The Fall in Bitcoin Continues: $622 Million Evaporated as BTC Dropped Below $63,000! What is the reason for the decline?

While the correction that started last week in the leading cryptocurrency Bitcoin deepened further before the FED’s March interest rate decision, the price fell to $ 63,000.

While BTC is currently down nearly 15% from its ATH of over $73,000, many investors have liquidated due to the volatile movements in BTC.

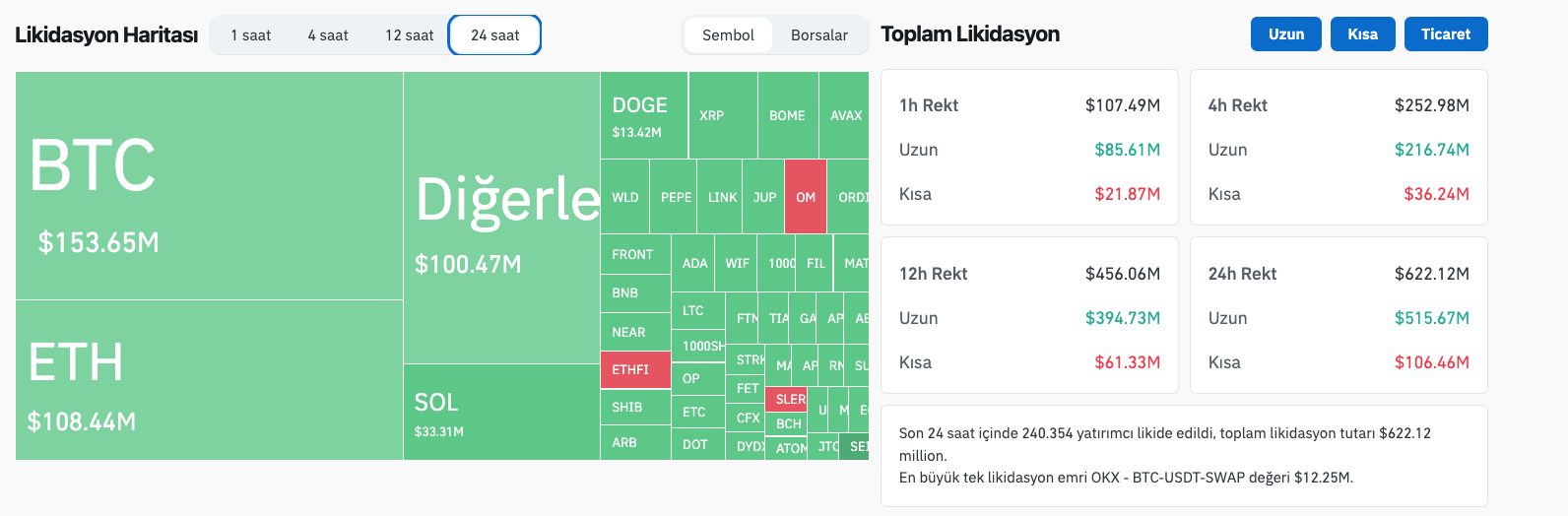

According to data from Coinglass, $622 million was liquidated in the last 24 hours. Of these liquidations, $515 million consisted of long positions and $106 million consisted of short positions.

While 240,354 investors were liquidated in the last 34 hours, the largest liquidation took place in the BTC / USDT transaction pair worth $ 12.2 million on the OKX exchange.

What is the reason for the decline?

Analysts think that behind the sharp decline in Bitcoin is the decrease in inflows in the spot Bitcoin ETF and Grayscale’s regular transfer of BTC.

According to data on March 18, there was a net outflow of 154 million dollars from spot Bitcoin ETFs. In Grayscale’s ETF product GBTC, the net outflow was $642 million.

With this figure, Grayscale’s ETF broke the single-day net money outflow record since its first trading day, while BlackRock ETF IBIT, known for its large BTC purchases, realized a net money inflow of $451 million. However, despite this large inflow, it could not prevent the decline caused by GBTC in Bitcoin and the general crypto market.

Bitcoin continues to trade at $63,820 at the time of writing.

*This is not investment advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom