This Is BTC’s Next Target After Surging 4% Daily: Bitcoin Price Analysis

Bitcoin’s price has been trending lower since the last week of August, breaking below multiple support levels.

Yet, it’s currently showing signs of a possible rebound, as the asset jumped by more than four grand yesterday. Could there be more bullish moves on the horizon?

Technical Analysis

By Edris Derakhshi

The Daily Chart

The daily chart demonstrates that the BTC price has dropped since getting rejected from the 200-day moving average, located around the $64K resistance level. Several support levels have been lost since, and the price has dropped to just over $52K.

The market has rebounded slightly from that level, but the momentum is clearly bearish. As a result, the asset still needs to break above the $64K zone and the 200-day moving average to begin a new bullish trend.

The 4-Hour Chart

In the 4-hour timeframe, it is evident that the price has been declining inside a descending channel. Yet, the market has broken above the channel recently, and a rally toward the $60K level is likely in the short term.

This is, of course, if the breakout is valid and the market does not quickly drop back inside the channel. With the RSI also showing bullish momentum in this timeframe, a rally higher is highly probable.

On-Chain Analysis

By Edris Derakhshi

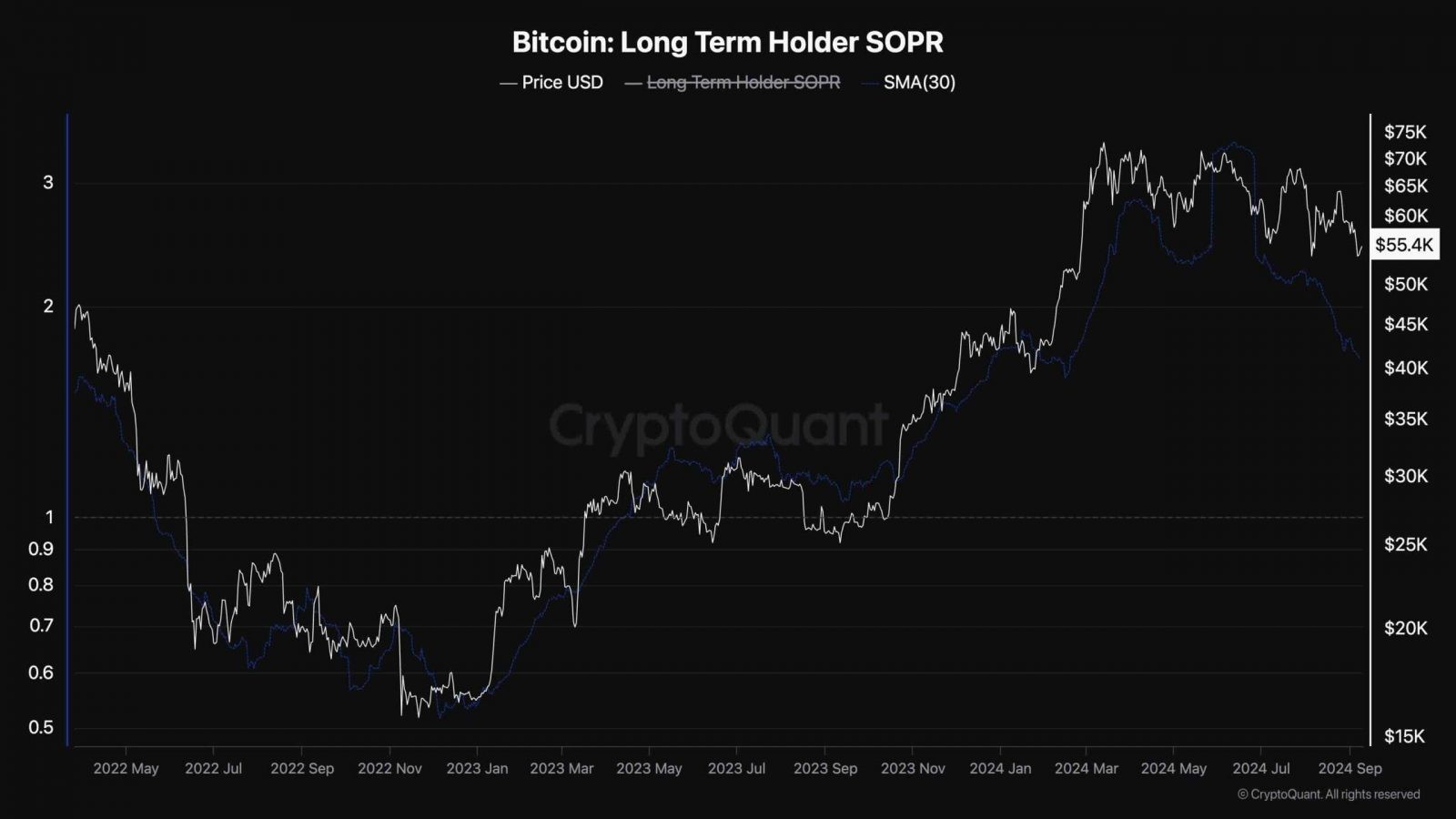

Bitcoin Long-Term Holder SOPR

In the Bitcoin network, long-term holders usually possess the majority of the supply. As a result, analyzing their behavior could be highly beneficial for understanding the market supply and demand dynamic.

This chart presents the 30-day moving average of the Long-Term Holder SOPR metric, which measures the ratio of realized profits/losses by long-term BTC holders.

As the chart suggests, the LTH-SOPR has been declining since the market’s failure to break above the $70K level. This demonstrates profit-taking behavior by long-term holders when the price is declining. If this trend continues, the subsequent selling pressure can lead to even more downtrend for the price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond