The charts that defined crypto in 2023

During the final three months of 2023, there was a marked increase in the values of cryptocurrencies like bitcoin and ether, which rose by 51% and 36% respectively. This upward trend in the market has left many traders feeling optimistic about what’s to come in 2024.

As investors get their 2024 strategies in order, here is a review of some of the charts and data points that defined the crypto market in 2023.

Bitcoin’s correlation with stocks

Bitcoin’s correlation with the S&P 500 and Nasdaq Composite indexes whipsawed this year.

The asset was most closely correlated with the S&P 500 in February 2023, when its 30-day rolling average coefficient hit 0.9. The max is 1, meaning they are each trading perfectly in tandem. Bitcoin’s S&P 500 correlation dipped to a low of -0.77 at the end of October 2023, before bouncing back to around 0.75 to end the year.

Read more: With days left, analysts hold out hope for new crypto highs in 2023

The tech-heavy Nasdaq Composite followed a similar trend with bitcoin this year, hitting peak correlation of 0.93 in February. Bitcoin’s Nasdaq correlation also dipped at the end of October, hitting a low of -0.71. As of Dec. 27, 2023, bitcoin’s 30-day rolling Nasdaq Composite correlation was back to 0.67.

Periods of tight correlation often coincided with broader macroeconomic trends and events, such as Federal Reserve meetings and inflation reading releases. Bitcoin and the S&P 500 hit a correlation of 0.72 on Dec. 13, 2023, the day the Fed announced it would be cutting rates in 2024.

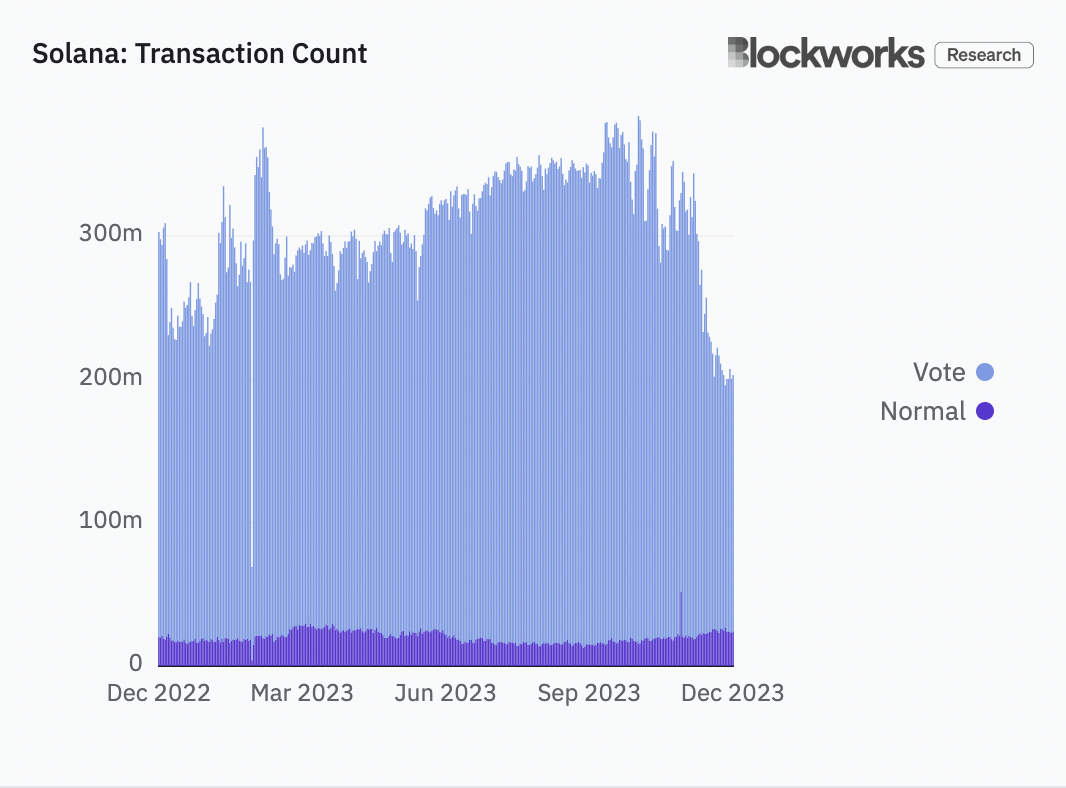

Solana non-vote transactions moving up

Solana is up nearly 900% in 2023, thanks primarily to a rally that kicked off in October. The blockchain’s native token gained more than 300% during the fourth quarter of the year. Solana (SOL) was headed for a last minute correction Thursday though, losing around 9%.

Read more: Meme coins unwind, SOL loses 9% in 24 hours

The seven-day moving average of non-vote transactions on Solana hit a high of 34 million this week.

Despite Thursday’s decline, the year on the whole has been eventful for the Solana blockchain. 85% of protocols on the chain are now open source, as opposed to 30% in 2021. Circle also debuted its Euro stablecoin (EURC) on Solana in December. The stablecoin issuer selected Solana for its “ulta-fast, near zero cost network,” Circle said on X at time of launch.

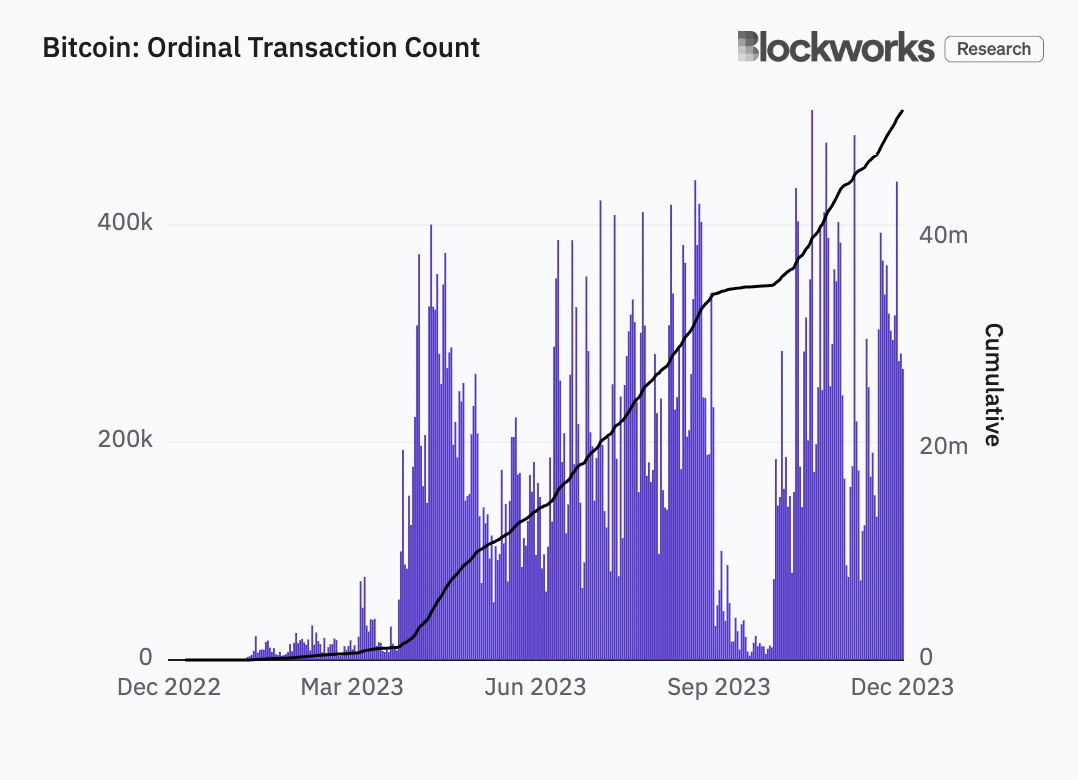

Ordinals are back on the rise

Ordinals debuted in January 2023, introducing a new method for embedding unique digital assets onto individual satoshis in the Bitcoin blockchain.

Ordinal sales peaked in May 2023 with $452 million in transactions before dipping to around $3 million by August, but transactions are back on the rise. There were more than 267,000 transactions on Dec. 27 alone.

While demand has ebbed and flowed, Ordinals have also made transactions on the network more expensive and slower to settle. Over the past year, the average transaction fee has soared upwards of 25x, according to Blockworks research.

Though Ordinals have spurred interest by introducing new use cases for the Bitcoin blockchain, they have also led to significant congestion in the network’s mempool.

Read more: Ethereum won’t flip Bitcoin anytime soon, but Ordinals could change that

This is evidenced by increased transaction times and fees, caused by the larger data size of Ordinals inscriptions, which take up more space in blocks and therefore reduces the network’s transaction processing capacity.

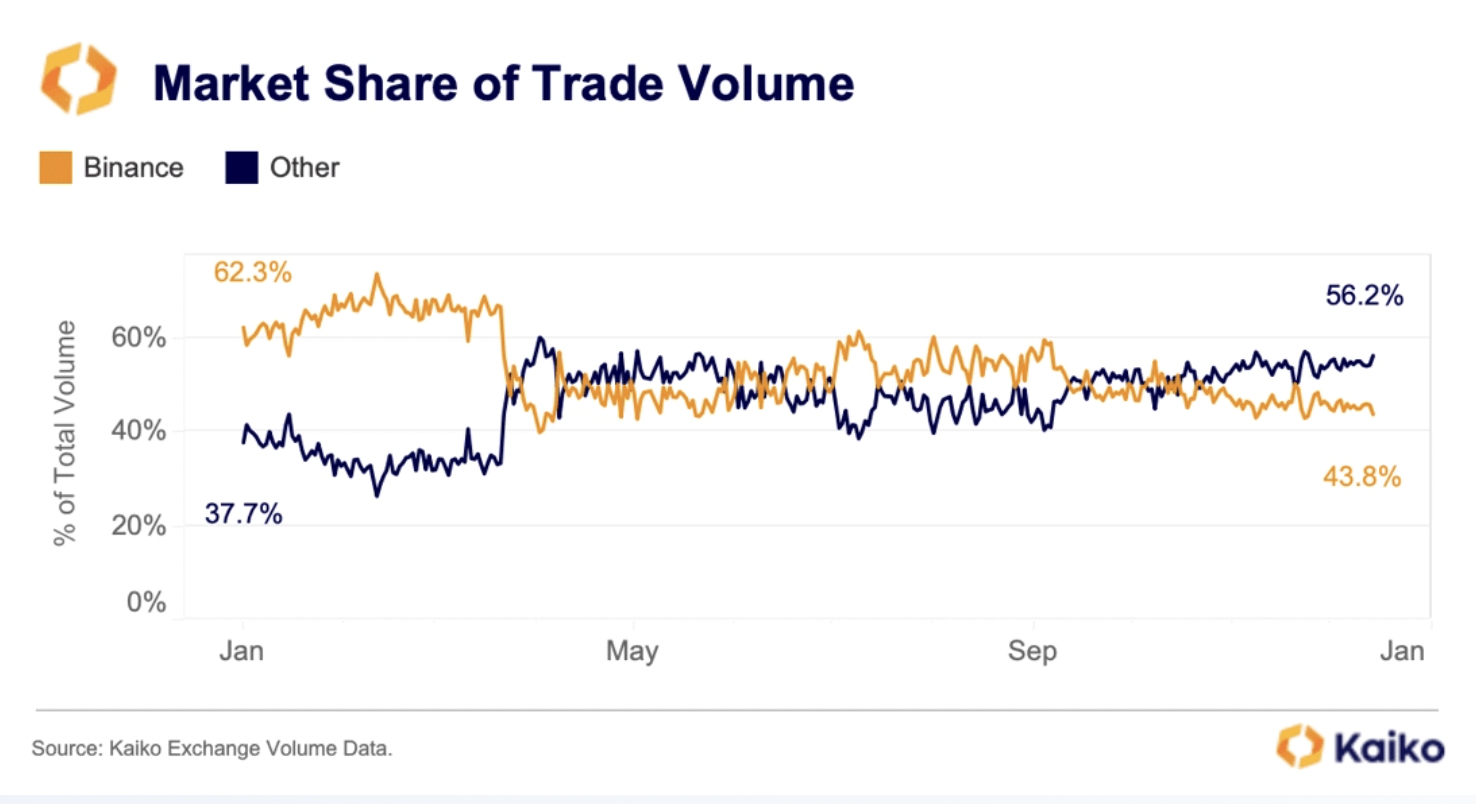

Binance remains dominate exchange by volume

Binance, which made headlines in November when the exchange entered into a historic settlement of $4.3 billion with the US Department of Justice and the Commodity Futures Trading Commission, is still the top exchange by trading volume, but its market share did take a dip this year.

The CFTC announced it had charged Binance in March for allegedly moving high-volume US-based traders from Binance.US to Binance. The news gave a significant blow to Binance’s total market share, losing around 20%.

The SEC also charged Binance in June for, among other things, allegedly commingling assets. This resulting legal battle remains ongoing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  DigiByte

DigiByte  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Bitcoin Gold

Bitcoin Gold  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy