This crypto ‘will melt faces’ when altcoin season starts, according to analyst

Not long after professional cryptocurrency analyst Michaël van de Poppe shook up his altcoin portfolio, adding assets he believes will offer solid returns on investment (ROI) following the recent crash, his peer Ali Martinez has focused on one particular altcoin that is about to “melt faces.”

As it happens, Martinez is confident that “if altcoin season kicks off,” as van de Poppe expects, “Polygon (MATIC) will melt faces!” as long as it meets a critical weekly close condition, as the renowned crypto trading expert pointed out in an X post published on August 13.

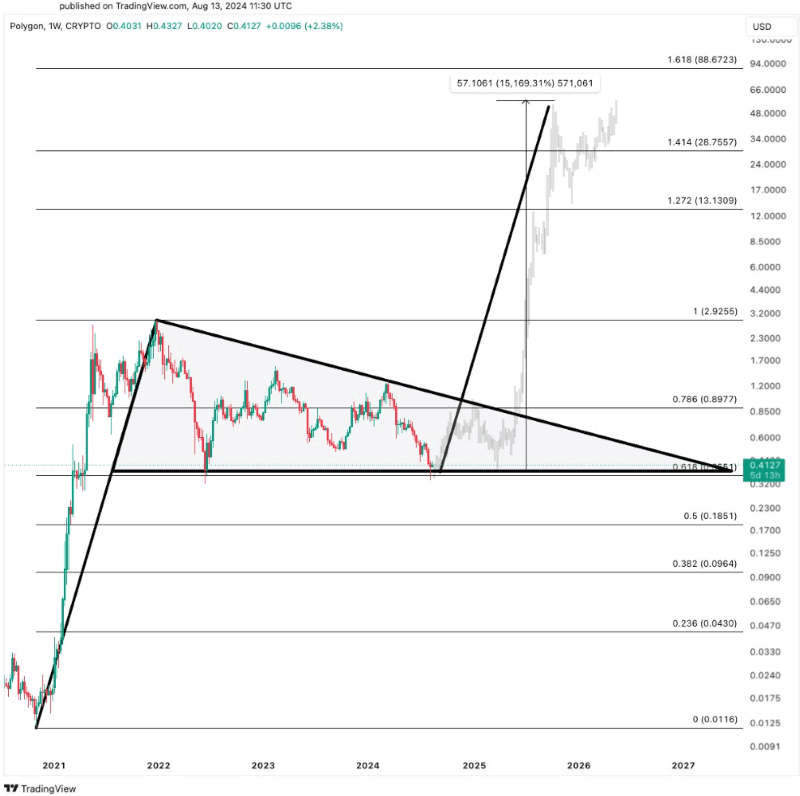

Specifically, Polygon would need to close this week above $0.30 as closing below it “would invalidate the bullish thesis,” according to the crypto market analyst, whose chart pattern analysis suggested that, in that case, this crypto asset might reach the price of $50 in late 2025.

Polygon price performance analysis and prediction. Source: Ali Martinez

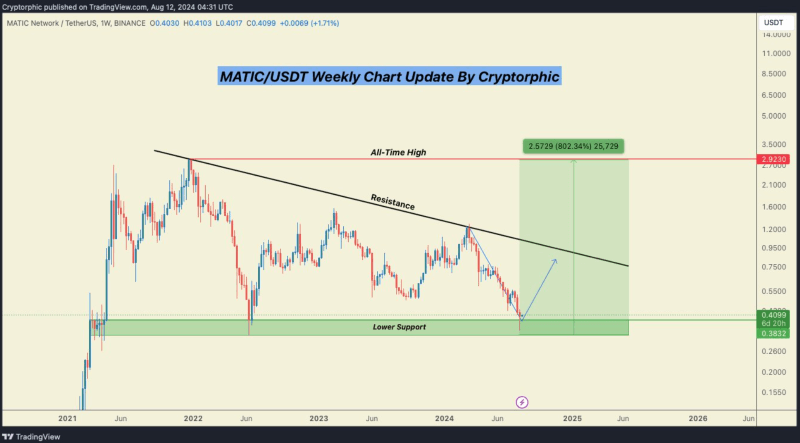

Meanwhile, Cryptorphic is another crypto expert who has joined the crowd of Polygon optimists, albeit slightly less bullish than Martinez, making a bold forecast of a potential surge of over 600% following its recent bounce off a crucial support level, in an X post on August 12.

Polygon price performance analysis and prediction. Source: Cryptorphic

On the other hand, this crypto analyst warns that “things could turn out poorly” if MATIC fails to hold the critical support range between $0.316 and $0.387 and breaks down, setting the resistance level at $0.9860 and a new all-time high (ATH) of $2.923 as the long-term target.

Polygon price analysis

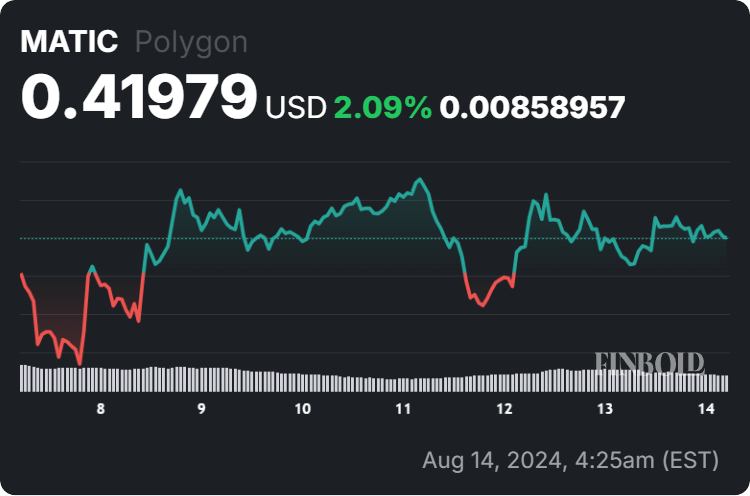

For the time being, the currently 21st-largest asset in the crypto sector by market capitalization is changing hands at the price of $0.41979, which suggests a 0.96% advance in the last 24 hours, adding up to the 2.09% gain across the previous seven days, as it reduces its monthly chart losses to 21.84%, as per data on August 14.

All things considered, MATIC could, indeed, see a ‘face-melting’ rally toward the end of this year and at the beginning of the next, provided it manages to retain bullish technical analysis (TA) and positive sentiment. However, things can easily change, so doing one’s own research is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  Zcash

Zcash  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  Bitcoin Gold

Bitcoin Gold  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Hive

Hive  Status

Status  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond