SOL’s Perfect Retest Setup: Is a 52% Price Rally Just Around the Corner?

- SOL recently tested a crucial support level at $20, which may have provided a basis for a 52% price surge.

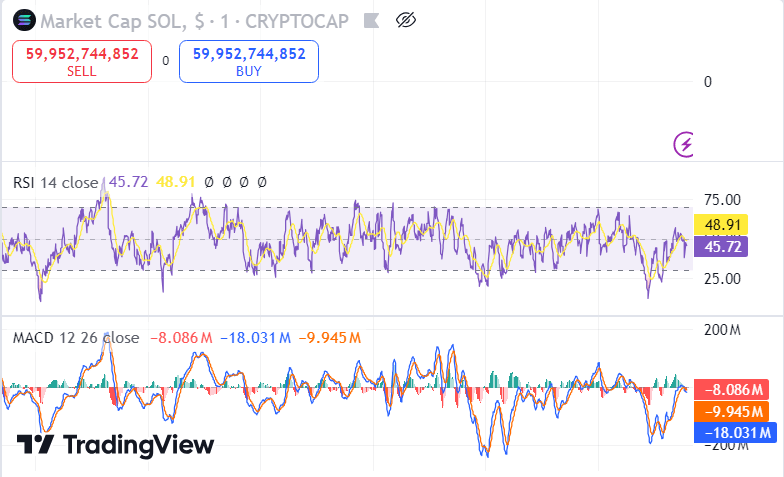

- Technical analysis shows that SOL has a high potential for further growth and is currently undervalued according to RSI.

- Although SOL enjoys positive technical signals, market factors as well as other external factors can still affect the company.

Recently, Solana (SOL) has emerged in the cryptocurrency market and the chart shows its technical analysis to hint at the price rise. Several experts are directing attention to the fact that SOL tested a key support area known as a ‘retest’ which implies that there can be a 52% bullish movement in the future.

This prediction occurs at a time when the general cryptocurrency market is characterized by volatility, something that makes such forecasts significant to traders as well as investors. While not definitive, this price retest typically occurs alongside bullish outlooks which should be reassuring for SOL holders.

The Retest Setup Explained

A retest occurs when a cryptocurrency backward moves to a previous support level after a downtrend, to check if that level can support its price. In the case of SOL, the cryptocurrency recently rebounded towards the key support of $20.

⚠️ WILL IT REVERSE? 🍿

A beautiful retest, will it bounce? 👀

🔮 $SOL has been range bound for month, a reversal from here could trigger a rally to $187 (+52.94%) 🚀

It’s time to lock in 🔒 pic.twitter.com/PXpwIu8WwC

— CRYPTOWZRD (@cryptoWZRD_) September 4, 2024

This successful retest is indicative of the fact that the market sees this price point as a sustainable level, which could lead to further purchases. If SOL is to sustain this level, experts expect the cryptocurrency to pull off a rally in the price appreciated by 52% to the $30.50 area.

Technical Analysis Backing the Prediction

There are many technical factors that analysts use to support the view that price is going to rise. Indicators such as the Relative Strength Index (RSI), for instance, reveals that SOL remains reasonably neutral to overbought, meaning additional upward movement may still be possible.

Source:Trading view

At the same time, volume patterns suggest increasing demand for purchases, which also contributes to the bullish outlook. This optimism is somewhat offset by market level factors such as changes in Bitcoin (BTC) price and macroeconomic factors that may affect SOL.

Market Uncertainty Remains

However, traders are cautioned that despite this technical arrangement, the underlying market remains bullish. Market conditions, regulatory issues, and changes in perception of other leading cryptocurrencies may affect SOL. Despite the optimistic outlook given by the technical characteristics, it is necessary to be cautious, since fluctuations in the cryptocurrency market occur frequently and can be unexpected. This means that even if there is a projection of 52% that such an increase is possible, it greatly depends on various factors outside the company.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom