StakeLayer up by over 250% amidst market downturn: DMT and THL up by double digits

Amidst the slumpy market conditions, StakeLayer has surged by over 250% alongside Thala, Dream Machine Token, which surged by double digits.

The crypto market cap has dropped by over 1.5% in the last 24 hours. As per CoinMarketCap data, it currently stands at $2.17 trillion.

Bitcoin (BTC) is bleeding alongside Ethereum (ETH) in single digits. However, the Stakelayer token is up by over 250% during the same period.

Stakelayer market cap eyes $50 million with the pump

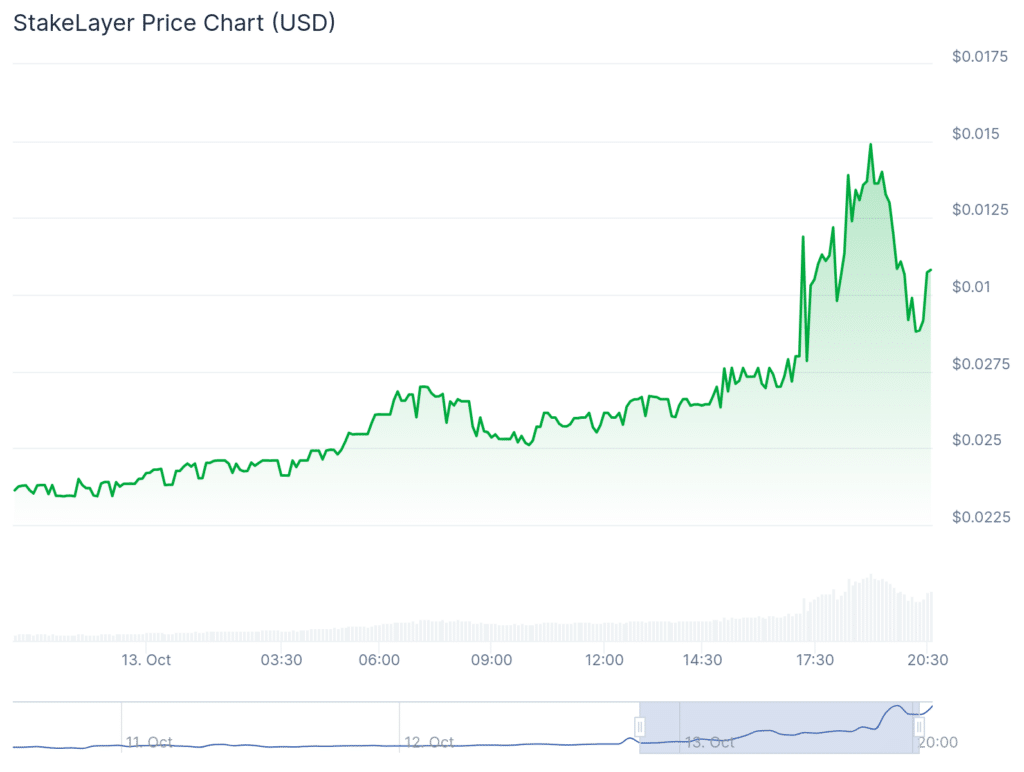

Data from CoinGecko reveals interesting price movement for the cross-chain staking and restaking platform’s token. The token has pumped from a 24 hour low of $0.00344 to a high of $0.001489.

Chart taken from CoinGecko

The rally has however cooled down as the token is trading at $0.01299 at press time. StakeLayer also touched an all time high today and is down by over 27% from that high.

The token has also earned its spot as the largest gainer on CoinGecko in the last 24 hours. A look at their X account reveals that the team had announced a buyback and burn initiative, which could be one reason for its price surge.

🚨 Announcing that Buyback and Burn Initiative has Begun, with $STAKELAYER surging over +350% in just 24 hours! 📈

At StakeLayer, we are committed to building long-term value and stability.

Stay tuned as we continue to deliver on our vision and strengthen the ecosystem! 💪🌐 pic.twitter.com/Xb3QqlrayT

— StakeLayer (@StakeLayerIO) October 13, 2024

Read more: Aptos surges 20% in 24 hours, open interest reaches 6-month high

Thala and Dream Machine Token surge double digits

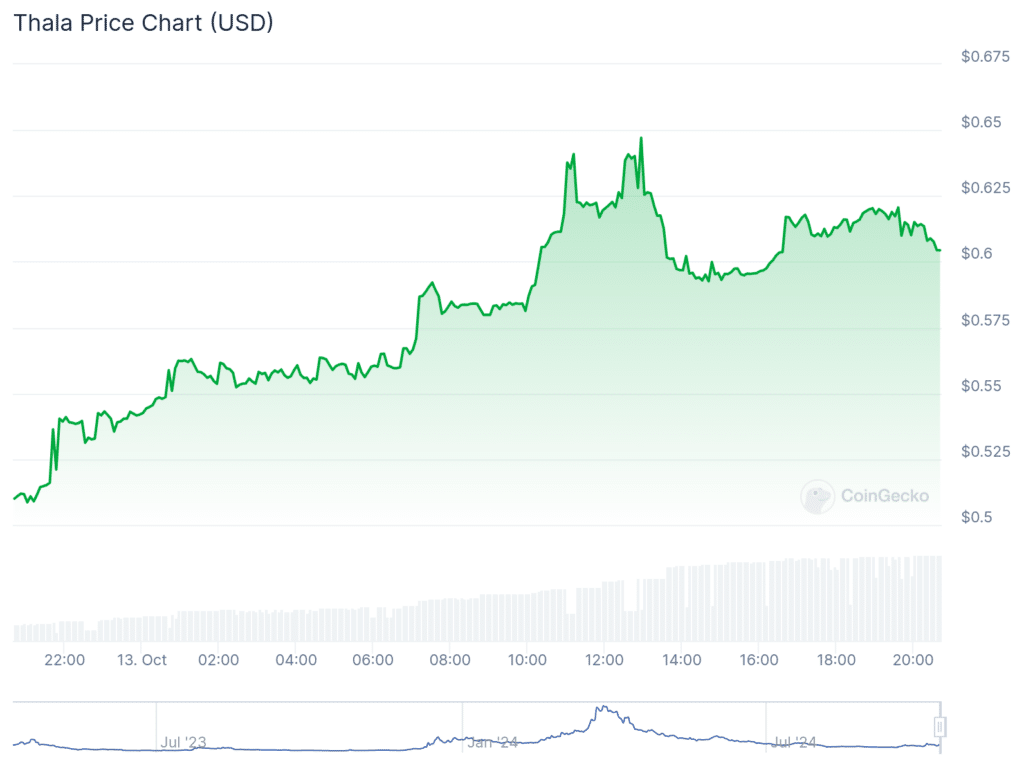

Interestingly, during the same timeframe, Thala (THL) and Dream Machine Token (DMT) surged by double digits. As per CoinGecko data, THL price is up by over 18.5%, while DMT has pumped by 20%.

Even though the exact reason for the surge in DMT’s price is unclear, THL’s price surge can be attributed to the price pump of Aptos (APT). Thala Labs is an ecosystem protocol that aids in borrowing, lending, trading, staking and validating APT.

Chart from CoinGecko

The recent surge in APT’s price, which saw it touch as high as $10.27 from a weekly low of $7.87, is likely the primary catalyst for the surge in its price. THL is up by over 71% in the last 30 days.

The token has also shown a decent surge in the last week, with its price touching as high as $0.6354 from a low of $0.4228.

Read more: Bitcoin reserves on exchanges plunge to all-time low, fundamentals remain strong

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  OKB

OKB  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  Zcash

Zcash  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Huobi

Huobi  Ontology

Ontology  Nano

Nano  Bitcoin Gold

Bitcoin Gold  Status

Status  Hive

Hive  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom