This Ethereum (ETH) Signal Led to a 1,000% Increase in 2020 – Will History Repeat?

The Ethereum (ETH) price broke out from long-term horizontal and diagonal resistance levels.

The weekly RSI is giving a signal that preceded a parabolic ETH increase in the previous market cycle.

Will Ethereum Accelerate Increase?

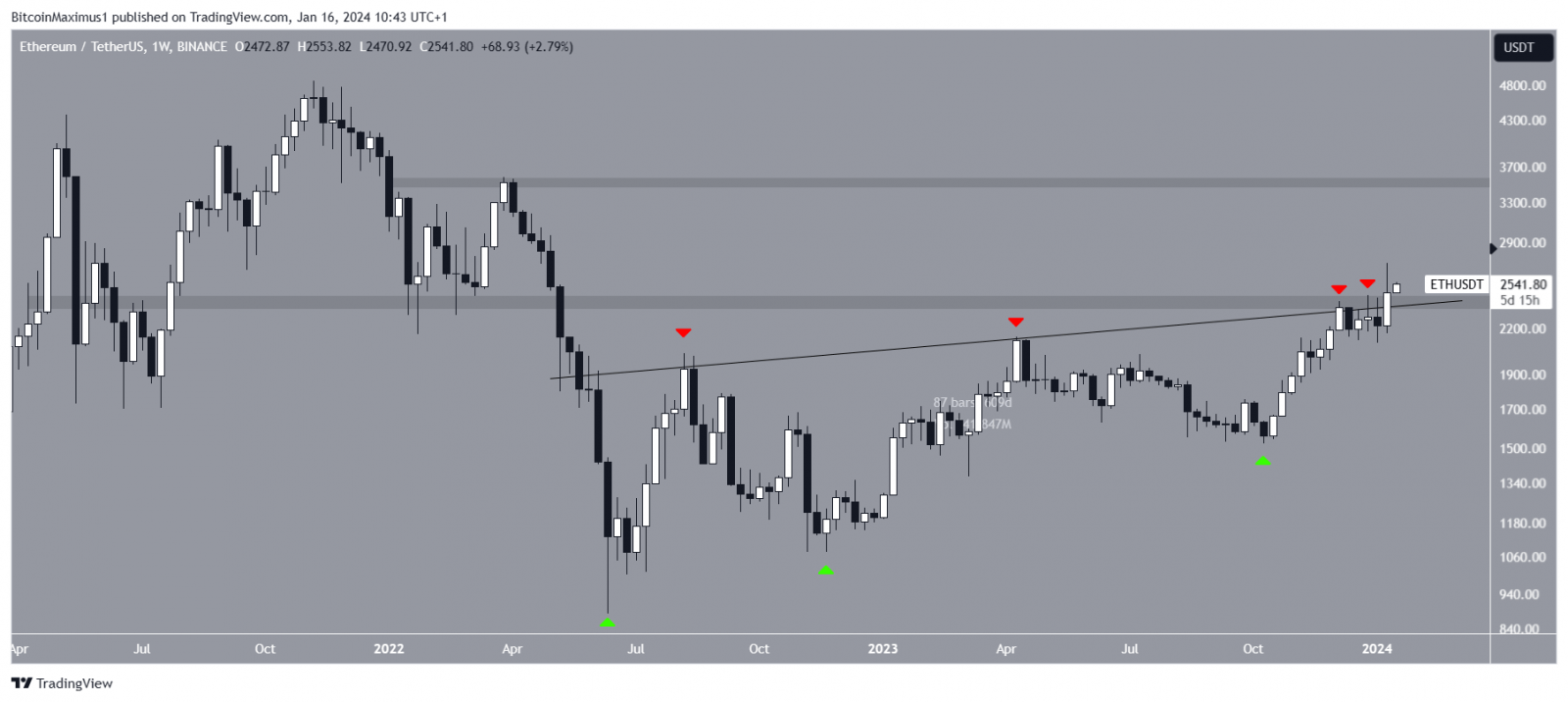

The ETH price has increased gradually since falling to a low of $880 in June 2022. The upward movement was constrained by an ascending resistance trend line, which caused four rejections (red icons). The most recent occurred in December 2023.

ETH also created higher lows during the upward movement, accelerating the increase every time ETH bounced (green icons). The most recent bounce occurred in October.

After more than 600 days, the ETH price finally broke out from the ascending resistance trend line last week.

ETH/USDT Weekly Chart. Source: TradingView

The breakout was consequential since it took ETH above a long-term horizontal resistance area. Previously, the area had intermittently acted as both support and resistance since April 2023.

What do Analysts Say?

Cryptocurrency traders and analysts on X have an overwhelmingly positive view of ETH.

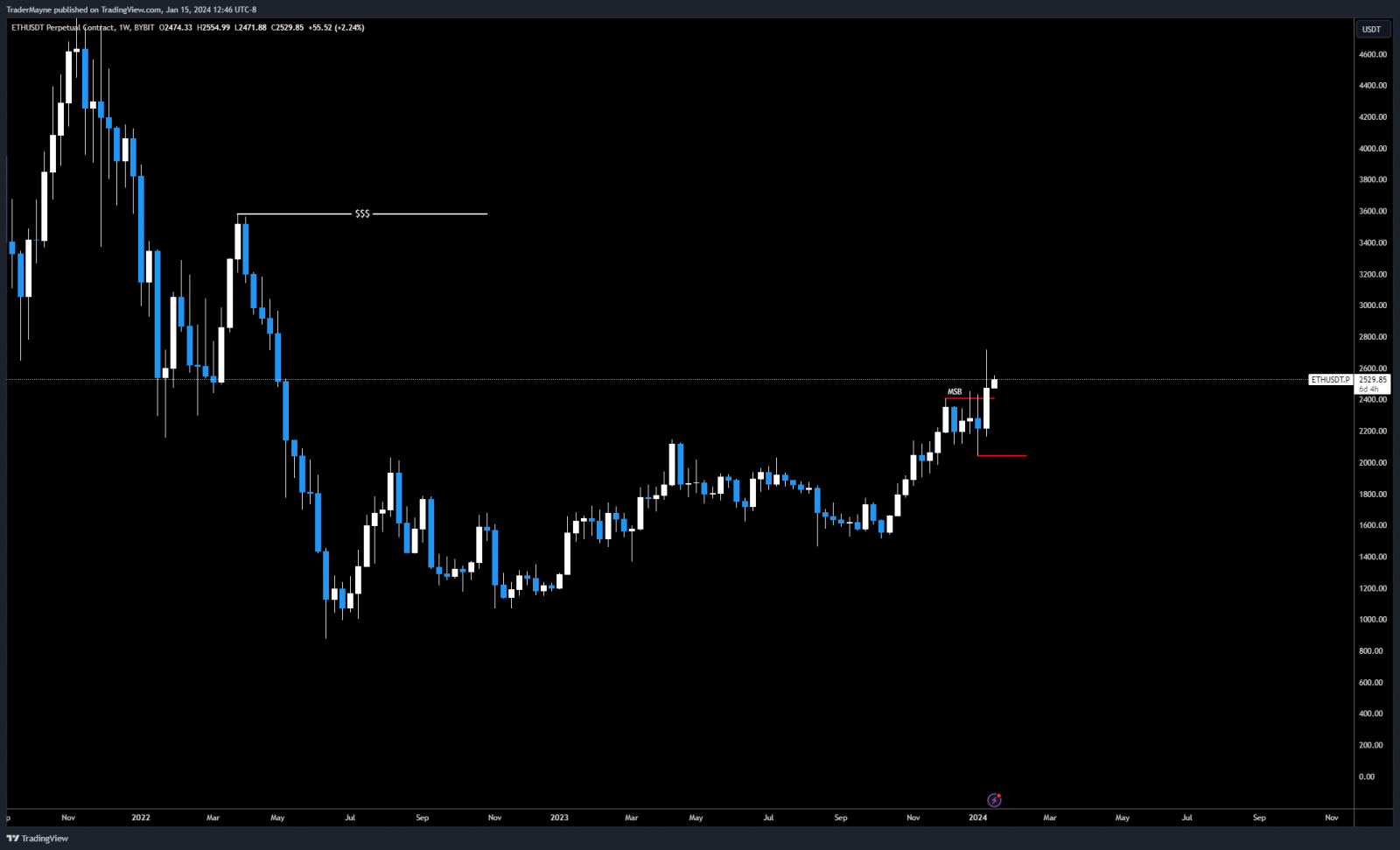

Trader Mayne leads the charge, tweeting:

I’m still fully allocated to spot ETH and ETH betas. I believe $3400 remains the target, invalidation would be a weekly close below $2044.

ETH/USDT Weekly Chart. Source: X

Cold Blood shill suggests that the ETH price will soon move above $3,000, while CJ believes a sweep of the lows will occur tomorrow, after which the ETH price will move upwards.

Finally, Bluntz Capital predicts that ETH will outperform Bitcoin. He expects a price of ₿0.01 for ETH/BTC in 2024, a level not reached since 2018.

ETH Price Prediction: Will 2020 Fractal Lead to Parabolic Increase?

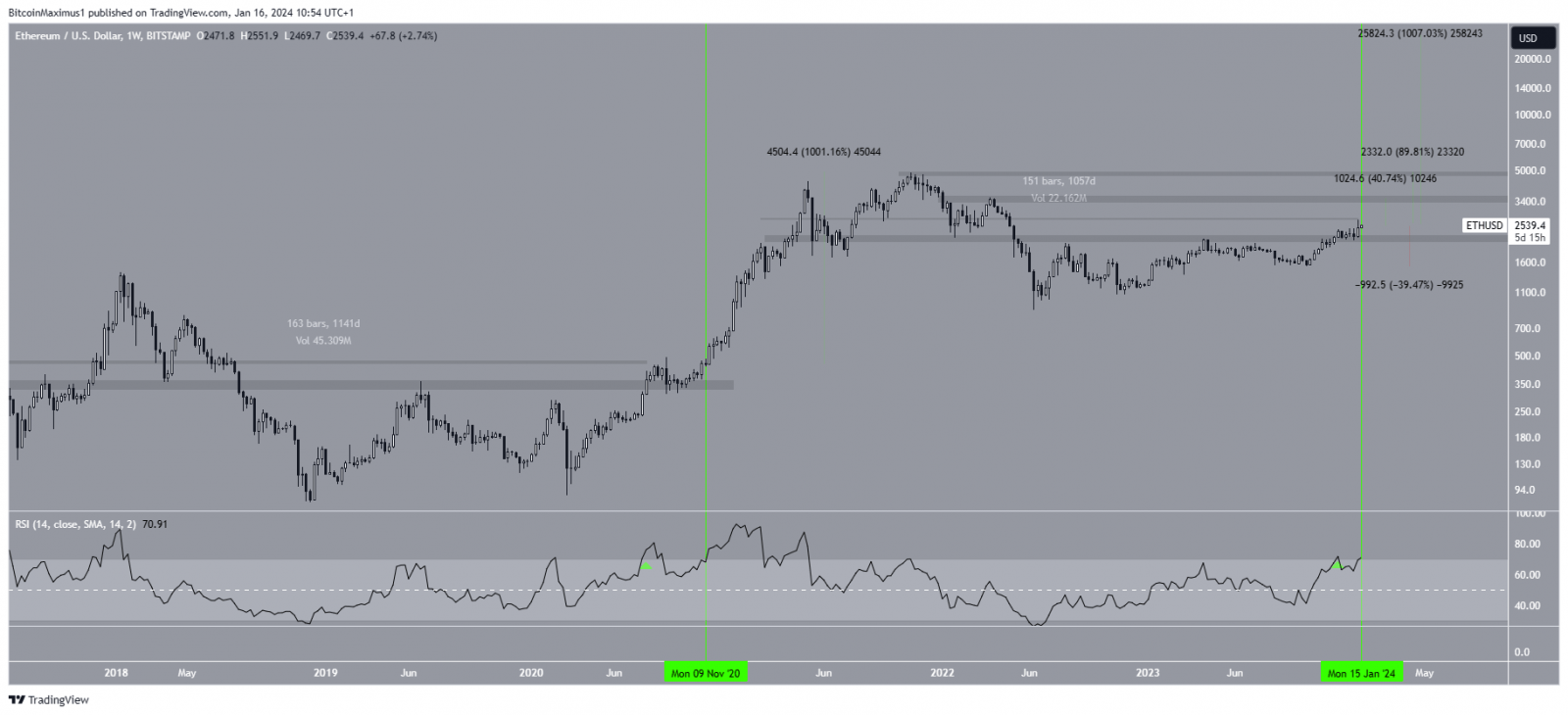

An interesting realization comes from comparing the Ethereum price movement in the previous bull cycle to the current one.

In 2020, Ethereum broke out from a horizontal resistance area that, had at times, provided support and resistance for more than 1,000 days. This is very similar to the current breakout.

Also, the RSI readings are almost identical. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite.

In 2020, the RSI moved into overbought territory (green icon) and then fell below. The second movement into overbought territory (green vertical trend line) gave a signal that catalyzed a parabolic ETH upward movement of 1,000%, leading to the all-time high.

A 1,000% increase would take the ETH price to $27,000 this cycle. For the short-term, more reasonable targets are at $3,500 and $5,000, 40 and 90% above the current price.

ETH/USDT Weekly Chart. Source: TradingView

Despite this bullish ETH price prediction, closing below $2,200 will invalidate this bullish prediction. Then, the price could fall by 40% to $1,600.

For BeInCrypto‘s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi