Starknet (STRK) plummets 3% amid broad market surges; here’s why

Digital coins flourished today as the crypto market cap reclaimed the $2 trillion level after a 3.18% increase in the past day.

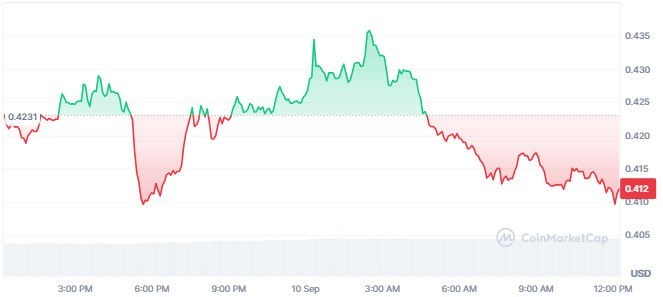

While such sentiments catalyzed significant gains in the altcoin space, Starknet (STRK) displayed struggle, losing 2.97% in its daily chart to hover at $0.4137.

Why is STRK down?

The ongoing Three Arrows Capital bankruptcy proceedings contribute to Starknet’s bearishness.

Arkham Intelligence data shows the insolvent company’s liquidation address moved over 2.07 million STRK tokens, worth approximately $856K) to Wintermute for over the counter (OTC) sale on 9 September.

Wu Blockchain @WuBlockchain ·Follow

Teneo: 3AC Liquidation Address: 0xC7…3741 transferred 2.07 million STRK (about $856k) to Wintermute for OTC sale on September 9. The address also transferred 1.12 million ARB to Binance Deposit on September 10, worth about $583k. platform.arkhamintelligence.com/explorer/addre…

5:49 AM · Sep 10, 2024 23ReplyCopy link Read 2 replies

While the motive behind the transaction remains speculative, firms in the crypto space often send tokens to exchanges ahead of liquidations. Thus, enthusiasts will track the possible effect of the asset transfer on price actions.

3AC’s bankruptcy developments

Three Arrows Capital filed for bankruptcy following the Luna-driven market crash of 2022. Amid the liquidation proceedings, Teneo joined to navigate the challenges of the case.

That has attracted substantial transfers of cryptocurrencies from the company as it stares at massive debts.

Meanwhile, the latest report reveals enormous altcoin movements to exchange Binance. Besides yesterday’s 2.07 million STRK transactions, the Teneo wallet sent 1.12 million ARB tokens to Binance today (10 September).

Meanwhile, 3AC’s liquidations have directly impacted around 150 creditors, claiming $3.4 billion from the debacle company. However, liquidation officials confirmed that the creditors will likely get about 45.74% of the claims.

Three Arrows Capital’s investigations

3AC’s regulatory developments have attracted the crypto community and regulatory authorities.

Founder Su Zhu’s arrest and imprisonment on 29 September 2023 and the freezing of assets worth $1.1 billion reflect the crucial intersection between regulation and finance in the growing cryptocurrency industry.

Mad For NFTs || NFT DAO VC @Madfornfts ·Follow

7:32 AM · Dec 22, 2023 0ReplyCopy link Read 2 replies

STRK’s current price action

Starknet traded at $0.4137 after losing nearly 3% of its value within the past day. Its performance attracted attention as the broad market recorded rallies, with Bitcoin jumping 3.55% in the last 24 hours to trade above $57K.

Source: STRK 1D Chart on Coinmarketcap

Starknet’s downside follows the significant asset transfer by the insolvent Three Arrows Capital, which highlighted an upcoming dump.

3AC-associated wallet transferred over 2.07 million STRK tokens on 9 September amid its liquidation proceedings. The company is possibly preparing to offload the assets to repay its debts.

Thus, STKR could experience increased selling momentum, hindering its revivals amid broad market recoveries.

The altcoin will likely plummet further from its current prices, according to the 200-EMA on the 4-hour timeframe.

Meanwhile, crypto enthusiasts will watch how 3AC’s liquidation developments impact STRK prices and whether ARB will pause its ongoing bounce-back and join Starknet’s declines.

The post Starknet (STRK) plummets 3% amid broad market surges; here’s why appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Cronos

Cronos  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  NEO

NEO  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Holo

Holo  Decred

Decred  Ravencoin

Ravencoin  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  NEM

NEM  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Huobi

Huobi  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy