The financial woes of small Solana validators

Today, enjoy the Lightspeed newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Lightspeed newsletter.

Howdy!

Happy first day of the NFL season. It’s a little embarrassing how much I’ve looked forward to the world’s best sports league returning.

My Super Bowl pick for this season is the Detroit Lions, who are giving Michiganders a reason to hope again after decades of disappointment. Anyways:

Small Solana validators grapple with declining revenue

Solana is churning up less in revenue and fees as the network cools off from a hot summer. One group in particular is feeling the pinch — small network validators.

These smaller validators who help run the Solana network’s consensus mechanism are often propped up by the Solana Foundation’s delegation program, which covers some costs and stakes SOL with smaller validators to increase the number of validators who can exist. 72% of Solana validators participate in the delegation program, according to a report from Solana infrastructure outfit Helius.

It’s not an easy living for small validators. As Helius noted, many validator costs are fixed, while their revenues scale with the amount of stake they control as well as the price of SOL.

Now, these thin margins have grown even thinner. 95% of Solana validator revenue currently comes from SOL issuance, according to a Dune dashboard, and SOL’s price is down 9% over the past month. Fees and MEV make up the rest of validators’ revenue, and the total amount of fees and MEV running through Solana has fallen from levels seen in recent months, according to Blockworks Research’s “total economic value” metric.

Making matters worse, the Solana Foundation delegation program recently lowered the maximum commission participants can charge from 7% to 5% — and also set a 10% commission cap on Jito MEV. Before, validators could collect 100% of Jito MEV if they so desired.

In simple terms, this means that in order to use the foundation’s delegation program — a must for smaller validators looking to break even — validators cannot charge stakers as much for their services.

One smaller Solana validator estimated that after these changes, validators who aren’t having their voting costs covered by the Foundation would need to control roughly 65,000 SOL to break even (up from around 40,000 before). That’s a climb from $5.2 million to $8.45 million at current prices. For validators having their voting fees covered, which are the costs validators pay to vote on transactions and agree to add them to the blockchain, the break even price climbed from 4,000 SOL to 6,000 SOL, by the validator’s estimate.

With Solana’s economic value slackening and the delegation program being less lucrative than it once was, small validators need to attract staked SOL from other sources — like marketing themselves while passing along better yield or participating in large stake pools.

Marinade is one of these big stake pools, but it now makes validators bid for allocations from its supply via its “stake auction marketplace.” This has raised Marinade’s yield as part of its “v2” rebrand, but it also doesn’t do small validators any favors. Some have accused Marinade’s new marketplace of rewarding malicious validators who are disqualified from the foundation’s delegation program. Marinade core contributor Michael Repetny did not immediately return my request for comment

All good things must come to an end, and it appears that a relatively profitable few months for small Solana validators may not be sustained. The Solana Foundation delegation program clearly does help decentralize Solana’s set of validators, but a system that relies so heavily on grants can’t last forever.

By lowering the commissions small validators can charge, the Solana Foundation is arguably doing the equivalent of kicking an unlaunched adult child out of the family basement. The real world is scary — it’s hard attracting your own stake, and Marinade’s stake pool is difficult to join — but you can’t live off mom and dad’s cooking forever.

— Jack Kubinec

Zero In

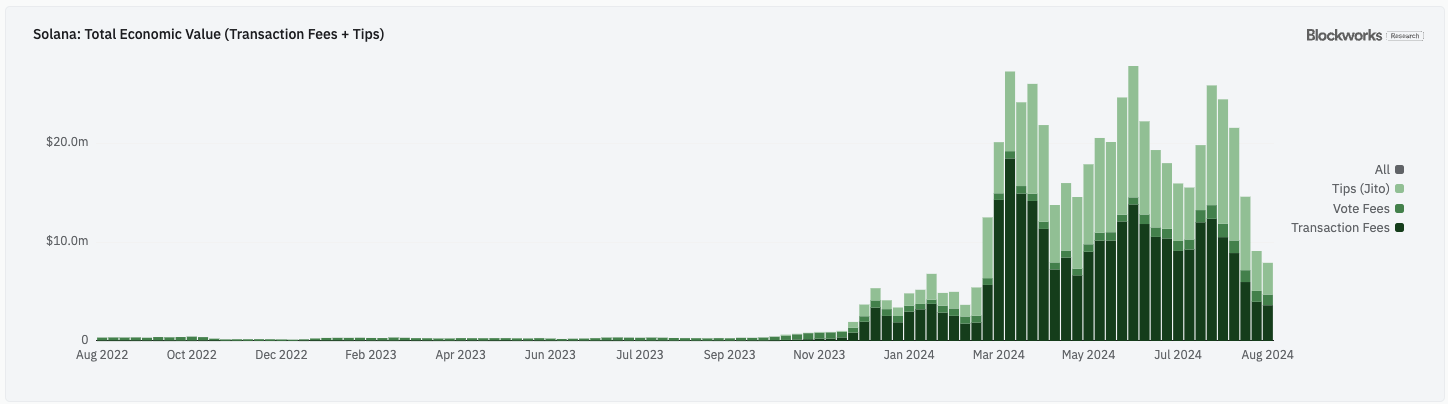

This Blockworks Research chart contextualizes the decline of transaction fees and Jito tips:

The price of SOL is falling, and as you can see, so are the tips and fees validators can collect. The past two weeks have seen SOL’s total economic value fall to a level we haven’t seen since February.

If you see a Solana validator, buy them a beer. It’s tough out there.

— Jack Kubinec

The Pulse

Binance has announced its latest Solana offering: the BNSOL token. The move is part of a broader liquid staking token (LST) trend, with Bybit, Bitget and others also rolling out their own versions of the concept. BNSOL is reportedly powered by Sanctum, which is known for supporting Solana’s LST infrastructure.

Staking on Solana (and other proof-of-stake blockchains) usually requires users to lock up their tokens for an agreed-period, limiting their ability to use them elsewhere. Not so with LSTs. These assets are more flexible, allowing users to trade, lend and utilize their staked tokens in DeFi applications while still earning staking rewards.

On X, some appeared bullish on the potential for growth, while others remain skeptical of Binance’s role in the decentralized space. @DefiSolar was optimistic, pointing out the scale of Binance’s SOL holdings: “Sanctum TVL is about to skyrocket knowing Binance holds around $3b worth of SOL. $CLOUD seems to be the play…”

@dudify_xyz noted, “bnSOL restaking and delegation on @solayer_labs will increase TVL. It’s nice to see a win-win situation for two SOL ecosystem projects.”

@DLFinCrypto1 took a swipe at Binance’s centralized control, warning: “Ah, Binance: where ‘partnership’ often means ‘we control it all.’ $CLOUD might be the play, but don’t forget the house always wins. Decentralization, anyone?”

— Jeffrey Albus

One Good DM

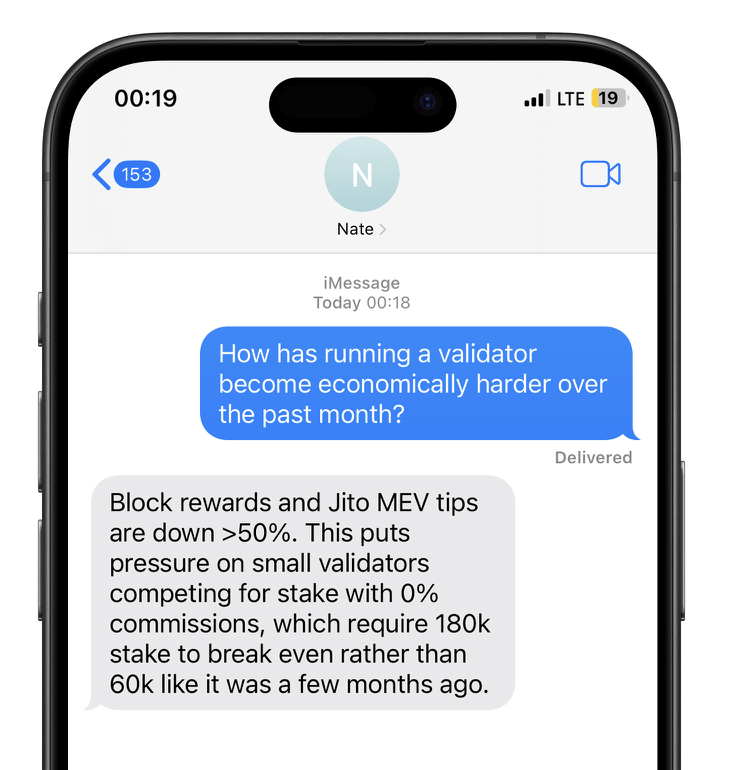

A message from Nate, who anonymously operates the Aurora validator:

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Zcash

Zcash  IOTA

IOTA  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Holo

Holo  Enjin Coin

Enjin Coin  Dash

Dash  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy