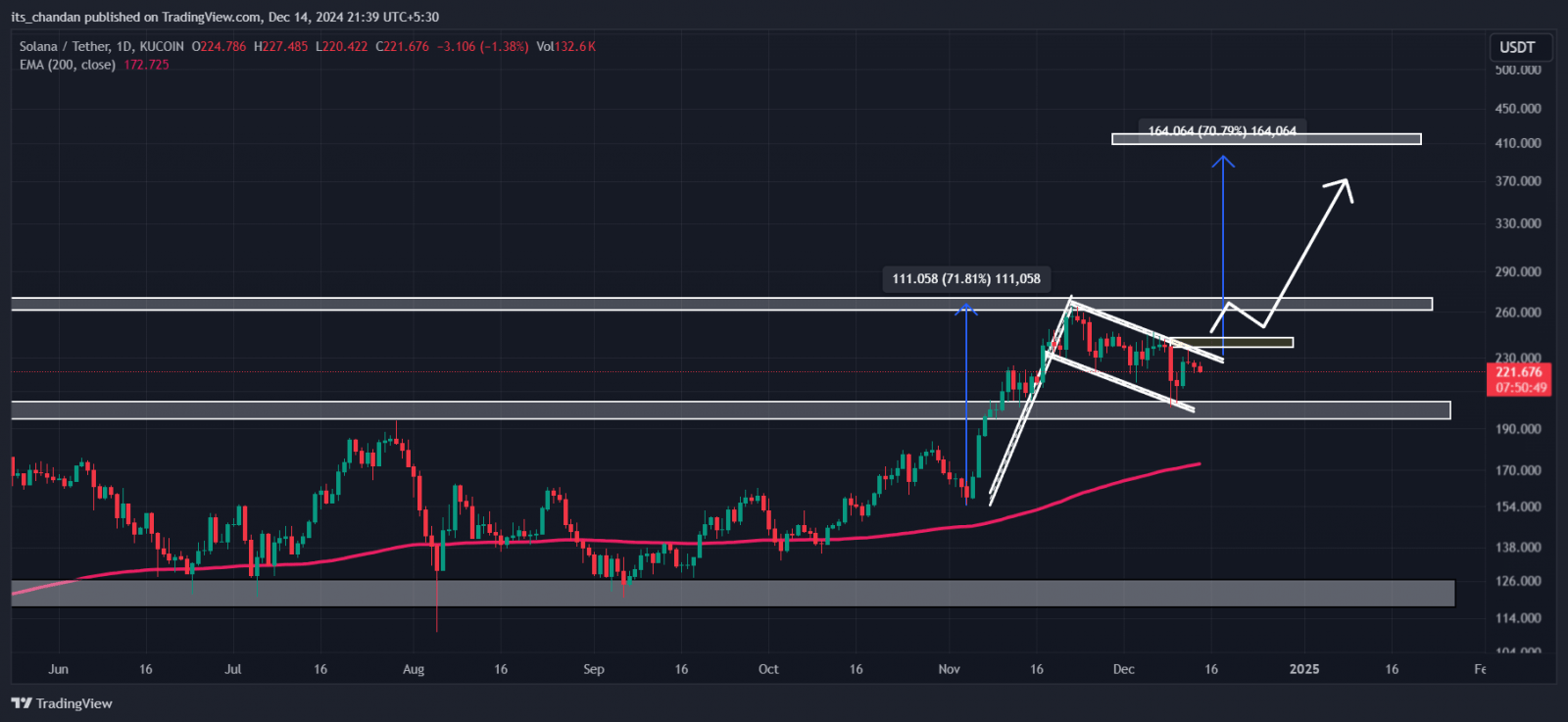

According to expert technical analysis, SOL has been consolidating for over three weeks and has formed a bullish flag-and-pole price action pattern on the daily timeframe. A flag-and-pole is a price action pattern that traders and investors use to build long positions over different time periods if the price breaches or breaks out of the pattern.

Source: Trading View

However, SOL appears to be struggling to break out of this pattern. According to technical analysis, if SOL successfully breaks out and closes a daily candle above the $236 level, there is a strong possibility it could soar by 70% to reach the $415 level in the coming days.

Additionally, SOL’s Relative Strength Index (RSI) is currently near the oversold region, indicating that the asset is poised for upside momentum.

This bullish thesis will remain valid only if SOL breaks out of this price action pattern and closes a daily candle above the $236 level; otherwise, it may fail.

81% of Traders Long on SOL

SOL’s technical analysis is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, the Binance SOLUSDT long/short ratio currently stands at 4.28, indicating strong bullish sentiment among traders. At present, 81.05% of top Binance traders hold long positions, while only 18.95% hold short positions.

These on-chain metrics and technical analysis indicate that the bulls are currently dominating the asset, which could support SOL in breaching the bullish pattern.

Current Price Momentum

At press time, SOL is trading near $222 and has experienced a price decline of 0.75% in the past 24 hours. Additionally, its trading volume has dropped by 24% during the same period, indicating reduced participation from traders and investors compared to the previous day.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Basic Attention

Basic Attention  Qtum

Qtum  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom